May 20, 2024 | 18:59 GMT +7

May 20, 2024 | 18:59 GMT +7

Hotline: 0913.378.918

May 20, 2024 | 18:59 GMT +7

Hotline: 0913.378.918

The price of NPK fertilizer to fertilize an acre of corn has increased by USD 10 in September alone, bringing its total price increase from spring to fall to 45%. This is enough to knock 35 cents per bushel of corn down from its 2022 production margin, and alarmingly there is still no clear sign that the fertilizer market will stop moving for the worse.

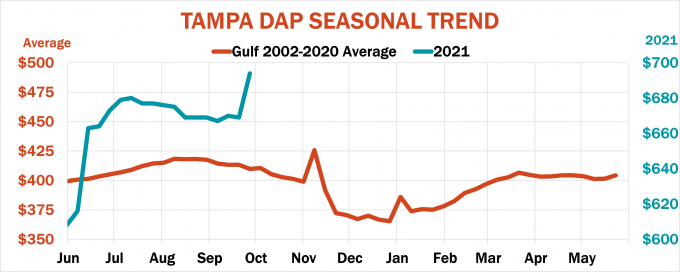

The chart depicting the seasonal fluctuation in DAP fertilizer prices (recently updated). Photo: FP.

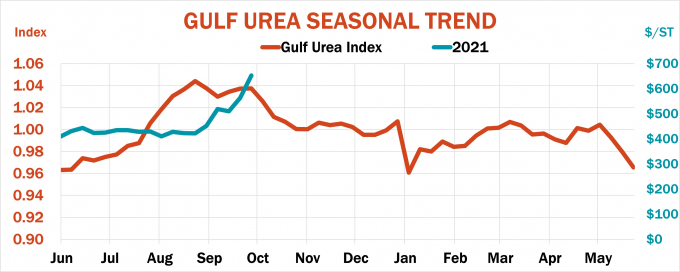

To be more specific, Urea fertilizer’s forward price for the Gulf from the beginning of last week to Friday increased by nearly USD 150 and remained at USD 667.50/ton, while the price of some retail offers was up to nearly $800/ton.

This has pushed fertilizer prices in the Gulf to their highest levels since 2012, and higher prices can only be traced back to the frenzy of 2008 when the market hit an all-time high rate.

According to analysts, the bad situation in the world fertilizer market began with the occurrence of Hurricane Ida. The incident seemed to have "added fuel to the fire" to the supply chain problems by limiting nitrogen supplies. Hurricane Ida not only disrupted shipment in the US but also "suppressed" the supply of natural gas to ammonia plants that had just barely recovered from the pandemic crisis to once again begin production.

Furthermore, natural gas inventories are at a lower-than-normal level in early winter as the rigs in the Gulf region are trying to restart amid a 15.4% lower stock price over the same period and 6.3% lower than the five-year average.

The gas shortage crisis forced Europe to cut production activities, while China, the world's top phosphates and urea exporter, was also struggling to cope with widespread power outages due to shortages of coal, making companies unable to maintain operation.

There are only a few bright spots in the current context. Production facilities in the Caribbean and the Middle East are operating again in order to replenish supplies after having received maintenance and repair.

However, when food becomes a national security issue worldwide, free trade is only a concept now.

The current price of ammonia for October Gulf contracts is pegged at USD 603 while the average retail price is nearly USD 800. The price of DAP fertilizer in the Gulf at last Friday's closing trade session was USD 682.50, up USD 80 from September. The retail price of MAP fertilizer on the other hand was at USD 800.

The price of potash fertilizer in Brazil is approximately USD 700/ton and the retail price in the US is near the USD 800/ton mark in some areas. Gulf UAN fertilizer contracts last week settled at USD 410 which is USD 100 higher than last week.

The chart depicting the price movement of urea fertilizer in the Gulf region. Photo: FP.

Although fertilizer prices have sharply increased in September, their current movements seem irregular in terms of ammonia, urea and DAP commodities in the Gulf region (recorded since 2002).

Another challenge arises which is the difference between the retail market and the wholesale market as some dealers raised the price of ammonia by nearly USD 100 last week, causing prices to be in constant fluctuation while suppliers usually only change the price once or twice a year.

These are the obstacles that farmers will have to face as they manage risks right in the aspect of production inputs affecting their income, not to mention the winter weather in the northern hemisphere harbors other potential risks. The current La Nina phenomenon or the upcoming Polar Vortex is likely to increase heating demand which may further complicate the situation.

Translated by Samuel Pham

(VAN) Although it is assessed as rich in potential, to exploit that potential well and be successful in the Halal market, Vietnam's livestock industry still has a lot of work to do.

(VAN) Vietnam's production is decreasing, so the pepper industry is looking for solutions to stabilize the area and productivity to maintain its global market position.

/2024/05/18/1754-1-151202_20.jpg)

(VAN) The rubber industry is urgently meeting EUDR regulations on traceability from large plantation rubber to smallholder rubber and imported rubber.

(VAN) Durian export value has increased sharply in recent months, combined with increased output, this year's durian exports may exceed USD 3 million.

(VAN) Vietnam's fruit and vegetable exports in 2023 reached USD 5.6 billion, an increase of 66.7% compared to 2022 thanks to a sharp increase in exports to China, the EU, and Korea.

(VAN) Vietnam hopes to expand durian exports to India, helping reduce dependence on China and opening up new development opportunities for the agricultural industry.

(VAN) Coffee prices dropped by 35,000 dong per kilogram one week after reaching a record high. However, the downward momentum is expected to be halted by ongoing concerns over coffee supply.