May 24, 2025 | 16:20 GMT +7

May 24, 2025 | 16:20 GMT +7

Hotline: 0913.378.918

May 24, 2025 | 16:20 GMT +7

Hotline: 0913.378.918

Since 2000, developed countries in general have significantly expanded their networks of marine protected areas. 21% of marine areas are currently designated for protection and most countries have some systems in place. However, establishing effective management plans for marine protected areas and allocating sufficient resources to implement them remains a challenge.

Marine conservation and tourism development are challenges for many countries at present. Photo: Hai Nam.

The number of countries with economic instruments aimed at ocean sustainability has increased significantly over time. According to the OECD's PINE database, by 2021, 58 countries have launched ocean-related instruments, more than three times more than in 1980. Among these, taxes are the most common type of instrument.

More than 40 countries have enacted ocean-related taxes such as taxes on fishing, shipping or marine pollution. Although most ocean-related instruments are taxes, the proportion of tradable permit systems in the ocean economy sector is much higher than in any other environmental sector.

Ocean-related fees and charges have been introduced in at least 28 countries. This includes national park entrance fees, fishing license fees, ocean discharge fees, and non-compliance fines. Environmentally motivated subsidies have been reported in at least 19 countries, commonly seen in the form of feed-in tariffs for offshore wind, tidal and wave power generation and grants to conserve marine biodiversity.

The share of ocean-related tax revenue in total Environmentally Related Tax Revenue (ERTR) is decreasing, from 0.68% in 2000 to 0.62% in 2020 in several developed countries' reports. Pollution and transportation dominate the tax base, accounting for 32% of ocean-related tax revenues in 2020. Revenue from taxes on ocean resources (e.g., fishing taxes) increased by 20% of ocean ERTR, while energy taxes experienced a 16% increase in ocean-related tax revenue.

A large number of ocean-related fossil fuel support measures are in force, with 118 measures identified in 30 countries. Other countries that primarily consume fossil fuels tend to divide ocean-related support between the fisheries sector and the transportation sector.

Illegal, unreported and unregulated (IUU) fishing is a serious threat to fisheries and communities that depend on this sector. Photo: Hai Nam.

One thing to note is that caution should be exercised when interpreting economic instruments. The existence of an instrument does not guarantee its implementation. Furthermore, the level of stringency may not be sufficient to achieve the desired environmental outcomes, and the sample of instrument types recorded in the OECD’s Policy Instruments for the Environment (PINE) database may not represent all available instruments.

Environmental tax indicators should not be used to evaluate the "environment-friendly" nature of the tax system. For such an analysis, additional information describing each country's economic and tax structure is needed. Some environment-related taxes may have serious impacts on the environment, even if they generate little (or no) revenue.

The European Union (EU) is working to close loopholes that allow operators to profit from IUU fishing activities. The EU Regulation to prevent, deter and eliminate illegal, unreported and unregulated fishing (the IUU Regulation) entered into force on 1 January 2010. The European Commission (EC) is actively working with all stakeholders to ensure strict application of the IUU Regulation.

Only marine fisheries products accompanied by a catch certificate confirmed by the competent flag state can be imported into the EU. The EU regularly updates its list of IUU vessels, which includes IUU vessels identified by regional fisheries management organizations.

The IUU Regulation can take steps against countries that turn a blind eye to illegal fishing activities. First, the EC issues a warning (yellow card), then if the country still fails to comply, it shall deem that country “non-cooperative” (red card) and put it on the list of non-cooperative countries. Fishery products from the country concerned will then be banned from entering the EU market. The IUU Regulation also applies to EU operators anywhere in the world and under any nationality.

Illegal, unreported and unregulated (IUU) fishing is a serious threat to fisheries and the communities that depend on them, undermining the sustainable development of ocean economies. Pressure on fish stocks from IUU fishing harms law-abiding fishermen by creating unfair competition, reducing profits and employment opportunities throughout the value chain.

Translated by Samuel Pham

(VAN) South Korea is currently the second-largest investor in Hai Phong in terms of the number of projects (186 projects) and the largest in terms of total registered investment capital, reaching USD 14.2 billion.

(VAN) As consumers become more environmentally conscious, legal regulations grow increasingly stringent...

(VAN) CJ Feed&Care officially launched the FCR improvement campaign called “2025 Find Challenge Reach” in April 2025. In Vietnam, this campaign is implemented by CJ Vina Agri.

(VAN) The swamp in Pho Thanh is gradually being covered with red mangrove, creating a favorable environment for producing clean, high-quality salt.

(VAN) The trade turnover of agro-forestry-fishery products is growing significantly, along with investment cooperation commitments that are opening up new development directions between Vietnam and Russia.

(VAN) Khanh Hoa is investing over 545 billion VND to develop 240 hectares of high-tech marine aquaculture in order to guarantee a consistent supply of seafood exports and achieve the USD 1 billion target.

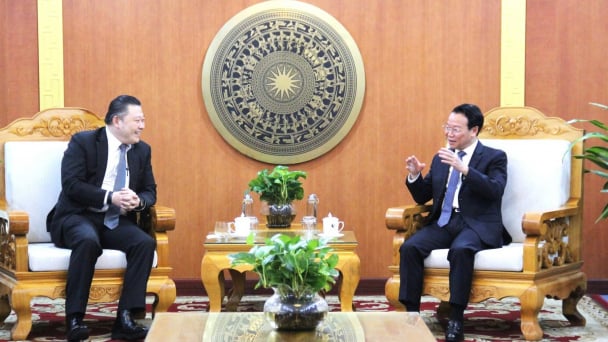

(VAN) Minister of Agriculture and Environment Do Duc Duy held a meeting with Soopakij Chearavanont, Chairman of C.P. Group, on May 15.