June 15, 2025 | 05:40 GMT +7

June 15, 2025 | 05:40 GMT +7

Hotline: 0913.378.918

June 15, 2025 | 05:40 GMT +7

Hotline: 0913.378.918

Considering the forecasts in the Agricultural Outlook 2023 - 2032, the world market of key agro-products and international trade in general may continue to experience major changes in the next ten years.

Agricultural Outlook 2023 - 2032 is derived from medium-term forecasts for the most produced, consumed and traded agricultural and fishery products globally. Agricultural demand is expected to grow more slowly over the next decade due to population decline and per capita income growth, and agricultural commodity production may grow at a slower rate.

The growth drivers are reduced not only by the weakening global demand for agricultural products but also by the slowdown in productivity growth due to rising input prices especially in fertilizers, and tightening environmental regulations.

| Production index (2013 - 2022 average = 100) | Real price index (2013 - 2022 average = 100) | |

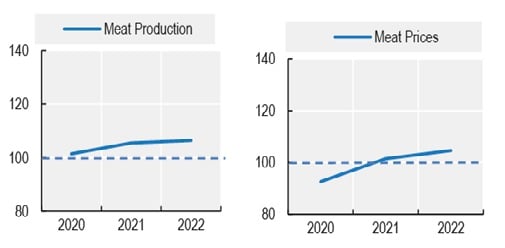

| Meat: In 2022, international meat prices remain high, except for lamb meat which declined slightly due to weakening import demand from China. However, various factors such as livestock diseases, increasing input costs, and extreme weather conditions act as impediments to meat production growth. Despite the challenges, there has been an overall expansion in meat production mainly because of increased meat output in Asia, notably a spike in pork production in China. |  | |

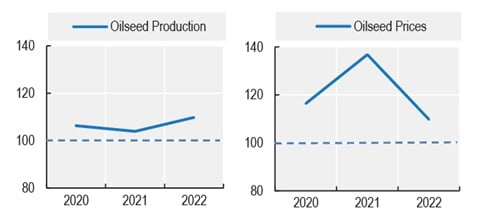

| Oilseed: International oilseed prices have dropped from the record peak from record highs observed in 2022 but are still above the recent years’ average. The decline in price is supported by a recovery in terms of soybean and rapeseed output despite losses in sunflower seed production in Ukraine and reduced prospects for soybean production in Argentina. Improvement in the supply of palm oil potentially from Indonesia and Malaysia also contributes to the drop in oilseed prices. |  | |

| Sugar: Global demand increased in the current crop year, albeit at a slower rate due to slowing economic growth. Despite the recovery in Brazil, the world's main sugar supplier, weakened production prospects in other major sugar exporting countries coupled with high input costs are partially contributing to the overall pressure on international sugar prices. |  | |

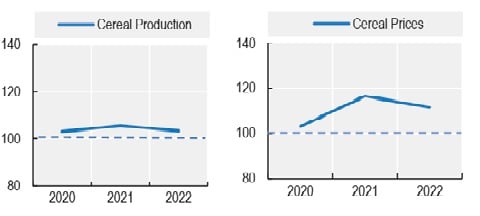

| Cereal: Global wheat production and stocks have increased, while production of corn and other coarse grains has not been able to meet the demand. Rice output is above average and prices are still relatively high. Wheat and coarse grains prices between 2021 and 2022 were the highest recorded in 20 years but began to decline in late July 2022 when an agreement was reached in the Black Sea Grain Initiative. |  | |

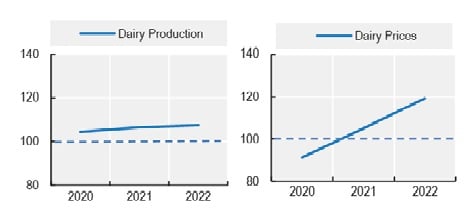

| Milk: The international milk price was up 20% in 2022 but dropped at the end of the same year, primarily due to an increase in input prices. Domestic milk prices experienced a rather strange development as only a small portion of milk produced was traded internationally. Global milk production increased at a slower rate in 2022 than in previous years. World trade in dairy products also declined, mainly because China reduced imports. |  | |

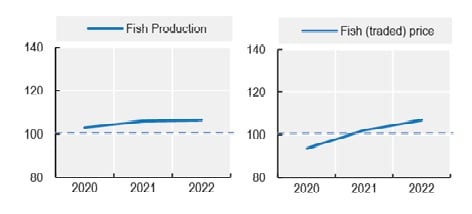

| Fish: After a strong recovery in 2021, the world continued to expand fish consumption in 2022 because of the ongoing global economic recovery, while fish production has only increased slightly. International fish prices, which increased significantly in 2021, continued the uptrend in 2022 due to increased demand and higher production costs. |  | |

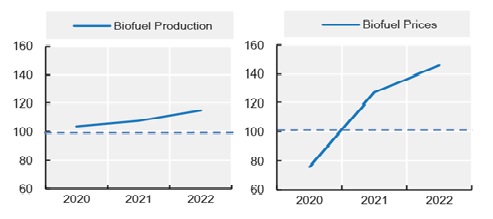

| Biofuel: In 2022, biofuel consumption increased, offsetting the decline caused by the drop in global transportation during the COVID-19 pandemic. The ethanol market almost made a comeback to the levels seen in 2019. The biodiesel market also recovered as it was less affected by the pandemic. The price of biofuels in the world increased because of the higher cost of production. |  | |

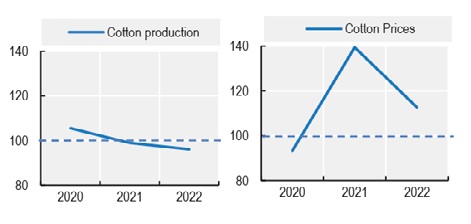

| Cotton: In 2022, global consumption declined in major textile producing countries due to economic uncertainty, inflation and high depreciation against the US dollar. As a result, international prices fell in the second half of 2022, after reaching an 11-year high in May 2022. The slight decline in world cotton production mainly reflects reduced output in the USA and Pakistan. |  | |

International trade will remain essential for food security and the livelihoods of laborers along the food supply chain in food exporting countries. The increasing risk of climate variability, crop and livestock diseases, changes in input prices, evolving macroeconomics, and policy shifts lead to biases in market results from current forecasts.

Translated by Samuel Pham

![Turning wind and rain into action: [4] Bringing climate bulletins to remote and isolated areas](https://t.ex-cdn.com/nongnghiepmoitruong.vn/608w/files/linhnhp/2025/06/14/1152-z6704423696987_15fd32ffc26d590d204d520c9dac6786-nongnghiep-151141.jpg)

(VAN) The Vietnam Agriculture and Nature Newspaper interviewed Mr. Vu Thai Truong, Acting Head of Climate Change and Environment at UNDP Vietnam, to gain deeper insight into how climate bulletins are delivered to farmers.

(VAN) In Tien Giang, a high-tech shrimp farm has developed a distinctive energy-saving farming model that has yielded promising results.

![Turning wind and rain into action: [3] 300.000 farmers benefit from agro-climatic bulletins](https://t.ex-cdn.com/nongnghiepmoitruong.vn/608w/files/news/2025/06/12/e5a48259d6a262fc3bb3-nongnghiep-125122.jpg)

(VAN) The agro-climatic bulletin has become a valuable tool for farmers in the Mekong Delta. After more than five years of implementation, the initiative is gradually being expanded nationwide.

![Turning wind and rain into action: [2] Providing forecasts to the people](https://t.ex-cdn.com/nongnghiepmoitruong.vn/608w/files/news/2025/06/12/e5a48259d6a262fc3bb3-nongnghiep-103927.jpg)

(VAN) In addition to improving the quality of hydrometeorological forecasts, putting forecast bulletins into practical use is crucial for production and disaster prevention.

(VAN) Blue carbon is receiving attention for its rapid absorption capacity and vast potential. It represents a promising nature-based solution to respond to climate change.

/2025/06/11/3507-1-161904_583.jpg)

(VAN) Seagrass beds and coral reefs serve as 'cradles' that nurture life in the ocean depths, creating rich aquatic resources in Vietnamese waters.

![Turning wind and rain into action: [1] Forecasting for farmers](https://t.ex-cdn.com/nongnghiepmoitruong.vn/608w/files/news/2025/06/11/e5a48259d6a262fc3bb3-nongnghiep-111919.jpg)

(VAN) Weather is no longer just a matter of fate. Forecasts have now become an essential companion for farmers in every crop season.