May 21, 2025 | 09:02 GMT +7

May 21, 2025 | 09:02 GMT +7

Hotline: 0913.378.918

May 21, 2025 | 09:02 GMT +7

Hotline: 0913.378.918

The Organization for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization (FAO) of the United Nations recently provide an assessment of the ten-year outlook (2023-2032) for the agricultural commodity and fisheries market at national, regional and global levels amid continued risks to the global economy and high energy prices.

The Agricultural Outlook 2023 - 2032 is a collaborative effort between the OECD and FAO, prepared using information input from member countries and international commodity organizations. The basis of the projections in this outlook for the next decade takes into account the World Economic Report of the International Monetary Fund (IMF).

The fourth Global Conference of the One Planet network’s Sustainable Food Systems Program recently held in Hanoi, Vietnam. Photo: VAN

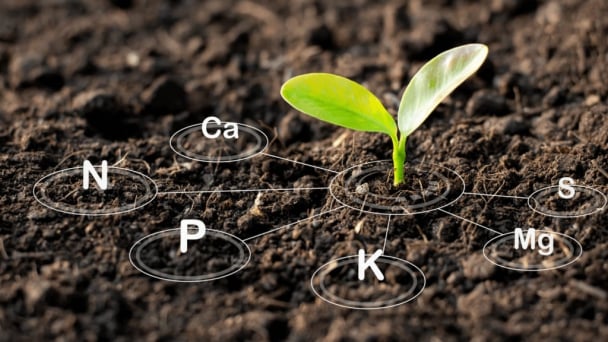

The skyrocketing prices of agricultural inputs over the past two years have raised concerns about food safety. The 2023 report shows that rising fertilizer costs may potentially lead to higher food prices. According to an OECD-FAO analysis of the estimate scenario, for every 1% increase in the price of fertilizers, the price of agricultural commodities will increase by 0.2%.

The increase will be more significant for crops that use fertilizers directly as inputs for livestock production except for poultry and pork production that relies heavily on mixed food. Although this scenario focuses on the link between fertilizers and agricultural commodities, fluctuations in the prices of energy, seeds, labor and machinery will also affect food prices.

Estimates of food consumption are done by combining analytical methods to calculate food loss and waste. The measurement efforts need to provide evidence based on support policies to halve the amount of food waste per capita at retail stores and consumers, reduce food loss along the production and supply chain by 2030. FAO has shown great efforts to advise countries in using food effectively, avoiding waste.

The global market is witnessing a sharp increase in demand for agricultural commodities used as feed for production.

Economic growth over the next decade is forecast between 2.6% and 2.7%. Energy prices will decline in 2023 before continuing to increase slowly until 2032. Global forecast of medium-term trends for supply, demand, trade and prices for major agricultural and fishery commodities differed only slightly from last year's forecast.

However, according to the Agricultural Outlook 2023-2032, conflicts in some countries and territories continue to add to the uncertainties for food, energy as well as agricultural input prices. At the beginning of the conflicts, reduced availability of grain and fertilizer would be a major concern for the global market.

In this context, the use of major agricultural commodities is projected to grow by 1.3%/year over the next decade, a slower rate than the previous decade because population and income per capita growth are expected to slow down.

Agricultural products used as feed for animal husbandry and aquaculture are increasing, thus pushing the expansion and intensification of livestock production in low and middle-income countries. This leads to a rapid increase in the demand for animal feed in the next decade. In contrast, in high-income and some upper middle-income countries, lower livestock production growth and improved feeding efficiency will result in slower feed demand growth compared to the last decade.

Demand for first-generation biofuel feedstocks is expected to grow slowly in the next ten years. Most of the use of supplemental biofuels for agricultural crops may occur in India and Indonesia, due to the increased use of transport fuels and higher biofuel blending demands.

In other key markets, such as the EU, demand for first-generation biofuel feedstocks is expected to decline due to the decline in fuel-driven transport and the shift to other feedstocks. Overall, the share of global use of cane oil and vegetable oil biofuels is expected to increase, while corn's share of biofuels is expected to decline.

Regarding investment in technology, infrastructure and training, the situation remains unchanged from last year's predictions. Thus, growth in total global agricultural output will remain at 1.1%/year. Most of this growth will happen in low and middle-income countries. The Outlook report predicts that access to food is getting better and better even if the price of energy and agricultural inputs (e.g. fertilizer) will continue to rise, which will increase production costs and possibly lead to food price inflation and greater food insecurity.

In the context that global growth is forecast to slow down in the next 10 years, the impact of conflicts in some countries has caused the price of agricultural inputs to escalate, affecting agricultural production and supply chains, the linkage and support between countries in the production and supply of global food is considered extremely vital.

Translated by Samuel Pham

(VAN) Facing the threat of rabies spreading to the community, Gia Lai province urgently carries out measures to vaccinate dogs and cats on a large scale.

(VAN) Disease-free livestock farming not only protects livestock herds but also stabilizes production and livelihoods for many farmers in Tuyen Quang.

(VAN) Japan's grant aid project contributes to capacity building, promoting organic agricultural production, and fostering sustainable community development in Dong Thap province.

(VAN) For years, the CRISPR-Cas9 genome technology has been reshaping genetic engineering, a precision tool to transform everything from agriculture to medicine.

(VAN) Vietnam aims to become a 'leader' in the region in the capacity and managing effectively soil health and crop nutrition.

![Reducing emissions from rice fields: [Part 1] Farming clean rice together](https://t.ex-cdn.com/nongnghiepmoitruong.vn/608w/files/news/2025/05/05/z6509661417740_a647202949c539012a959e841c03e1d3-nongnghiep-143611.jpg)

(VAN) Growing clean rice helps reduce environmental pollution while increasing income, allowing farmers to feel secure in production and remain committed to their fields for the long term.

/2025/05/19/5136-1-144800_230.jpg)

(VAN) The Nghe An Provincial People's Committee has just approved the list of beneficiaries eligible for revenue from the Emission Reductions Payment Agreement (ERPA) in the North Central region for the year 2025.