June 15, 2025 | 11:37 GMT +7

June 15, 2025 | 11:37 GMT +7

Hotline: 0913.378.918

June 15, 2025 | 11:37 GMT +7

Hotline: 0913.378.918

While supply concerns in phosphorus will likely continue into the New Year, the potash fertilizer market is in a well-supplied situation around the world.

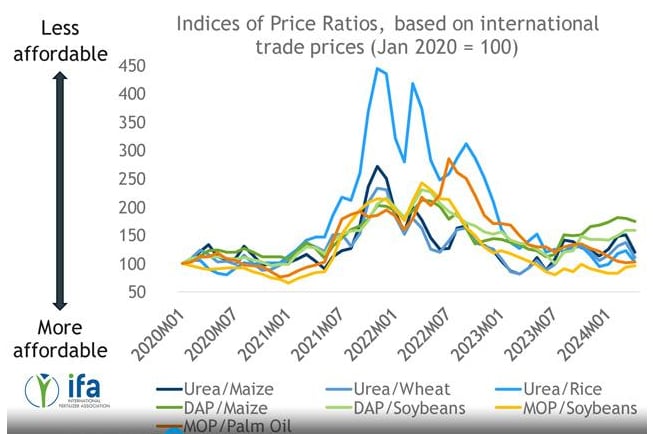

Because of a huge global supply of potash fertilizer, the affordability of this nutrient is positive. This situation is expected to continue into 2025, according to fertilizer analysts. Chart courtesy of the International Fertilizer Association.

With plenty of supply in the global market, potash fertilizer prices should continue to see little volatility and be more affordable in 2025, according to fertilizer analysts. However, there are some geopolitical concerns facing the market.

K FERTILIZERS RECOVREY GLOBALLY

Global fertilizer consumption (nitrogen, phosphorus, potash) was forecast to increase by 4% in 2023 and by 3% in 2024, according to the Summary Report Medium-Term Fertilizer Outlook by the International Fertilizer Association (IFA) (https://www.fertilizer.org/…). That report with its estimates was released during summer of 2024. This comes after declines in consumption in the two previous consecutive years.

Consumption was forecasted to reach 203.7 million metric tons (mmt) of nutrients in 2024, slightly above the previous record reached in 2020. This recovery was because of improving affordability since prices reached their peak in May 2022, according to IFA.

The recovery in global fertilizer use has not been equally shared among the three major nutrients. Potash fertilizer use fell by 6.2 mmt (minus 15%) between 2020 and 2021, and in 2024 consumption was expected to be about 2% lower than in 2020.

Global potash fertilizer production was estimated to have risen by 13% to 69.3 mmt in 2023. The East Europe/Central Asia (EECA) region was the largest driver behind this recovery, thanks to higher output from Belarus and Russia.

IFA said potash exports from Belarus recovered by 82% in 2023 to 8.2 mmt after falling in 2022 because of western sanctions. Another 1.3 mmt could be stored at Russia ports, the report said.

K MARKET WELL SUPPLIED

Josh Linville, vice-present of fertilizers for StoneX, said supply from both Belarus and Russia continues to flood the global K market despite the western sanctions. These financial penalties were in response to Russia's 2022 invasion of Ukraine and were applied to both Russia and Belarus.

Russia's potash exports were close to 10 mmt in 2021 and then dropped to just 7.5 mmt in 2022, he said. However, 2023 export data shows Russia's potash exports increased to 11.2 mmt.

The sanctions had a temporary effect on potash exports, but they were short-lived. Both nations were able to continue to ship the nutrients out of the Black Sea region, he said.

"There was some talk that Belarus' president wanted to see a 10% reduction in (potash) supply, but we really don't think this will happen," Linville told DTN.

The potash market did avoid a major supply issue in mid-2024, according to Mark Milam, senior editor for fertilizers for Independent Commodity Intelligence Services (ICIS).

The Canadian rail and port strike could have limited supply of Canadian potash to the world market, he said. Canada is the world's leading potash producer, exporting 23 mmt with reserves totaling 1.1 billion metric tons, according to the government of Canada website.

Milam said potash fertilizer affordability is the most positive of the three major nutrients, even with lower commodity prices, he said.

"Potash supply and prices are in very good shape right now," Milam said.

COMPANIES INVESTING IN K PRODUCTION

Justin Rackleff, Americas fertilizer markets lead for London-based CRU, said potash fertilizer manufacturers are making huge investments in their businesses and expanding their production around the world. Many companies are growing their portfolios, while also attempting to lower their carbon footprint, he said.

As a result, even more potash supply could be coming to the global market, Rackleff said.

Global potash capacity is expected to grow by 19% to 76 mmt in 2028 compared to 2023, according to IFA data. Investments in Laos and Russia are expected to be the major contributors to growth until about 2026 while new mine investments in Canada, Russia and Belarus should come online in 2027.

"There appears to be no risk to the up supply in this market," Rackleff said.

Because of this increasing supply to the potash market, it appears potash prices should remain stable in 2025, Rackleff said.

Linville said he believes potash prices won't move much during the new year. While prices might not fall too much, they probably won't climb higher either, he said.

"I don't think there is much to get excited about with potash prices," Linville said.

While the forecast appears to be stable, there is still some risk to the potash market, according to Samuel Taylor, Rabobank analyst for farm inputs.

Taylor said roughly 35% of the global potash market is based in Belarus and Russia. As Russia continues its military conflict with Ukraine, any further escalation or even expansion of this war could have a negative effect to the global potash market.

"These are things you really can't predict," Taylor stressed.

Despite this geopolitical risk in the Black Sea region, he does believe potash prices will remain steady and are expected to remain "bland" for the first six months of 2025, Taylor said.

FERTILIZER WILD CARDS

Linville said something he is watching in 2025 which may affect fertilizer markets is the new Trump administration, which will take control in mid-January. Donald Trump has threatened new tariffs against both Mexican and Canadian products.

Some analysts believe that tariffs against Canadian products, specifically Canadian potash, would cause prices to increase.

Tariffs seem to work in other markets, but it is not exactly clear what will happen with fertilizers, Linville said.

"It will be fascinating to see what exactly happens," Linville said.

How much potash fertilizer gets applied in the fall application window could influence supply and prices in 2025, according to Milam.

After an extremely wet November, the U.S. Corn Belt did see and continues to see some nutrients applied. How much is applied matters -- logistic and supply concerns might emerge in the spring if some regions do not see some application at the end of 2024, he said.

Potash prices could jump some this spring and then settle back down if limited amount of the nutrient is applied, Milam added.

DTN

(VAN) Noting risks, report examines impacts of avian influenza, changing trade patterns since 2022, fish fraud, and shipping industry’s net-zero goals.

(VAN) Mr. Tran Quang Bao, General Director of the Forestry and Forest Protection Department, met and worked with the International Wood Products Association to promote cooperation in the field of timber trade.

(VAN) China's outbound shipments of rare earths in May jumped 23% on the month to their highest in a year, though Beijing's export curbs on some of the critical minerals halted some overseas sales.

(VAN) To sustain capital flow, administrative reform alone is not enough; what farmers truly need is an ecosystem where both government and businesses grow together in support.

(VAN) Vietnam and the United States are proactively working together, each in their own way, to ensure that every container of agricultural goods carries not just products, but also long-term trust and value.

(VAN) Stores have started selling rice from the government’s stockpile to feed demand for the staple.

(VAN) Omaha Steaks CEO says rebuilding cattle herds will take about a year to ease price pressures.