June 3, 2025 | 00:18 GMT +7

June 3, 2025 | 00:18 GMT +7

Hotline: 0913.378.918

June 3, 2025 | 00:18 GMT +7

Hotline: 0913.378.918

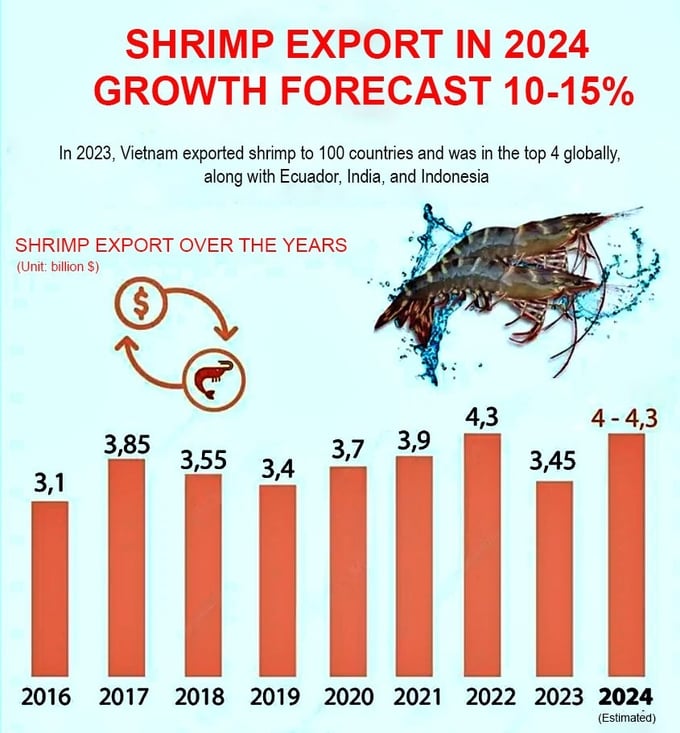

2023 is a challenging year for Vietnam's shrimp industry.

From the beginning of 2024, the shrimp industry is forecast to face difficulties when the American Shrimp Processing Association (ASPA), an organization representing the interests of the country's wild shrimp exploitation and shrimp processing industry, filed a request to impose anti-subsidy duties on shrimp imported from Ecuador, India, Indonesia and Vietnam.

Additionally, tensions in the Red Sea caused shipping costs to the United States to increase. In February 2024, VASEP assessed that shrimp exports to the United States - Vietnam's largest single export market - would be affected throughout the first half of 2024.

However, the export of all kinds of shrimp to the United States in 2 months reached US$ 72 million, an increase of 26%. Besides, after hitting bottom in November 2023, the average price of shrimp increased in early 2024.

Mrs. Ta Thi Kim Thu, a shrimp market expert of VASEP, said that fresh and frozen seafood sales in the United States are forecast to stabilize in 2024, after facing many difficulties in 2023 due to inflation and people tightening their spending.

"Compared to some of the main shrimp suppliers to the United States, such as India, Ecuador, and China, Vietnam is considered more promising, especially when the diplomatic relations between the two countries are very good, opening up many opportunities for Vietnamese goods to go to the United States," Mrs.Thu analyzed.

Also, according to this expert, people in the United States now tend to consume more after the Federal Reserve System (Fed) gave optimistic signals about the economic picture this year, such as wages of workers in January 2024 increased by 4.5% compared to the same period in 2023, much higher than the previous forecast; real income increased 2.5% this year.

In addition, the US's GDP is forecast to increase by 2.1%, higher than the previous forecast of 1.4%. This country is implementing many policies to diversify import markets, reducing too much dependence on a few large markets.

Shrimp exports in 2024 could repeat the 2022 record at US$ 4.3 billion. Photo: VNA.

Vietnamese shrimp has been exported to about 100 countries and territories, with five major markets, including Europe, America, Japan, China, and Korea. Vietnam is continuously in the top 3 countries exporting the most shrimp globally, accounting for 13 - 14% of the total global shrimp export value.

The shrimp industry annually contributes 40 - 45% of the total seafood export value. In 2022, brackish water shrimp export turnover set a record of US$ 4.3 billion. Also, this year, the seafood industry exceeded the US$ 10 billion export mark for the first time.

The same thing may happen again in 2024, according to fisheries experts.

Based on the implementation plan for 2024, the Department of Fisheries stabilizes the total farming area (about 1.3 million hectares), including 737,000 hectares for brackish water shrimp farming. It is estimated that Vietnam will harvest about 1.12 million tons of shrimp, including 300,000 tons of black tiger shrimp, the rest of which are white-leg shrimp.

Five groups of tasks have also been identified for implementation from now until the end of the year. Director Tran Dinh Luan said that the fisheries industry would closely coordinate environmental monitoring and warning with disease surveillance to have accurate forecasts and early warnings to people.

Simultaneously, the entire shrimp industry will develop the production chain towards intensive farming and high technology. Farmers will be guided directly by advanced techniques, science, and technology suitable and effective for each farming method.

In key shrimp production areas, especially the Mekong Delta, businesses, cooperatives, and people are encouraged to organize production in association with quality certification for safe production, lower costs, and ensure product output. It also promotes applying techniques for extensive, improved, ecological, and organic black tiger shrimp farming areas.

Mrs. Tran Thuy Que Phuong recommended promoting shrimp exports to markets near Vietnam.

Accompanying with management agencies, export businesses strive to grow by 10-15% in 2024. VASEP informs that the demand for products derived from seafood protein is increasing. Consumers in developed countries tend to replace protein sources from terrestrial animals gradually.

Mrs. Tran Thuy Que Phuong, Chief of the VASEP Office, shared: "The growth of the small market is the driving force for Vietnam's shrimp exports to reach record milestones. Due to the impact of war and upheaval in the Middle East, Shipping costs to Europe and the United States are increasing, so market groups located near Vietnam, such as Japan, Korea, and China, will have an advantage."

Currently, Vietnamese shrimp ranks third in the Chinese market and first in Japan and Korea. Deputy Minister of Agriculture and Rural Development Phung Duc Tien stated that the shrimp industry needs to aim to increase production to have a "surplus" for export to small markets, including the Netherlands.

"The same amount of production but where to export to increase value needs to be calculated. To develop a sustainable shrimp industry, localities need to join hands to manage shrimp seeds, transportation, and commercial quality. Also, science and technology should be applied to seeds, biological products, the environment, food safety, and hygiene," the Deputy Minister requested.

Shrimp production costs in Vietnam are still relatively high. Specifically, white leg shrimp of 50 pieces/kg in Vietnam costs about VND 90,000 (US$ 4), while in India (US$ 3), Ecuador (US$ 2.5).

The reason is that the cost of shrimp feed accounts for a high proportion of the production cost (about over 65% of the cost of goods sold) and the high cost of imported shrimp broodstock. Many farming areas lack electricity and must use generators to pump water, fan air, and generate electricity.

Translated by Tuan Huy

(VAN) Businesses in Vietnam are attempting to export rice to the United States ahead of the implementation of reciprocal tariffs, while remaining their optimism regarding this critical market.

(VAN) From containers of cashew nuts, shrimp to in-depth technical dialogues, agricultural cooperation between Vietnam and the United States is entering a period of sustainable and two-way development.

(VAN) After the talks on May 28, Vietnam successfully exported its first batch of frozen durians to China, marking a new milestone in agricultural trade cooperation between the two countries.

(VAN) Several major companies, such as Red Dragon and Ameii Vietnam, have signed purchasing agreements for the 2025 season, targeting markets including Japan, the United States, and the EU.

/2025/05/30/5010-5-173638_943.jpg)

(VAN) On May 29, at the GO! My Tho Trading Center, the Tien Giang Department of Industry and Trade, in collaboration with Central Retail Corporation, held the opening ceremony of the 3rd Fruit Festival 2025.

(VAN) Reciprocal tariffs are exerting pressure on U.S. exports, prompting Vietnamese firms to shift their focus to Muslim markets, Thailand, and Brazil.

(VAN) A free booth for two years at Xinfadi, Beijing's largest wholesale market, will be allocated to Vietnam's agricultural products.