June 17, 2025 | 09:44 GMT +7

June 17, 2025 | 09:44 GMT +7

Hotline: 0913.378.918

June 17, 2025 | 09:44 GMT +7

Hotline: 0913.378.918

Still, both markets remain more than 10% below last spring’s bull market highs, and history offers mixed guidance about whether this January rebound could fade fast or turn into an even larger move.

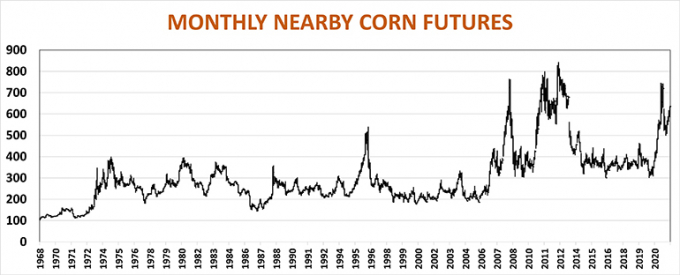

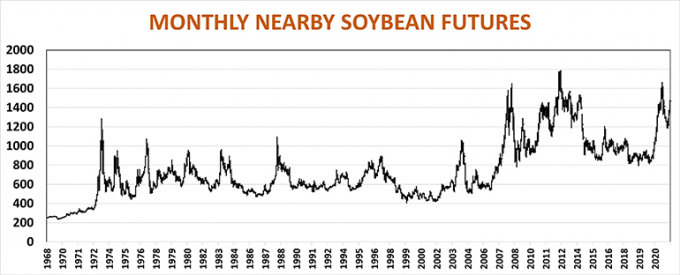

Drawing meaningful conclusions from the last 50 years of futures prices isn’t easy because there aren’t many bull markets to study. It’s a limited sample size: 10 for corn and 11 for soybeans. And years when a big rally was topped the following season are even more rare, happening just three times for each.

The most recent example of a big rebound rally came during the previous cycle, when 2011 highs were taken out by the big gains from the 2012 drought.

Back then strong demand from the burgeoning ethanol industry and a second consecutive year of disappointing yields took 2011 corn crop carryout below 1 billion bushels, and corn peaked a tick under $8. Subpar yields in the U.S. and South America amid growing demand from China helped 2011 soybeans top $14, priming the pump for one of the worst Midwest droughts on record.

Rebound targets

Growing season weather in the U.S. this year could be the ultimate factor in how far and how long the current rallies last. But first, prices must get back to the 2021 highs: $16.675 soybeans and $7.465 corn.

So far, rebounds for both crops are better than forecast by prior year trends. There’s a statistically significant correlation between these bounces and size of the original rally. The better the first rally, the larger the second.

The $8.5925 surge for soybeans projects a rebound target at $13.78, a goal achieved on the second trading day of 2022. The next hurdle for futures comes in at $15.96, but topping that and hitting the next objective of $18.15 faces long odds.

Corn also met its initial objective of $5.67, based on its $4.4525 rally, shortly after briefly trading below $5 at harvest. The next hurdle for corn comes at $6.88, with the longshot at $8.10.

Price charts illustrate the challenge ahead. Last week’s soybean rally retraced 61.8% of its pullback from May high to November low, an important achievement for technical traders. Corn passed its 50% retracement, with the 61.8% line at $6.53.

Brazil soybean losses mount

With news out of China likely sparse this week as the country celebrates Lunar New Year holidays and the opening of winter Olympics, all eyes will be on South American weather. Key parts of Argentina’s central growing region picked up crucial moisture last week, though forecasts for the next two weeks are on the dry side. Argentine soybeans showed a slight improvement, according to the latest Vegetation Health Index maps, but yield projections still point to production 10% or more below USDA’s January estimate.

Damage to Argentine corn could be even greater unless rains return to help late-planted fields, giving a modest boost to U.S. export potential.

Brazil’s soybean yield potential also took a hit last week as losses were confirmed in southern growing regions of the huge country. That could force China to turn to U.S. supplies earlier than expected, and buyers there picked up 2021 and 2022-crop soybeans last week; USDA’s daily export sales wire reported more business Monday.

Urea prices crash

Just as uncertain is the state of the battle to buy 2022 corn and soybean acres. Estimates from private sector farmer surveys are all over the place. USDA doesn’t query growers for their prospective planting plans until March but will update the statistical guess made last fall at its annual outlook conference Feb. 24-25.

While soaring nitrogen prices last fall looked ready to shift ground from corn to soybeans, the fertilizer market continues to rock with volatility. February urea futures at the Gulf traded all the way down to $510 last week before closing Friday at $632 on news of another tender from India. Middle East prices tumbled $300 before also recovering a bit. For reference, Gulf urea topped out at a record $897 in November.

UAN also pulled back last week, with 32% at the Gulf ending at $505 a ton. But the go-to source of N for many corn growers – ammonia – bucked that trend, with February contracts at the Gulf settled for $1,135, up $20. With retail ammonia running an average of $1,457, bargains for spring application could be rare.

All these factors mean the fate of rallies in 2022 is a story that should take months to play out from planting through the peak of the growing season this summer.

A cautionary note

For all the potential, history of past bull markets also serves up some caution. On average, past bull markets in both corn and soybeans lost more than 50% of their peak value, pointing to potential for $3.50 corn and soybeans with a $7 handle by the time the next round of cycle lows are made.

(Farm Progress)

(VAN) Extensive licensing requirements raise concerns about intellectual property theft.

(VAN) As of Friday, a salmonella outbreak linked to a California egg producer had sickened at least 79 people. Of the infected people, 21 hospitalizations were reported, U.S. health officials said.

(VAN) With the war ongoing, many Ukrainian farmers and rural farming families face limited access to their land due to mines and lack the financial resources to purchase needed agricultural inputs.

(VAN) Vikas Rambal has quietly built a $5 billion business empire in manufacturing, property and solar, and catapulted onto the Rich List.

(VAN) Available cropland now at less than five percent, according to latest geospatial assessment from FAO and UNOSAT.

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.