April 15, 2025 | 16:23 GMT +7

April 15, 2025 | 16:23 GMT +7

Hotline: 0913.378.918

April 15, 2025 | 16:23 GMT +7

Hotline: 0913.378.918

Weather-related problems with Brazil's second corn crop have sparked a spate of companies exiting their contracts on washout clauses, causing what some traders described as potentially the biggest wave of export cancellations for the world's No. 2 supplier in five years.

According to grain traders and brokers who spoke to Reuters on condition of anonymity, a lot of the corn earmarked for exports is being redirected to the domestic market as premiums are attractive due to shortfalls after the crop was hit by drought and an ill-timed frost.

"It will be really difficult to execute corn contracts," said a trader at a large U.S. firm. "After crop failure ...firms are doing washouts when possible."

In a grains contract, a party can get out of it by paying a settlement amount to a counterparty, a mechanism known as a washout.

A second grain trader at another big U.S. firm said its export program was cut on supply shortage fears, adding the washout wave is comparable to that of 2016, when bad weather also spoiled Brazil's corn crop.

Meatpackers, which use corn as feed, are eager buyers of the redirected product, brokers said. Pork and poultry processors are also importing corn from Argentina thanks to a favorable exchange rate, Ricardo Santin, president of meat lobby ABPA, told Reuters.

Some of the corn trades now being reversed were set at between 40 reais ($7.82) and 45 reais per 60-kilo bag of corn, one broker said. Domestic buyers are prepared to pay 90 to 95 reais, hence the washout bout.

The same broker said grain merchants Cargill and Gavilon would not export any corn via the key Paranagua port this year.

Cargill declined to comment.

Gavilon said late planting and unfavorable weather may have negatively affected the second corn crop, declining to elaborate.

Abramilho, a corn farmers association, said there is uncertainty regarding the amount farmers will be able to harvest, hampering sales to traders.

Brazil's second corn crop, being harvested now, is forecast to be 8 million tonnes lower than last year, with imports likely to rise 58% driven by strong domestic demand.

Brazil's corn exports, in turn, may fall around 15% to 29.5 million tonnes this season, the government said.

($1 = 5.1130 reais)

(AgWeb)

(VAN) Deputy Prime Minister Nguyen Hoa Binh has just signed a decision approving the Project to organize administrative units at all levels and build a two-tier local government structure.

(VAN) This is an important goal that the UN-Habitat organization of the United Nations is implementing in Son La, aiming to respond to climate change and reduce disaster risks.

(VAN) In the context of increasingly complex climate change, the International Organization for Migration (IOM) is committed to supporting Vietnam in developing safe and sustainable migration models.

(VAN) In the second quarter, the whole sector plans to accelerate production and penetrate new, high-potential markets, including the Middle East, Africa, and Halal Islamic Countries.

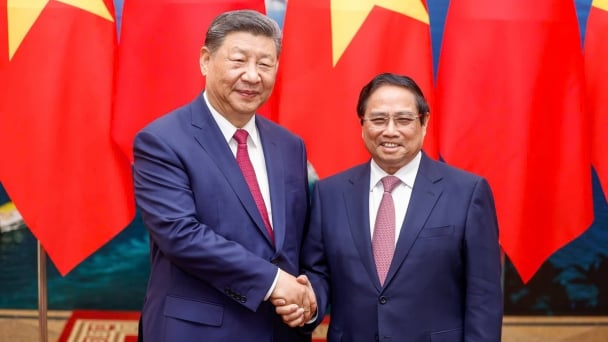

(VAN) On April 14, Prime Minister Pham Minh Chinh met with General Secretary and President of China Xi Jinping, who is on a two-day state visit to Vietnam from April 14 to 15.

(VAN) This represents the most significant growth in the first quarter in the past four years. From January to March 2025, the export turnover of AFF products was 15.72 billion USD.

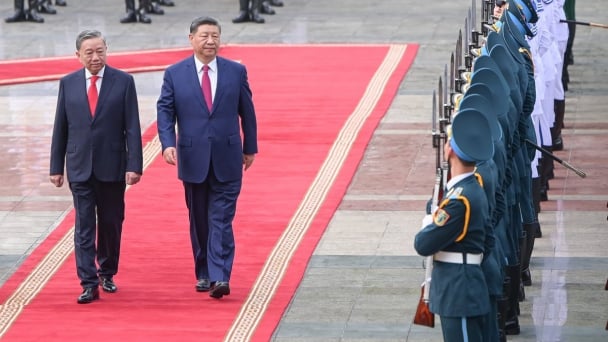

(VAN) On April 14, at the Presidential Palace, Vietnam General Secretary To Lam chaired the welcoming ceremony for General Secretary and President of China Xi Jinping, who is on a two-day state visit.