May 20, 2025 | 18:02 GMT +7

May 20, 2025 | 18:02 GMT +7

Hotline: 0913.378.918

May 20, 2025 | 18:02 GMT +7

Hotline: 0913.378.918

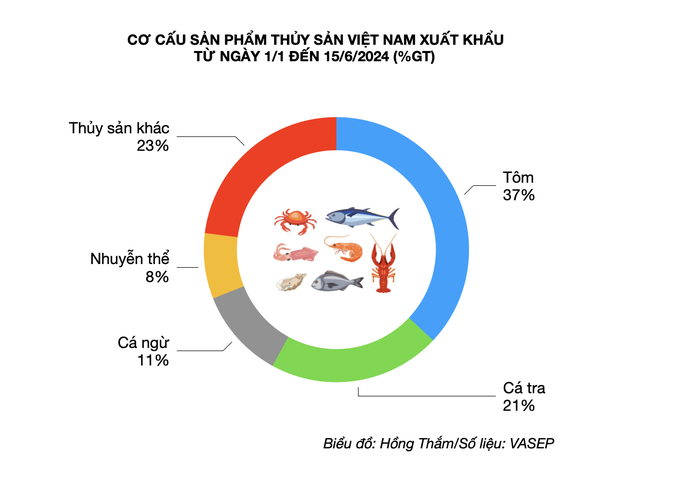

During the review meeting for the first half of 2024 conducted by the Fisheries Department (Ministry of Agriculture and Rural Development), Ms. Le Hang, the Communications Director of the Vietnam Association of Seafood Exporters and Producers (VASEP), reported that Vietnam's seafood export revenue reached approximately USD 4.4 billion by the end of June 2024, marking a growth of nearly 7% compared to the corresponding period in the previous year.

Ms. Le Hang, VASEP Communications Director, said that Vietnam's shrimp exports in 2024 cannot reach the target of 4 billion USD. Photo: Hong Tham.

Shrimp exports experienced a 7% increase, mostly driven by a substantial surge in live lobster exports to China. Meanwhile, exports of white-leg shrimp showed a small growth, while black tiger shrimp exports declined.

"Our nation's shrimp exports for this year are unable to meet the target of USD 4 billion, as the first half of 2024 has only attained USD 1.6 billion," highlighted Ms. Hang.

Ms. Hang identified two significant challenges currently confronting the shrimp business. One reason is the competitive pricing of exports in different countries, which is influenced by the shrimp industries of Ecuador and India.

"Ecuador perseveres in the face of numerous challenges and maintains a steady growth in both shrimp production and exports." Ecuadorian shrimp is already dominating markets in Japan, Australia, and the EU, where it previously faced tough competition from us. "Simultaneously, Ecuador is exerting significant influence over major markets such as the US and China," Ms. Hang declared.

The primary concern for businesses and farmers at present is the disease that is impacting farmed shrimp, which is the second issue of utmost importance. The white feces syndrome (WFS) in white-leg shrimp is a complex and unresolved issue that may lead to a scarcity of shrimp resources in the latter part of 2024.

"The combination of low export prices and the presence of complex diseases has caused numerous farmers to abandon their ponds," stated Ms. Hang.

Based on data provided by VASEP, the export of pangasius in the first half of this year amounted to USD 922 million, representing a growth of almost 6% in comparison to the same period of the previous year. Despite an increase in demand, the pricing for exporting pangasius to several countries, including China, the EU, and the UK, continue to be low. The United States market exhibits more favorable indications in terms of both the price and volume of imports from Vietnam.

Ms. Hang emphasized that the long-term challenges for Vietnam's pangasius business are illnesses and breeding stock. Nevertheless, the current concern revolves upon the market conditions.

Vietnam's pangasius exports in the first half of this year reached 922 million USD, up nearly 6% over the same period. Photo: Hoang Vu.

The export of Vietnamese pangasius to key markets like as China, the U.S., and the EU is currently more hopeful in the U.S. market. This is due to lower inventory levels and a positive economic outlook.

The export price of Vietnamese pangasius to the Chinese market is very low. Currently, China is importing Vietnamese pangasius fillets at a price of approximately USD 1.8 per kilogram. Thus, enterprises may need to largely depend on exporting by-products, such as pangasius fish bladder, to this market.

As per a VASEP representative, tuna exports in the first half of this year witnessed a substantial growth of about 25%, amounting to USD 477 million. This growth may be primarily attributed to a significant rise in the sales of canned and bagged tuna. This suggests that inflation still has an impact on the market, with imports mainly comprising things that are modestly priced.

Although there has been an increase in export revenue during the first half of 2024, Vietnamese tuna companies are deeply concerned about the availability of raw materials.

According to Ms. Hang, VASEP member firms have reported that the current domestic tuna supply is only enough for processing for a period of 8-10 days. After this time, there is either a shortage of raw materials or they have to rely on imported supplies.

The procurement of raw materials for tuna production is highly complex and demanding, mostly due to the numerous hurdles associated with legislation against illegal, unreported, and unregulated (IUU) fishing. For instance, the efficiency of ports in issuing certificates is now lacking, and there exist regulations pertaining to the entire fishing process that are designed to guarantee food safety.

Furthermore, there are problems posed by the law mandating a minimum size of 50cm for skipjack tuna, as well as other regulations outlined in Decree No. 37/2024. These include the prohibition of combining seafood materials obtained from imported fishing with those obtained from domestic fishing in the same export batch.

"This situation instills fear in businesses, discouraging them from engaging in production using either. domestic or imported goods, as well as from importing goods for the purpose of export processing." At now, companies involved in export processing are reaping the benefits and witnessing a greater increase in sales compared to their counterparts. "Nevertheless, if this trend persists, we will progressively transform into a central hub for global market processing and forfeit our domestic resource advantages," stressed Ms. Hang

Translated by Linh Linh

(VAN) Oliyar, a prominent Ukrainian oil and fat manufacturer, has revealed plans to build a farm for 2.3 million laying hens in the Lviv region. The additional production quantities promise to change the competitive landscape of the egg market of the Eastern Europe region.

(VAN) On May 15, Ministry of Agriculture and Environment of Vietnam hosted the 'Connecting Vietnam - Germany agricultural, forestry and fishery trade' seminar in Berlin, Germany.

(VAN) In the face of counterfeit and imitation products, Khanh Hoa Salanganes Nest Company hopes for the prompt completion of the legal framework, strict enforcement against violations, and protection of the bird’s nest brand.

(VAN) Japan's efforts to lower the price of rice through the release of its stockpile may finally be making some progress, albeit at a snail's pace.

(VAN) U.S. tariffs are not only a 'shock', but also an opportunity for Vietnamese businesses to renew their mindset toward comprehensive development.

(VAN) As Bac Giang lychee enters the harvest season, Minister Do Duc Duy expects that the fruit will contribute greatly to agricultural exports due to standardized production and deep processing.

(VAN) Consumers have shown a preference for free-range eggs, but those farming systems are more vulnerable to biosecurity risks like bird flu.