June 21, 2025 | 20:50 GMT +7

June 21, 2025 | 20:50 GMT +7

Hotline: 0913.378.918

June 21, 2025 | 20:50 GMT +7

Hotline: 0913.378.918

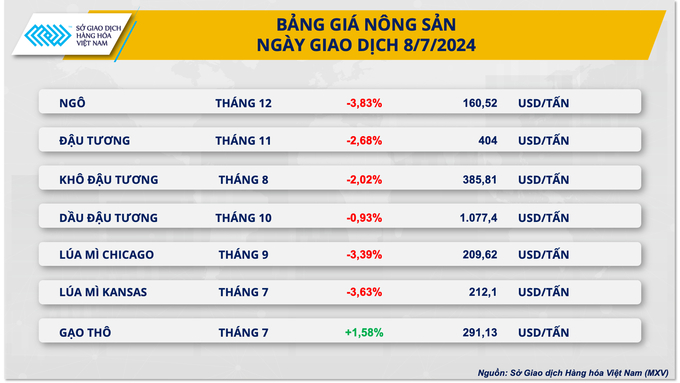

At the close of trading early this week, most agricultural commodities weakened across the board. Corn prices dropped nearly 4%, hitting their lowest level in four years and experiencing the most significant decline among agricultural commodities. Positive supply prospects from the U.S. and Brazil exerted pressure on corn prices yesterday.

In the US, flood-affected areas in the northern Midwest are expected to receive only light rain showers instead of the previously forecasted heavy rains. Meteorologists indicate that the remnants of Hurricane Beryl, expected to move towards the eastern Corn Belt by the end of this week, will bring beneficial rainfall to areas of Illinois and Indiana, where precipitation has been limited in recent weeks. In the western Corn Belt, drier weather is forecasted for next week, reducing flooding in previously inundated areas. Improved seasonal conditions are expected to boost supply expectations in the U.S., putting downward pressure on prices.

In addition, Brazil is expected to significantly boost exports starting this month due to rapid corn harvesting. Consulting firm AgRural reported that as of July 4, Brazil has harvested 63% of this year's second corn crop, up from 49% recorded the previous week and much higher than the 26% at the same time last year. Dry weather with above-average temperatures in most agricultural areas has facilitated harvesting activities.

Similarly, wheat prices also saw a sharp decline of over 3% yesterday. Russia's accelerated harvesting is creating seasonal pressures on the market, weakening wheat prices.

Consulting firm SovEcon noted that as of June 28, Russian farmers have harvested 6.9 million tons of wheat on 1.47 million ha of land. This significantly exceeds last year's figures when harvesting activities had just begun in some regions. Dry weather conditions this year have supported farmers in ramping up their harvest, adding new supplies to the market.

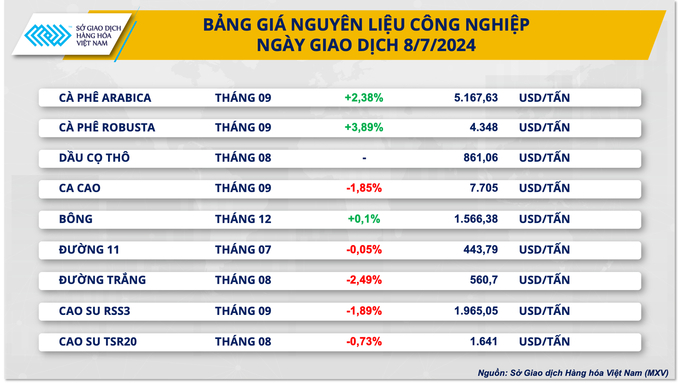

The prices of both Arabica and Robusta coffee surged in the opening session of the week. Specifically, Arabica coffee prices rose by 2.38% to $ 5,167.63/ton. Robusta coffee prices increased by 3.89% to $ 4,348/ton, marking the third consecutive session of strong gains. The market's attention is focused on concerns over coffee supply shortages in Vietnam.

Conversely, cocoa prices fell by 1.85% to $ 7,705/ton as supply showed signs of improvement.

Translated by Hoang Duy

(VAN) Coffee prices on June 20, 2025, fluctuated, with Arabica plunging by 3%. Domestic coffee prices remained flat, trading at VND 103,000 – 103,500/kg.

(VAN) The vice president of fertilizer with Stone X Group says increasing tensions in the Middle East are impacting global nitrogen prices.

(VAN) Coffee prices on June 19, 2025 dropped globally. Domestic coffee prices dropped by as much as VND 2,300, plunging to around VND 107,100 - 107,700/kg.

(VAN) Coffee prices on June 18, 2025, declined globally, with Arabica losing about 2.3%. Domestic prices fell by VND 1,600, down to VND 109,400 – 110,000/kg.

(VAN) Japan will release another 200,000 metric tons of rice from its emergency stockpile to tackle a doubling of prices since last year, Agriculture Minister Shinjiro Koizumi said on Tuesday.

(VAN) Coffee prices on June 13 declined sharply for Arabica. Domestic coffee market in Vietnam dropped by VND 2,000, trading at VND 111,500 – 112,300/kg.

(VAN) Coffee prices on June 12, 2025, continued to fall. Domestically, coffee prices decreased by another VND 2,000, trading at VND 111,500 – 112,300/kg.