June 18, 2025 | 12:11 GMT +7

June 18, 2025 | 12:11 GMT +7

Hotline: 0913.378.918

June 18, 2025 | 12:11 GMT +7

Hotline: 0913.378.918

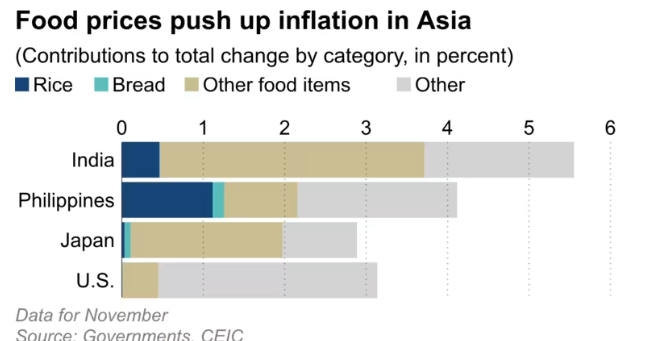

Inflation continues to simmer in many Asian countries largely due to higher prices of rice and other food items. Increases in food prices account for 50% to 70% of inflation in the Philippines and India.

Prices of rice, a regional staple, have soared due to poor harvests caused by extreme weather. Prices are unlikely to come down soon, as many rice exporters have grown reluctant to sell it abroad, giving priority to domestic demand. Concerns are mounting about a possible recurrence of the food crisis in the late 2000s.

Inflation has begun to show signs of slowing down in some Asian countries but continues to affect consumers. In November, the Philippines had inflation of 4.1%, compared to 3.1% in the U.S. and 2.4% in the eurozone. Nearly a third of the increase came from higher rice prices. President Ferdinand Marcos Jr. capped rice prices for a month through early October, calling the staple the lifeblood of the nation.

"Rice in Asia, rice in the countries where it is the staple, is in fact life," said Marcos.

Wheat and corn prices surged across the world in 2022 following the Russian invasion of Ukraine, known as Europe's breadbasket. But although food inflation hit the U.S. and Europe hard, the impact of the war was relatively limited in Asia.

Since the start of the year, however, the center of food inflation has shifted to Asia, which accounts for roughly 80% of global rice demand. Although international wheat prices have begun to fall, rice prices climbed to a 15-year high in late December, up about 40% from January.

Higher prices are largely blamed on droughts caused by El Nino, a warming of ocean surface temperatures in the eastern and central Pacific. The weather phenomenon, which emerged in the spring, brought dry spells to South and Southeast Asia, devastating rice crops.

Global rice production totaled 510 million metric tonnes in the 2022-2023 harvest year, according to the U.S. Department of Agriculture. The grain is often consumed domestically in producing nations, including China, the biggest producer at 150 million tonnes.

International rice prices tend to fluctuate widely because only 10% or so of global output is exported. Such fluctuations seriously affect countries that cannot meet domestic demand by themselves and have to rely on imports. The Philippines is the world's biggest importer of rice.

Global rice markets were dealt a fresh blow in July when India, which accounts for 40% of global rice exports, banned exports of white rice, with the exception of basmati.

The government of Indian Prime Minister Narendra Modi clearly wanted to prioritize domestic supply ahead of the nation's general election in 2024. Indian inflation was still high at 5.6% in November, with a 3.7% rise in food prices accounting for 70% of the overall increase. With the staple alone causing a 0.5% rise, Modi desperately needs to hold down rice prices.

Indonesia could do much the same, as it will hold a presidential election in 2024. "Eager to boost food security, Jakarta could move to prioritize domestic supply, sending international grain prices higher," said Toru Nishihama, chief economist at Dai-ichi Life Research Institute.

The world appears poised to fall into a negative spiral in which concerns about food security, heightened by increased abnormal weather, prompt grain-producing countries to hoard, exacerbating worries over supply.

Although international wheat prices have begun to fall, rice prices climbed to a 15-year high in late December, up about 40% from January.

"The memory of the 2008 Asian food price scare sits deep," wrote Frederic Neumann, the chief Asia economist at HSBC, in a recent report. Food prices spiked worldwide 15 years ago due to the inflow of speculative money into the market. Many foods are now showing even wilder price gyrations, with sharp fluctuations occurring in seven of eight staple crops in 2023, according to the International Food Policy Research Institute.

Food inflation seriously affects people's lives in South and Southeast Asia, where food accounts for 30% to 50% of total household spending, compared to about 10% to 20% in developed economies. Higher food prices influence government policies as well. Facing surging inflation, the Philippine central bank raised its key policy rate by 25 basis points (0.25%) to 6.5% per annum at an emergency meeting in late October.

Inflation is subsiding in the world as a whole. Speculation is rife that the Federal Reserve, which has spearheaded global monetary tightening, will shift to easing in 2024, fueling expectation that the U.S. economy could achieve a soft landing.

Many Asian countries are not out of the woods, however. With food inflation still simmering, policymakers in the region continue to face the challenging task of balancing control over prices with economic growth.

Nikkei

(VAN) Japan will release another 200,000 metric tons of rice from its emergency stockpile to tackle a doubling of prices since last year, Agriculture Minister Shinjiro Koizumi said on Tuesday.

(VAN) Coffee prices on June 13 declined sharply for Arabica. Domestic coffee market in Vietnam dropped by VND 2,000, trading at VND 111,500 – 112,300/kg.

(VAN) Coffee prices on June 12, 2025, continued to fall. Domestically, coffee prices decreased by another VND 2,000, trading at VND 111,500 – 112,300/kg.

(VAN) Coffee prices on June 11, 2025, fell sharply across global markets. Domestic coffee market dropped by VND 700, to the range of VND 113,500 – 114,300/kg.

(VAN) Coffee prices on June 10 2025, rose sharply worldwide for Robusta. Domestic coffee market increased by VND 800, reaching VND 114,200 – 114,800/kg.

(VAN) New FAO forecasts point to record global cereal output with a partial rebound in stocks and trade.

(VAN) Coffee prices on June 9, 2025, in domestic and global markets remain unchanged. Domestic coffee market is currently trading at VND 113,500 – 114,000/kg.