April 16, 2025 | 21:13 GMT +7

April 16, 2025 | 21:13 GMT +7

Hotline: 0913.378.918

April 16, 2025 | 21:13 GMT +7

Hotline: 0913.378.918

Crop supplies likely to remain tight amid rising global demand. Photo: FF

Farmer respondents from across the country in the most recent Farm Futures survey expect to harvest a national average of 178.7 bushels per acre (bpa) in 2021. While the total is 0.8 bpa lower than USDA’s early season forecast of 179.5 bpa, it will still beat out 2017’s haul of 176.6 bpa as the highest on record.

Using USDA’s current estimate of 88.5 million acres of corn expected to be harvested for grain this fall, 2021 production is estimated at 15.1 billion bushels – about 63.5 million bushels lower than USDA’s current 2021 production estimate. It will likely trail the 2016 harvest of 15.1 billion bushels as the second largest on record by a margin of 44.7 million bushels.

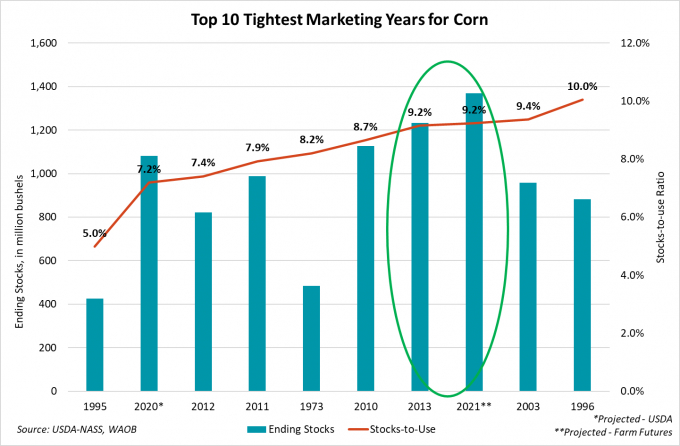

Holding 2021/22 usage rates constant at 14.84 billion bushels, Farm Futures’ yield estimate of 178.7 bpa would likely shrink available corn supplies by 63.5 million bushels. That would leave ending stocks at 1.37 billion bushels, shrinking USDA’s current stocks to use ratio for 2021/22 from 9.6% to 9.2%.

Corn stocks are expected to shrink to the second tightest level in the last 60 years by the time the 2020/21 marketing year ends at the end of this month, a result of aggressive 2020/21 exports and two previous years of crop shortfalls.

Barring any significant weather incidents before harvest, this year’s crop will help to replenish depleted corn stockpiles. But will it be enough? New crop corn supplies are expected to remain at the eight-tightest level in the past 60 years as global demand continues to rise.

Since touching a low of $3.21/bushel nearly a year ago, new crop December 2021 corn prices have surged a staggering 72% to $5.53/bushel at today’s market close, though prices briefly topped out at $7.32/bushel earlier this spring on planting delays.

Small crops, variable weather, and rising global feed demand created a perfect storm to fuel a price rally in 2020/21, with market conditions closely mirroring those of drought-plagued 2012. Does that mean 2021/22 could be a repeat of 2013?

There are certainly strong similarities when comparing stocks-to-use ratios. The damage from this year’s drought in the Upper Midwest and Northern Plains has not yet been repaired by Mother Nature, which could hinder production next year.

As global demand continues to intensify, expect any yield downgrades in next week’s World Agricultural Supply and Demand Estimates report to contribute to bullish prices in the corn complex.

Farmers expect record soybean production

Despite drought conditions in the Upper Midwest through the better part of the 2021 growing cycle, Farm Futures readers expect 2021 soybean yields to come in a half bushel higher than USDA’s current estimate of 50.8 bpa.

Farm Futures’ August 2021 survey finds U.S. farmers expect to harvest an average of 51.3 bpa from the 2021 soybean crop. That yield would follow 2016’s rating of 51.9 bpa as the second biggest yield in history.

The success of the 2021 soybean crop will be dependent on how wide the yield variance ends up between the Upper Midwest and the rest of the Corn Belt. Scattered showers have fallen in the Northern Plains in recent weeks, which will likely support peak pod development over the next week though the showers are likely not enough to significantly reduce the region’s drought classifications.

Farm Futures’ 51.3 bpa estimate would place the 2021 soybean crop at 4.45 billion bushels, about 41.8 million bushels more than USDA’s current projection. If realized, that total would best 2018’s record haul of 4.43 billion bushels as the largest U.S. soy crop ever.

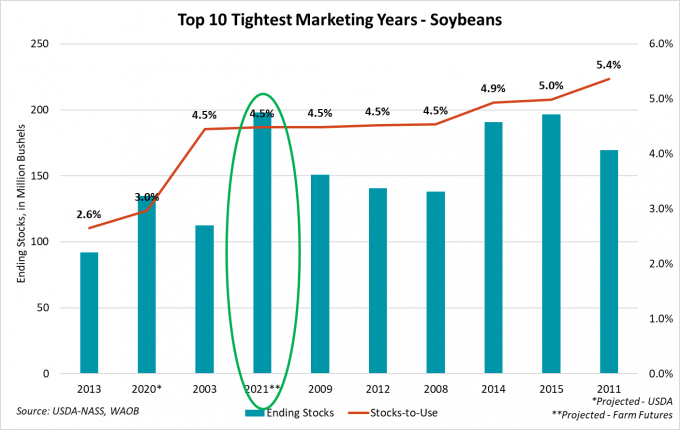

Provided USDA does not update demand estimates in next week’s WASDE report, leaving 2021/22 usage rates at 4.42 billion bushels, new crop ending stocks will increase from 156 million bushels to 198 million bushels.

The extra bushels forecasted by Farm Futures are not likely to linger long on the market though. With USDA forecasting 2021/22 soybean usage at a record-setting 4.42 billion bushels, exporters and domestic processors are likely to engage in stiff competition as crops are harvested this fall.

The strong demand projection will keep 2021/22 stocks to use ratio at a tight 4.5% despite the increased production forecast from Farm Futures. Soybean stocks are set to end 2020/21 at the second tightest volume in the past 58 years, while 2021/22’s forecasted stocks to use rating of 4.5% will the fourth tightest during the same time period.

Soybean price rallies were met with resistance this summer as doubts lingered about China’s willingness to buy high-priced soybeans in favor of cheaper grain alternatives, including corn and wheat. If USDA raises its yield forecast next week similar to that of Farm Futures’, producers could expect to see downward price pressure on new crop soybean contracts.

The August 2021 Farm Futures survey was conducted via email questionnaire between July 13 – August 1, 2021. A total of 737 growers from across the country responded. The survey’s margin of error was calculated at 3%.

(Farm Futures)

(VAN) 169 lotus seeds selected by the Vietnam Academy of Agricultural Sciences were carried into space by Vietnamese-American astronaut Amanda Nguyen.

(VAN) Tariffs are making life more expensive for John Pihl. He's been farming in Northern Illinois for more than 50 years.

(VAN) European and American farmer organisations are concerned about the import tariffs that the United States introduced on 9 April for products from the European Union. This makes them 20% more expensive.

(VAN) Global poultry trade is expected to remain strong amid relatively tight global protein supply and growing consumption, RaboResearch concludes in its latest animal protein report.

(VAN) Traditional methods benefit hundreds of species but as new agricultural techniques take over, the distinctive haystacks mark a vanishing way of life.

(VAN) The nation’s top banks are quietly advising their clients on how to build a financial life raft - or perhaps life yacht - from the wreckage of runaway climate change.

(VAN) From FAO Office in the Democratic Republic of the Congo.