June 18, 2025 | 16:30 GMT +7

June 18, 2025 | 16:30 GMT +7

Hotline: 0913.378.918

June 18, 2025 | 16:30 GMT +7

Hotline: 0913.378.918

In a few words, the January U.S. corn and soybean balance sheet changes added a miniscule amount of inventory cushion. Expected ending corn stocks increased 47 million bushels (3.1%) to 1.54 billion, and soybeans were raised 10 million bushels (2.9%) to 350 million.

The expected ending corn stocks estimate was about 60 million more than the average trade guess, and for beans, the trade pretty well nailed it with their 353 million bushel average.

As the trading day evolved after the release of the January World Agricultural Supply and Demand Estimates report, March corn traded 8 cents lower immediately after the report’s release and closed up 2 cents at $5.99; soybeans fell 13 cents but ended 13 cents higher at $13.99 ¼. Since the report, corn has gained about 17 cents, accompanied by some volatility. Soybeans, ten days post-report, benefited from what was thought to be Chinese buying last week as Brazil crop worries accelerated and are now 15 cents higher but did experience 40 cents to the downside in the interim.

Where to from here? The simple answer depends on just how much La Nina effects South American production of both corn and soybeans. In the meantime, we take a brief look at the U.S. corn balance sheet and prospects in the months ahead.

Corn supply and demand changes

The USDA added 100,000 acres to area planted and took harvested acres up 300,000 to 85.4 million. The national average yield remained at 177.0 bushels per acre. The new acreage number exceeded the trade average by 300,000, yield came in 1/10 below the trade, and the crop was 37 million larger than expected. Dec. 1 corn stocks of 11.647 billion bushels were 40 million greater than the trade estimate.

Feed demand

Netting out exports and feed/residual use from first quarter disappearance implied by the stocks number resulted in feed/residual use of 3.066 bbu, 146 million more than September, October, November of 2020-21. With the USDA maintaining its 2021-22 feed/residual forecast at 5.65 billion, this implies a Balance of the Year (BOY) total of 3.07 bbu, or about 146 million higher than a year ago.

Keep in mind the USDA’s is forecasting 0.7% fewer Grain Consuming Animal Units this year, corn ground for ethanol production is expected to be nearly 300 mbu larger, and at $5.45 per bushel, average producer prices are expected to be $1.02 higher versus 220-21 (a 20% increase). All of which are generally not conducive to a year-over-year increase in feed demand. Bias here is the USDA is perhaps 50 million too high on its forecast, but time is on their side.

Ethanol grind

Strong first quarter ethanol grind led the USDA to increase its forecast for FSI use by 80 million (75 for ethanol production with annual grind now at 5.325 bbu). Grain crush data from NASS ahead of the report put year-to-year September, October, November corn use up close to 6% (76 million) and BOY grind will have to run at about the same pace to reach the forecast. This looks reasonable with the caveat of how just will the economy react to this latest round of Covid-19 variants and with inflation approaching a 40-year high.

Corn exports

Despite the market’s concern with what has so far been a less than favorable evolution of the South American crop, U.S. exports were scaled back 75 million bushels to 2.425 billion. This puts the current estimate nearly 325 million below the 2020-21 total. The reduction came partially as the result of a 2 MMT increase in the Ukraine corn crop. Exports from that origin were raised 1 MMT to 33.5, nearly 10 million tonnes higher than in 2020-21.

Otherwise, despite slightly smaller crop estimates for both Argentina (down ½ MMT) and Brazil (down 3 MMT) this month, export estimates for those two were unchanged from December.

Competition

A couple of points regarding world trade prospects may be worth mentioning:

Foreign producers are now expected to export 1.3 billion bushels more corn in 2021-22 than they did in 2020-21. That’s about half the total of U.S. 2020-21 shipments - a huge increase.

Yet, preliminary September-November data for the four major U.S. competitors (Argentina, Brazil, Russia and Ukraine) reveals a surprising 180 million bushel decline versus 2020 (rather than an increase).

Although the pace of imports has accelerated recently, China appears to be in no real hurry to take its U.S. purchases. Shipments through mid-January of 115 million are barely one-half of last year’s same date total.

Ukraine has been an aggressive seller with December exports reaching a record 5 MMT and this has cut into the U.S.’s share to China and perhaps the Far East.

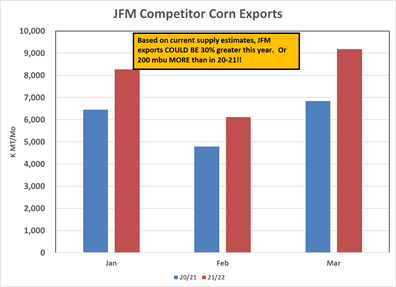

The graph “JFM Competitor Corn Exports” above gives a comparison of last year’s shipments versus what we expect this year for the January-March period. Although problems with Brazil’s first crop corn production could increase its import needs by 1-2 MMT, the overall impact on world export corn flows of a smaller Brazil first crop should be relatively small. And while Argentina’s export potential for this time frame is expected to be unchanged to a ½ MMT higher, ample supplies in the Ukraine are likely to boost combined exporter shipments during JFM by over 200 mbu!

Bottom line

Current USDA estimates of the South American crop are still 1.24 billion bushels HIGHER than the 2020-21 total. Further deterioration of the Argentine crop and poorer-than-expected production of Brazil’s yet-to-be planted safrinha crop will be necessary to significantly boost U.S. exports above the 2.5 bbu level.

The Russia/Ukraine uncertainty could add another element of volatility. A major disruption in the latter’s export flows would likely send China to the U.S. for its remaining import needs.

Otherwise, corn may eventually follow the direction of corn in 2016 and 2018, working lower into mid-summer. Given the potential for considerable volatility into the U.S. growing, options should work well for any remaining unsold 2021 corn as well as the yet-to-be planted 2022 corn crop. Talk with your risk management consultant for strategies to fit your situation.

(farmprogress)

(VAN) Extensive licensing requirements raise concerns about intellectual property theft.

(VAN) As of Friday, a salmonella outbreak linked to a California egg producer had sickened at least 79 people. Of the infected people, 21 hospitalizations were reported, U.S. health officials said.

(VAN) With the war ongoing, many Ukrainian farmers and rural farming families face limited access to their land due to mines and lack the financial resources to purchase needed agricultural inputs.

(VAN) Vikas Rambal has quietly built a $5 billion business empire in manufacturing, property and solar, and catapulted onto the Rich List.

(VAN) Available cropland now at less than five percent, according to latest geospatial assessment from FAO and UNOSAT.

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.