May 31, 2025 | 16:39 GMT +7

May 31, 2025 | 16:39 GMT +7

Hotline: 0913.378.918

May 31, 2025 | 16:39 GMT +7

Hotline: 0913.378.918

From increased input prices, to a dimmer outlook on corn export demand, analysts weigh in on their price picture projections for the 2022 marketing year. Source: Lindsey Pound

With a high of $6.36 ½ set on May 7, prices have continued to bounce across the board in a range of more than $1.

As analysts turn their attention to next year, which is creating more of a bullish outlook: corn or soybeans? The answer is mixed, but even with a tapered expectation of corn exports in the New Year, analysts are more optimistic when it comes to the price picture for corn.

“I'm a little bit softer on export demand. China has a lot of corn on the books, but they're not taking shipment of it. That's a concern until they start to do so that can always be rolled into the next year,” says Arlan Suderman of StoneX Group.

Despite the concern over the current status of corn exports, AgriTalk Host Chip Flory says corn seems to be finding true demand. He says total corn demand this year was estimated up slightly from last year in USDA’s November Supply and Demand Report.

“Most impressively, that estimate comes with the national average on-farm cash corn price expected to be up 90¢ from 2020-21, and more use at a higher price indicates a ‘real increase’ in demand,” says Flory.

The highlights for Flory include:

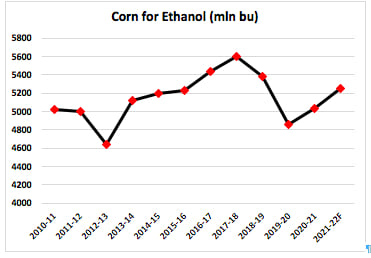

-Feed and residual use has found a home in the 5.6- to 5.7-billion-bushel range.

-Exports won’t reach last year’s level and will fall about 250 million bushels as China finds alternative feeds and alternative sources for feed grains.

-The difference is ethanol.

Input Dilemma

Even with a dimmer outlook on corn exports in 2022, Suderman says the key metric to watch is the price of inputs. He says as long as inputs remain high, with some even at record levels, he thinks the price of corn could also remain strong.

“But as far as the U.S. corn market, its primary objective in the months to come is to make sure we plant enough corn with these high fertilizer prices," he says. "The price of corn has to remain at a level the farmer can afford to pay, and fertilizer prices keep going up. That means the corn price has to go up. But if fertilizer prices break that allows the corn price to break in availability supplies is a factor there too. But we're not expecting that to be a major problem here in the United States. It will be though and some other competitor nations.”

Matt Bennett of AgMarket.net expects the acreage picture to remain competitive in 2022, as input prices and availability will be a tipping point on acreage for next year. But even with the horror stories about fertilizer prices and availability, he still thinks farmers won’t make a mass exodus away from planting corn. Reports already indicate areas like Missouri are seeing 140% of normal anhydrous ammonia applications for this time of year. And in northeast Iowa, retailer say more nitrogen has been applied this fall compared to last fall. Bennett points out an uptick in fall applied nitrogen this year has been very regional.

"The producers that were hesitant to prepay anhydrous, now they're betting on not only having the ability to put it on in the spring due to mother nature, but they're going to be betting on the fact that it's going to go down from these lofty levels we currently see. So, I think from an acreage standpoint, I still think that 90 million [acres] for soybeans and 90 millions [acres] for corn is what we’ll see in 2022,” says Bennett.

Corn Still Pencils

Flory points out the input price rise seen the second half of 2021 has growers sharpening their pencil and running the numbers on potential returns on 2022 corn and soybeans. At the end of November – despite the rise in fertilizer prices – corn was holding its own.

“Potential net returns for corn in the Midwest were good enough to keep growers committed to crop rotations for 2022,” says Flory. “However, corn’s input costs were also high enough to discourage corn acreage expansion. Unless corn can increase plantings from 2021, odds are corn carryover will remain tight into the 2022-23 marketing year – and likely into the 2023-24 marketing year.”

The Crude Factor

Another factor that could fuel corn prices into the New Year is the price of crude oil. Typically, strong oil prices translate into strong corn prices, and Suderman says even though that may continue to be the case in 2022 he thinks volatility will still be at play.

“I think particularly as long as inflation stays high and crude oil in the energy sector is a big part of that,” says Suderman. “That means that we manage supply and demand at a higher price level than we otherwise would do so. And so we can still have sell offs, we can still have that opportunity, but it means that we see the buying come in at a quicker level to kind of provide some underlying support for this market. “

Searching for Support

Suderman says when you look at the energy situation across the globe, plus potential acreage shakeups in some areas, corn prices could find support in 2022.

“So I think as we go forward, the world's kind of stays tight on corn for another year with the fertilizer problems that we have with reduced acreage in Europe and in the Black Sea region, reduced fertilizer application rates in Brazil and their Safina crops and dryness risk. I think we stay in there and we keep some support underneath the corn market going forward. And I think it'll present some opportunities for the US farmer,” Suderman adds. “

“December 2022 corn futures posted a contract high on November 24, 2021, at $5.65. Most market regions sported basis levels that supported $5.25-plus, fall 2022 delivery cash bids,” Flory adds. “Throughout calendar year 2021, I heard Pro Farmer Editor Brian Grete say countless times, “Corn is too cheap at $5 and too high-priced at $6.” I think I’ll hear it from Brian several times in the year ahead, as well.”

(AgriWeb)

(VAN) Vikas Rambal has quietly built a $5 billion business empire in manufacturing, property and solar, and catapulted onto the Rich List.

(VAN) Available cropland now at less than five percent, according to latest geospatial assessment from FAO and UNOSAT.

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.

(VAN) Fourth most important food crop in peril as Latin America and Caribbean suffer from slow-onset climate disaster.

(VAN) Shifting market dynamics and the noise around new legislation has propelled Trouw Nutrition’s research around early life nutrition in poultry. Today, it continues to be a key area of research.

(VAN) India is concerned about its food security and the livelihoods of its farmers if more US food imports are allowed.