June 24, 2025 | 03:24 GMT +7

June 24, 2025 | 03:24 GMT +7

Hotline: 0913.378.918

June 24, 2025 | 03:24 GMT +7

Hotline: 0913.378.918

Latest domestic and global coffee prices as of 07/27/2024

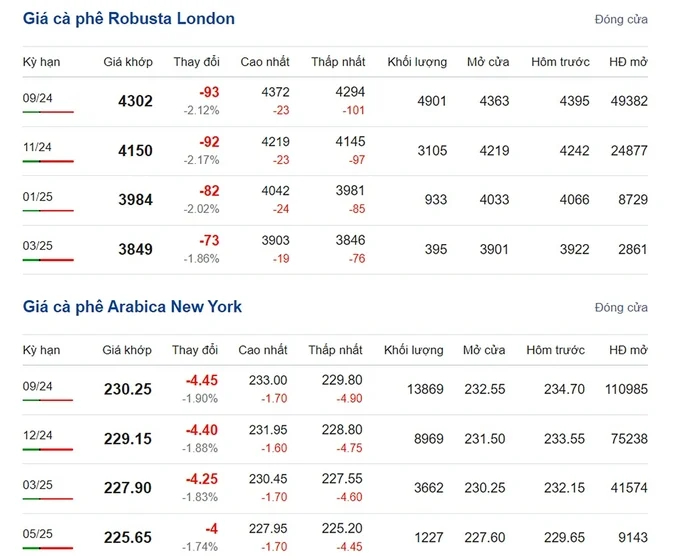

On the global market, both the London and New York exchanges experienced significant declines on July 27.

Specifically, the price of Robusta on the London exchange for September 2024 delivery dropped by $ 93, settling at $ 4,302/ton. The November 2024 delivery price fell sharply by $ 92, reaching $ 4,150/ton.

Meanwhile, on the New York exchange, the price of Arabica for September 2024 delivery decreased significantly by 4.45 cents, falling to 230.25 cents/lb. The December 2024 delivery price dropped by 4.4 cents, to 229.15 cents/lb.

Latest Arabica and Robusta prices on 07/27/2024

Today, global coffee prices have dropped sharply on both exchanges. However, market sources believe that the decline in Robusta prices is temporary and will quickly recover due to limited supply, especially in Vietnam.

For Arabica, prices are expected to continue rising in the near future due to supply disruptions caused by weather conditions, particularly in Brazil.

During this period, global weather patterns have been disrupted by the La Nina phenomenon. According to the U.S. National Weather Service's Climate Prediction Center, La Nina is expected to develop in early Q3 and persist for the rest of the year.

The exact timing and intensity of the La Nina phenomenon remain uncertain, but it is anticipated to bring drier conditions to the southern parts of South America, while equatorial regions and countries in the Pacific Ring will experience heavy rainfall.

Thus, global coffee prices on 07/27/2024, have turned sharply downwards compared to yesterday.

Domestically, the coffee market saw a significant drop of VND 1,500 compared to yesterday.

Specifically, in Lam Dong province, the districts of Di Linh, Bao Loc, and Lam Ha all trade at VND 123,400/kg.

In Dak Lak, Cu M'gar district is purchasing at VND 123,800/kg today, while Ea H'leo and Buon Ho districts are trading at VND 123,700/kg.

In Dak Nong province, traders in Gia Nghia and Dak R'lap are trading at VND 124,000 and VND 123,900/kg, respectively.

In Gia Lai province, Chu Prong district is trading at VND 123,700/kg, while Pleiku and La Grai districts are holding at VND 123,600/kg.

In Kon Tum, today's purchase price is VND 123,700/kg.

Domestic coffee prices today have turned sharply downwards and returned to the level of VND 124,000/kg, after a strong increase yesterday.

The Ministry of Agriculture and Rural Development estimates that Vietnam's coffee production for the 2023/24 season is 1.47 million tons, down 20% compared to the 2022/23 season, and the lowest production in four years.

In the first nine months of the 2023/24 season (from October 2023 to September 2024), Vietnam exported nearly 1.26 million tons, down more than 11% compared to the same period of the 2022/23 season. This export volume is equivalent to 86% of the 2023/2024 season's production.

If we exclude the stock carried over from the 2022/23 season, Vietnam currently has only about 210,000 tons left for export in the remaining three months of the 2023/24 season (from July to the end of September), until the new season begins harvest in October this year.

In reality, there is almost no stock carried over from the 2022/2023 season because, according to Mr. Do Ha Nam, Vice Chairman of VICOFA, Vietnam faced a shortage of coffee for export as early as May - June 2023. This shortage continued into the early 2023/2024 season, forcing many businesses to use coffee from the current season to fulfil export orders from the 2022/23 season.

The coffee export volumes in recent months further highlight the shortage of supply in Vietnam. In May 2024, Vietnam exported 79,000 tons, down 47.8% in volume compared to April 2024 and down 47% in volume compared to May 2023. In June 2024, Vietnam exported 70,000 tons, down 11.5% in volume compared to May 2024, and down 50.4% in volume compared to June 2023.

Due to the nearly depleted supply, Vietnam's coffee exports in the remaining three months of the 2023/24 season will continue to decline. This could lead to an increase in coffee prices as demand continues to rise.

Demand for coffee from European importers is increasing due to the trend of stockpiling ahead of the European Union's Deforestation Regulation (EUDR), which takes effect on 01/01/2025.

Vietnam's coffee production is not only expected to decrease in the 2023/2024 season but is also projected to continue decreasing in the 2024/25 season.

Thus, domestic coffee prices on 07/27/2024, are trading around VND 123,400 - 124,000/kg.

$ 1 = VND 25.091 - Source: Vietcombank.

Translated by Hoang Duy

(VAN) Coffee prices on June 20, 2025, fluctuated, with Arabica plunging by 3%. Domestic coffee prices remained flat, trading at VND 103,000 – 103,500/kg.

(VAN) The vice president of fertilizer with Stone X Group says increasing tensions in the Middle East are impacting global nitrogen prices.

(VAN) Coffee prices on June 19, 2025 dropped globally. Domestic coffee prices dropped by as much as VND 2,300, plunging to around VND 107,100 - 107,700/kg.

(VAN) Coffee prices on June 18, 2025, declined globally, with Arabica losing about 2.3%. Domestic prices fell by VND 1,600, down to VND 109,400 – 110,000/kg.

(VAN) Japan will release another 200,000 metric tons of rice from its emergency stockpile to tackle a doubling of prices since last year, Agriculture Minister Shinjiro Koizumi said on Tuesday.

(VAN) Coffee prices on June 13 declined sharply for Arabica. Domestic coffee market in Vietnam dropped by VND 2,000, trading at VND 111,500 – 112,300/kg.

(VAN) Coffee prices on June 12, 2025, continued to fall. Domestically, coffee prices decreased by another VND 2,000, trading at VND 111,500 – 112,300/kg.