June 21, 2025 | 02:25 GMT +7

June 21, 2025 | 02:25 GMT +7

Hotline: 0913.378.918

June 21, 2025 | 02:25 GMT +7

Hotline: 0913.378.918

Vietnam Agriculture Newspaper (VAN) had an interview with General Secretary of the Vietnam Association of Seafood Exporters and Producers (VASEP) Truong Dinh Hoe to understand better the opportunities as well as the "big waves" that seafood exports face this year. We also have to make timely "turns" to maintain the growth momentum in this field.

Vietnam's seafood export turnover in 2023 only reached nearly US$ 9 billion, down 18% compared to 2022. So, in 2024, what are our country's seafood export expectations, Sir?

Our country's seafood export turnover in 2023 decreased due to the impact of high inflation, especially in large markets such as the US, EU, and Japan, reduced consumer demand, and high inventory and export prices decreased compared to the previous year.

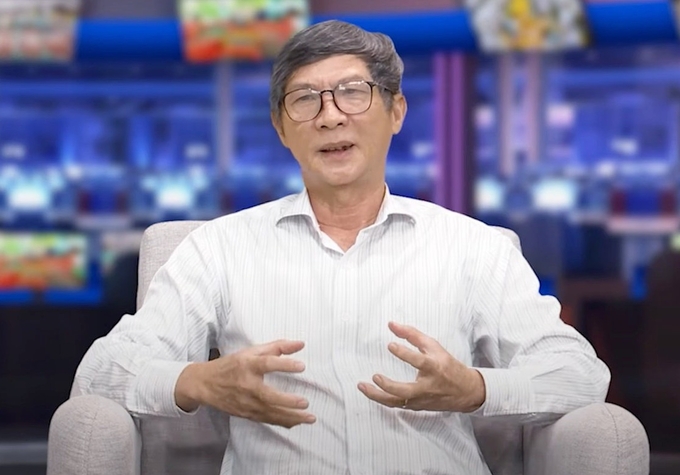

Mr. Truong Dinh Hoe, General Secretary of VASEP, said that the strength of Vietnamese seafood is value-added products and deep processing, so it is necessary to promote this strength. Photo: HT.

In particular, shrimp, the main export item accounting for 40% of total export turnover, also decreased sharply by more than 21% in 2023, affecting the entire industry's export turnover.

In 2024, the causes affecting seafood exports will gradually be controlled and recovered. Although inflation is under control, it will recover slowly, market demand will also be affected, and production costs are still high while prices are relatively low. In addition, instability in the Red Sea increases logistics costs, other related costs, and unstable raw material sources.

All of the above causes will directly impact seafood exports in 2024. It is forecasted that businesses will need time to adjust and adapt gradually to recover in the second half of 2024, bringing export turnover to Vietnam's seafood exports this year to US$ 9.5 - 10 billion.

How do you assess the opportunities and challenges for our country's seafood export sector this year?

As mentioned above, the seafood industry will continue to face problems with consumption demand; competitiveness with other countries; consumer trends; corporate responsibility requirements such as sustainability certifications, environmental protection certifications, and animal welfare certifications...; and trade barriers such as anti-dumping, anti-subsidy lawsuits, illegal, unreported and unregulated (IUU) fishing...

Regarding internal issues, businesses will face challenges from unstable seed quality, climate change, and epidemics that affect farming efficiency, leading to unstable raw material sources for export processing.

However, currently, with the attention of the Government and the Ministry of Agriculture and Rural Development in implementing a series of projects and topics to support businesses in adapting to climate change and applying science and technology to farming and production, businesses have focused on more processing activities to solve the problem of lack of raw materials, paying more attention to deeply processed seafood products, added value, and the domestic market have an important role in helping balance seafood supply and demand while import markets are experiencing many fluctuations.

Currently, Red Sea tensions are a matter of concern for the seafood export business community. In your opinion, what impact will this have on future orders or the additional costs businesses will bear?

The recent incident of a shipping ship being attacked by Houthi forces in the Gulf of Aden, Red Sea, has warned all parties, especially shipping lines and export businesses in general and seafood in particular.

In recent times, with the Red Sea instability, seafood businesses have had to shoulder more transportation costs and other insurance costs. This contributes to the increased cost of goods sold.

At the same time, businesses still face safety risks for shipments sold to the EU or US if shipping lines choose to sail through the Red Sea.

Faced with so many challenges, what turning points should Vietnam's seafood exports have in terms of markets and export products to maintain growth, Sir?

The strength of Vietnamese seafood is value-added products and deep processing, so it is necessary to promote this strength.

Seafood export businesses must promote international certifications in food hygiene and safety sustainable development... to meet current consumer needs and trends. Photo: Hong Tham.

Simultaneously, increase focus on promoting international certifications in food hygiene and safety (HACCP, ISO, BRC, IFS...), sustainable development (MSC, ASC, BAP, FIP...), social responsibility and environmental responsibility (CSR, BSCI...) to meet consumer needs and trends.

In addition, businesses also need to research and select advantageous markets in terms of geographical location and small and other potential markets.

So, in your opinion, how flexible should Vietnamese seafood export enterprises adapt themselves to increase competitiveness in the market?

To increase the competitiveness of seafood export businesses and affirm their position in today's challenging conditions, companies need to be more proactive in applying science and technology applications in aquaculture and production to increase operational efficiency.

Promote the training of high-quality human resources, apply digital transformation applications in management and business, and focus more on deeply processed seafood products, strong products...

It is necessary to carefully research the market and consumer trends to be flexible in building production and business strategies.

Furthermore, businesses need to calculate political instability and market fluctuations to appropriately estimate this cost into export prices without reducing the competitiveness of Vietnamese seafood.

Thank you so much for your time!

Translated by Tuan Huy

(VAN) Last week, the U.S. Department of Agriculture (USDA) released its June World Agricultural Supply and Demand Estimates (WASDE), raising projections for both Indian rice production and U.S. rice imports for the 2025/2026 marketing year.

/2025/06/17/2344-1-131758_261.jpg)

(VAN) Amid tariff risks and growing trade barriers in the U.S. market, Australia is emerging as a promising destination to sustain the growth momentum of Vietnam's shrimp exports.

/2025/06/17/2013-1-nongnghiep-112009.jpg)

(VAN) This notable growth trend reflects the global taste for fresh, nutritious fruits and the expanding use of lychees across various sectors.

(VAN) The political and cultural insulation of Japan’s beloved grain is falling apart, and experts warn the country’s relationship with the staple will have to adapt.

(VAN) Noting risks, report examines impacts of avian influenza, changing trade patterns since 2022, fish fraud, and shipping industry’s net-zero goals.

(VAN) Mr. Tran Quang Bao, General Director of the Forestry and Forest Protection Department, met and worked with the International Wood Products Association to promote cooperation in the field of timber trade.

(VAN) China's outbound shipments of rare earths in May jumped 23% on the month to their highest in a year, though Beijing's export curbs on some of the critical minerals halted some overseas sales.