June 18, 2025 | 18:09 GMT +7

June 18, 2025 | 18:09 GMT +7

Hotline: 0913.378.918

June 18, 2025 | 18:09 GMT +7

Hotline: 0913.378.918

Source: SF

In fact, when you ask someone to list the three factors that will most strongly influence the corn market in the new year, they have a hard time keeping it to just three or four or five.

In any given year, the market reacts to the number of acres U.S. farmers plant in the spring.

While it will be no different in 2022, the reason for the acreage uncertainty is gaining a lot of attention, according to some analysts.

As farmers started pricing and, in some cases, buying their inputs as early as October, the sharply higher crop-nutrient costs for the upcoming planting season signaled a possible decrease in U.S. corn acres.

The market is searching for the answers to two very important questions.

With acreage a major talking point for next year, will farmers use their big profits from this year to pay for costlier inputs this winter to be able to plant the same amount or more corn in 2022? Or will the higher input costs deter corn planting?

Bryan Doherty, vice president of brokerage solutions and senior market adviser at Total Farm Marketing by Stewart-Peterson, says there is often the perception that big acreage swings will occur, yet in the end, sometimes not much changes.

“Depending on when and if they secure inputs, and what the price of new-crop corn is versus soybeans, will help guide farmers in their decision. Many prefer to stay with a rotation they are comfortable with, yet 2022 could be much different. Expectations as of this writing are that soybeans can be hedged at a price that likely suggests gains. Corn is not necessarily priced at a level that offers this opportunity. The uncertainty of securing inputs is also a factor that could sway planting decisions,” Doherty says.

Ag economists at the University of Illinois recently put pen to paper on the increased production costs for 2022.

In a white paper that appeared first on farmdocdaily.illinois.edu this fall titled “2022 Planting Decisions, Nitrogen Fertilizer Prices, and Corn and Soybean Prices,” Gary Schnitkey, Krista Swanson, and Nick Paulson, Department of Agricultural and Consumer Economics at the University of Illinois, wrote that budgeting prices of $4.50 per bushel for corn and $12.00 per bushel for soybeans causes soybeans to be more profitable than corn across Illinois.

“Changes in nitrogen, corn, and soybean prices between now and spring will alter projections of relative profitability, thereby likely influencing 2022 planting decisions,” the ag economists stated.

PRODUCTION COSTS

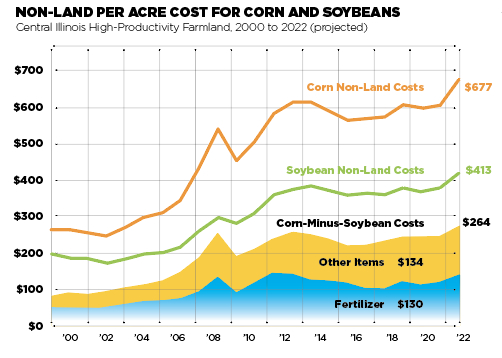

In Illinois, both corn and soybean non-land costs are projected to be the highest since 2000, the year in which comparable cost data began to be prepared, the University of Illinois economists stated. “Current 2022 estimates of non-land costs for high-productivity farmland in central Illinois are $677 per acre for corn and $413 per acre for soybeans. The $677 per acre estimate for corn is $70 higher than the $607 cost for 2021. The $413 estimate for soybeans is $42 per acre higher than the $371 cost for 2020,” according to the economists.

Because nitrogen fertilizer is used at a much higher rate on corn acres vs. soybean acres, it skews the difference in corn-minus-soybean expenses.

“From 2000 to 2021, differences in fertilizer costs account for 48% of the difference in corn-minus-soybean expenses. The 2022 estimate is 49%. Changes in phosphate and potash prices — two other major fertilizer nutrients — are used more proportionally across corn and soybean acres. As a result, changes in nitrogen fertilizer prices have the most significant effect on the relative profitability of corn and soybeans,” the university ag economists stated.

ACREAGE ESTIMATES

At the time of this writing, market participants pegged the U.S. 2022 corn acreage between 89 million and 90 million acres.

If realized, it would fall below the 90.5 million five-year average for U.S. corn acreage, slightly below the 91.8 million 10-year average, and below the 93.3 million (five-year high) from last year.

Patrick Quaid, R.J. O’Brien & Associates commodities trader, says fertilizer prices are at the top of his list of 2022 market factors. “Fertilizer costs will be the main force. If the fertilizer is not available, then corn will lose a bunch of acres,” Quaid says.

With automotive manufacturers struggling to produce pickup trucks because of supply-chain shortages, farmers may shift their spending, for tax reasons, to the higher priced fertilizer, Quaid says. “However, if fertilizer supply remains the main worry, farmers will have no choice but to switch to planting more soybeans,” Quaid says.

OTHER MAJOR FACTORS

Energy prices and China’s demand for U.S. corn are other major market factors for 2022.

“With the current state of the world with food inflation, economic inflation, energy prices, and the current administration’s policies, I don’t see much of a break in this corn market or for all commodities, for that matter,” Quaid says.

Peter J. Meyer, head of grain and oilseed analytics for New York-based S&P Global Platts, says a cut in corn acres is not a matter of if but by how much. “One good year cannot make up for the past few years of poor returns. So, farmers will be cautious about spending ‘too much’ on nitrogen-based fertilizers in 2022. We expect a minimum cut of 3 million corn acres from 2021,” Meyer says.

(SF)

(VAN) Extensive licensing requirements raise concerns about intellectual property theft.

(VAN) As of Friday, a salmonella outbreak linked to a California egg producer had sickened at least 79 people. Of the infected people, 21 hospitalizations were reported, U.S. health officials said.

(VAN) With the war ongoing, many Ukrainian farmers and rural farming families face limited access to their land due to mines and lack the financial resources to purchase needed agricultural inputs.

(VAN) Vikas Rambal has quietly built a $5 billion business empire in manufacturing, property and solar, and catapulted onto the Rich List.

(VAN) Available cropland now at less than five percent, according to latest geospatial assessment from FAO and UNOSAT.

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.