November 22, 2024 | 21:43 GMT +7

November 22, 2024 | 21:43 GMT +7

Hotline: 0913.378.918

November 22, 2024 | 21:43 GMT +7

Hotline: 0913.378.918

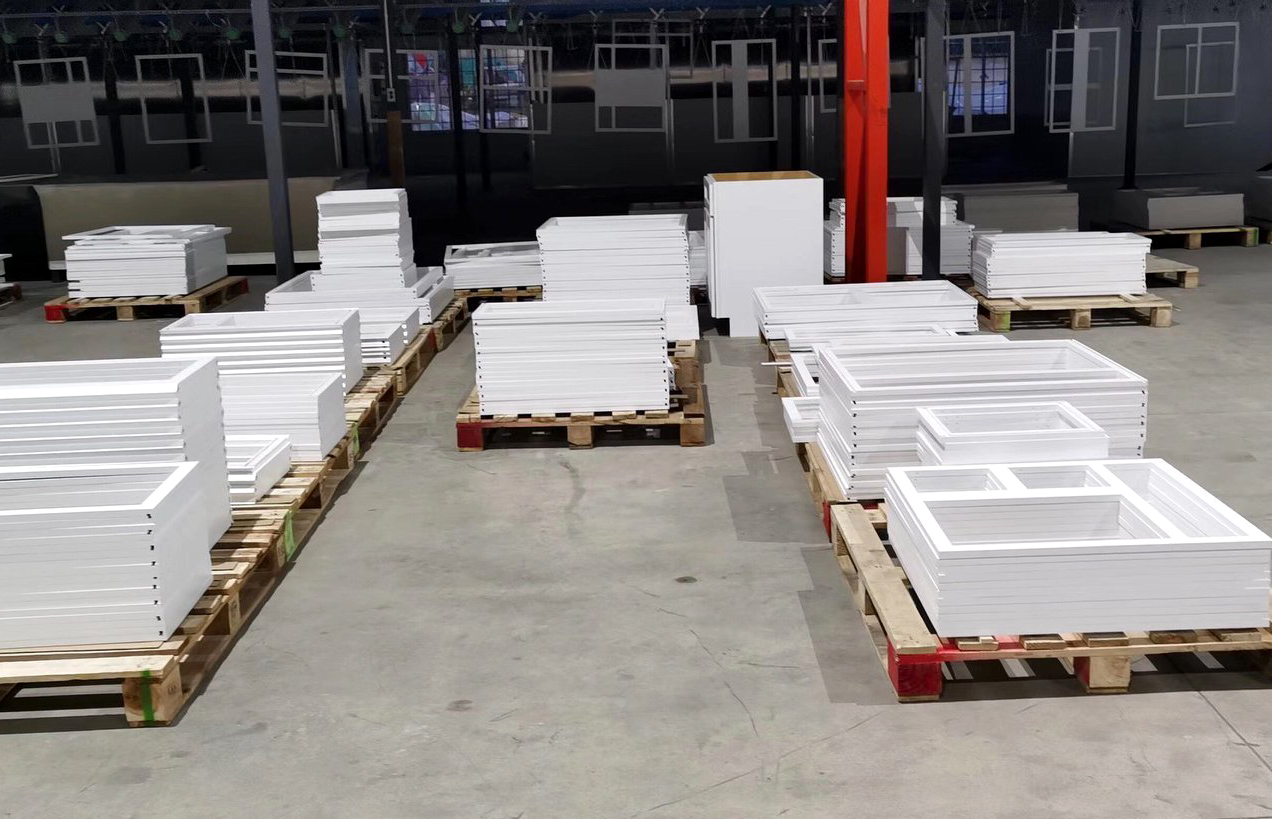

Wood processing for export at a factory in Binh Duong. Photo: Son Trang.

The Middle East is a growing market for wooden furniture, with the United Arab Emirates (UAE) being the most prominent. According to Mr. Truong Xuan Trung, Head of Vietnam Trade Office in the UAE, the revenue of furniture products in this market is estimated to reach 4 billion USD in 2023. The market has a projected annual growth of 4.12% between 2023 and 2027. Additionally, living room furniture is this market's largest subsegment, with a value of 1.08 billion USD in 2023.

According to Mr. Trung, the UAE is one of the most attractive economies in the Middle East. It is also one of the 25 most competitive economies in the world. In addition to its thriving economy and openness to international business, the UAE is also one of the world's most attractive tourist destinations. This wealthy country has attracted an increasing number of tourists over the past two decades, resulting in great demand for its products. On the other hand, the UAE is primarily concerned with the extraction and processing of oil and gas. As a result, most of the wooden items and furniture in the UAE are imported.

China is the largest supplier to the UAE's furniture market, followed by Germany, Thailand, Romania, and India in terms of import turnover. Vietnam is currently ranked 15th in the list of furniture exporters to the UAE.

The UAE is currently shifting its focus to urban construction and development. Subsequently, the demand for wooden furniture for new buildings and luxury villas is rising rapidly. Most notably, rental houses in the UAE are not pre-equipped with furniture. As a result, potential tenants must buy all of the furniture and household items such as beds, cabinets, tables and chairs by themselves.

Furniture for living room, dining room, bedroom, etc. are the top choices among UAE buyers due to the popularity of real estate projects in these areas. Additional projects will be developed in the future because the UAE government has pledged to invest 200 billion USD in building infrastructure over the next five years. Consequently, the demand for furniture in this market will continue to increase exponentially.

On the other hand, despite the large amount of import from China, furniture distributors in the UAE are looking to diversify their supply sources as well as expand their product range. This is an excellent opportunity for Vietnamese wood businesses to enter this market.

Wood products at a factory in Binh Duong. Photo: Son Trang.

However, promoting the export of wood and wood products to the UAE can be a challenging task. Mr. Nguyen Liem, Chairman of the Board of Directors of Lam Viet Joint Stock Company headquartered in Binh Duong province shared his thoughts on the issue: "We have visited Dubai multiple times in search of export opportunities at international fairs. However, we find it very difficult to sign contracts because we would have to follow different orders for each individual hotel, resort and so on. Due to the need for specialized equipment, not all factories in Vietnam can satisfy this high demand. On the other hand, a team of skilled workers is required to complete these orders. Furthermore, businesses must also designate a manager in the import market to supervise the installation and warranty of products.

Despite the challenging circumstances, the potential to export to the UAE as well as other countries in the Middle East has motivated many Vietnamese businesses in the wood industry to surveys and identify export opportunities.

According to the General Department of Customs, the export turnover of Vietnam's wood products to countries in the Middle East increased sharply during the first four months of 2023, with the UAE holdng the major market share. Vietnam's exports of wood and wood products to the UAE during the first four months of 2023 yield a profit of 11.2 million USD, which is an increase of 38% compared to 2023. The main export products to this market are items used in construction and furniture.

On the other hand, Vietnam is striving to achieve a 'green' supply chain in the wood industry. Namely, Vietnam will establish a roadmap to convert production with a focus on reducing greenhouse gas emissions. As a result, Vietnamese wood businesses will have better opportunities at accessing strict foreign markets with a 'green' supply chain.

Translated by Nguyen Hai Long

(VAN) In its monthly grain market report, released on Nov. 21, the IGC revised total grains ending stocks lower by 8 million tonnes, to 576 million, a 3.5% decrease from the previous year.

(VAN) Vietnam's tea industry, one of the top five tea-exporting countries in the world, is facing a concerning reality as the average export price of Vietnamese tea is only 67% of the global tea price.

(VAN) Analysts at EastFruit have observed that fruits and vegetables are contributing to inflation in Russia, despite the government's efforts to combat it through fiscal policies and an increase in the key interest rate to 21%.

(VAN) Expanding high-quality tea varieties has become a strategic goal for Vietnam's tea industry to increase export value and escape the 'cheap price trap' when exporting tea to global markets.

(VAN) After implementing the OCOP program, several products from Bac Kan Province have established a strong presence in the market and are moving towards export.

(VAN) On November 20, a Vietnamese company exported nearly 10 tons of bird's nest to China's market through the Bac Luan II border gate in Quang Ninh.

(VAN) Many businesses believe that Halal market is huge and has a lot of potential; even in Vietnam, there are Muslims, and improving product quality is important.