June 25, 2025 | 10:45 GMT +7

June 25, 2025 | 10:45 GMT +7

Hotline: 0913.378.918

June 25, 2025 | 10:45 GMT +7

Hotline: 0913.378.918

Update on global and domestic coffee prices on 07/18/2024.

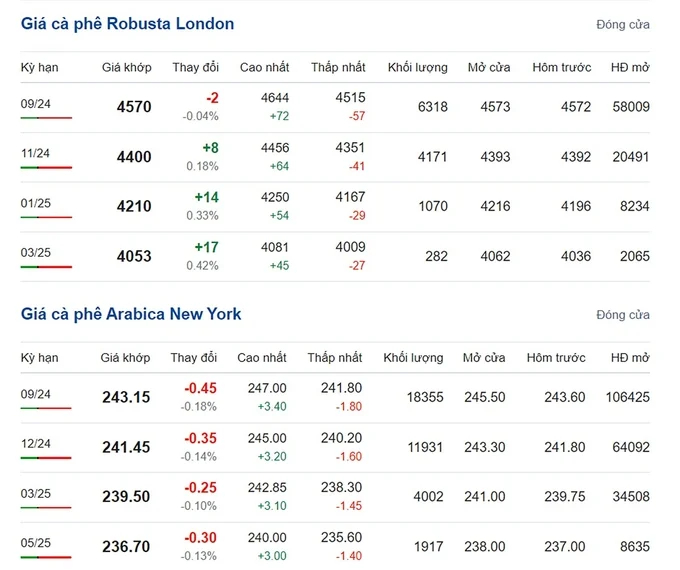

On the global stage, the London and New York exchanges continue to show mixed movements today, July 18.

On the London exchange, Robusta prices for September 2024 delivery slightly decreased by $ 2, settling at $ 4,570/ton. Meanwhile, the November 2024 delivery slightly increased by $ 8, reaching $ 4,400/ton.

On the New York exchange, Arabica prices for September 2024 delivery slightly decreased by 0.45 cents, down to 243.15 cents/lb. The December 2024 delivery also decreased by 0.35 cents, reaching 241.45 cents/lb.

Latest Arabica and Robusta prices on 07/18/2024

Global coffee prices continue to show slight fluctuations. According to experts, the decrease in Arabica prices on the New York exchange has led to a drop in the London exchange. However, the slight increase in November Robusta prices indicates that concerns about market supply in the medium term are still present.

According to VITIC, droughts affecting coffee harvests and ongoing conflicts in the Red Sea have driven up global coffee prices, also impacting coffee deliveries to Europe. New regulations on coffee production and deforestation are making a cup of coffee more expensive.

The newly adopted EU deforestation regulations could soon lead to thousands of tons of coffee exports to the EU being rejected, as they are produced on newly deforested land.

Additionally, the shortage of Arabica due to climate change is expected to increase demand for Robusta, as roasters will need to diversify their products.

The World Coffee Research Organization warns that the world could face a shortage of up to 35 million bags (60 kg/bag) of Robusta by 2040.

The organization explains that although Robusta is more resilient to climate change and pests than Arabica, it is not immune, especially to highly destructive diseases and extreme weather patterns. Furthermore, many Robusta plantations have not received adequate investment in care and breeding improvements for a long time, posing challenges to production.

Thus, global coffee prices on 07/18/2024, show mixed changes compared to yesterday.

In the domestic market, coffee prices on July 18, remain stable compared to yesterday.

Specifically, in Lam Dong province, the districts of Di Linh, Bao Loc, and Lam Ha are trading at VND 127,000/kg.

In Dak Lak, Cu M'gar district is purchasing at VND 127,500/kg today. Meanwhile, Ea H'leo and Buon Ho districts are trading at VND 127,400/kg.

In Dak Nong province, traders in Gia Nghia and Dak R'lap are trading at VND 127,600 and VND 127,500/kg, respectively.

In Gia Lai province, Chu Prong district is trading at VND 127,500/kg, while Pleiku and La Grai are both holding at VND 127,400/kg.

In Kon Tum province, the purchasing price today is VND 127,500/kg.

The domestic coffee prices today remain unchanged, staying below VND 128,000/kg. Meanwhile, domestic pepper prices continue to decline, now ranging between VND 147,000 - 149,000/kg.

Thus, domestic coffee prices on 07/18/2024, are trading around VND 127,000 - 127,600/kg.

Translated by Hoang Duy

(VAN) Coffee prices on June 20, 2025, fluctuated, with Arabica plunging by 3%. Domestic coffee prices remained flat, trading at VND 103,000 – 103,500/kg.

(VAN) The vice president of fertilizer with Stone X Group says increasing tensions in the Middle East are impacting global nitrogen prices.

(VAN) Coffee prices on June 19, 2025 dropped globally. Domestic coffee prices dropped by as much as VND 2,300, plunging to around VND 107,100 - 107,700/kg.

(VAN) Coffee prices on June 18, 2025, declined globally, with Arabica losing about 2.3%. Domestic prices fell by VND 1,600, down to VND 109,400 – 110,000/kg.

(VAN) Japan will release another 200,000 metric tons of rice from its emergency stockpile to tackle a doubling of prices since last year, Agriculture Minister Shinjiro Koizumi said on Tuesday.

(VAN) Coffee prices on June 13 declined sharply for Arabica. Domestic coffee market in Vietnam dropped by VND 2,000, trading at VND 111,500 – 112,300/kg.

(VAN) Coffee prices on June 12, 2025, continued to fall. Domestically, coffee prices decreased by another VND 2,000, trading at VND 111,500 – 112,300/kg.