June 14, 2025 | 12:44 GMT +7

June 14, 2025 | 12:44 GMT +7

Hotline: 0913.378.918

June 14, 2025 | 12:44 GMT +7

Hotline: 0913.378.918

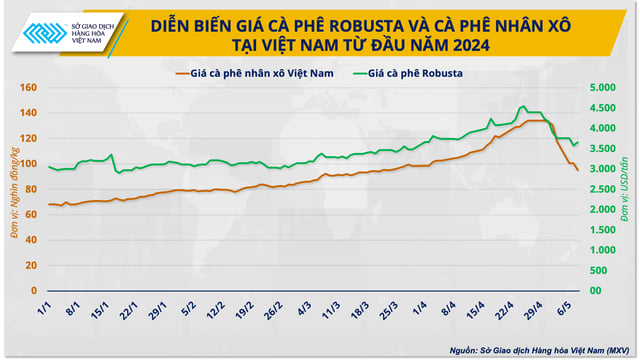

Robusta coffee prices on the Intercontinental Exchange Europe (ICE EU) and green coffee bean prices in Vietnam experienced significant increases in the first four months of 2024. Namely, Robusta coffee prices rose by over 60%, hitting an all-time high on April 24. Similarly, Vietnamese coffee prices peaked at 134,400 Vietnamese dong per kilogram on April 30, doubling compared to the beginning of the year.

However, a shift occurred at the start of May, as both Vietnamese coffee and Robusta coffee prices on the ICE Exchange plummeted from their record highs. Accordingly, Robusta prices dropped by 18% within a single week of trading, reaching their lowest point in a month. In addition, coffee prices in the Central Highlands and Southern provinces dropped below the 100,000 Vietnamese dong per kilogram threshold, marking a decrease of nearly 30% compared to the record high in late-April.

The decline in coffee prices can be primarily attributed to the impact of speculative fund liquidation activities, combined with a positive shift in coffee supply from several major producing countries.

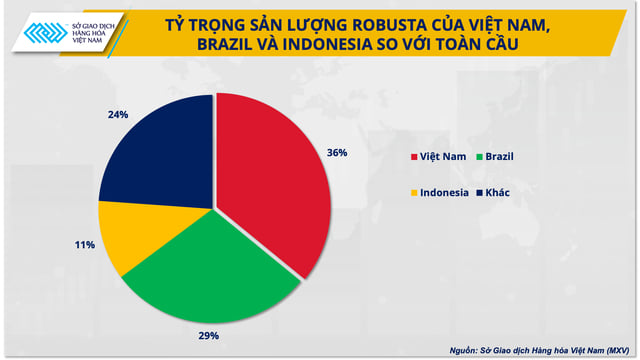

Brazil, the world's second-largest Robusta coffee producer, reported an increase in harvesting activities since the beginning of May as a result of favorable weather conditions. Consequently, the market anticipates Brazil's increased coffee production to contribute to global supply, and promote Robusta coffee exports in the near future. During the first three months of 2024, Brazil exported approximately 2.5 million bags of Robusta coffee, doubling compared to the corresponding period in 2023.

On the other hand, off-season rainfalls in Vietnam's key coffee production regions have mitigated local water shortage concerns. The additional water volume has strengthened the coffee trees' recovery from the intense heatwaves. Additionally, favorable weather conditions helped assuage market concerns regarding the potential decline in Vietnam's coffee yield for the 2024-2025 crop.

Regarding the recent coffee price fluctuations, Mr. Nguyen Ngoc Quynh, Deputy General Director of the Mercantile Exchange of Vietnam (MXV), noted: "The adjustment in coffee prices in early May was anticipated beforehand. The current significant decline is not overly surprising, as coffee prices are gradually returning to their intrinsic value after being influenced by speculative funds."

Despite the recent significant decline in coffee prices, stemming in part from the shifts in supply, fundamental market information regarding coffee continues to favor long-term price support.

In terms of supply, the risks to the supply sources in leading coffee-producing countries persist.

Despite recent rainfall, Vietnam projected a decline in its coffee yield for the 2024-2025 crop compared to the current crop, as coffee cherries and trees have been unable to fully recover from the preceding drought. Moreover, the anticipated return of La Nina, which will replace El Nino in the latter half of 2024, presents the risk of storms and floods during the crucial late harvest season. The aforementioned challenges, coupled with the current low coffee inventory levels among farmers, poses as a significant obstacle in promoting coffee sales. Consequently, Vietnam's coffee supply is expected to face considerable difficulties in the near future.

The coffee harvesting season is currently underway in Brazil; however, analysts are lowering their forecasts for bitter-rich coffee yield by five to ten percent compared to their initial figures. Moreover, Brazilian coffee plants experienced severe heat waves during the early stages of the 2024-2025 crop, which negatively impacted the output of the crop.

Indonesia, the second-largest Robusta coffee producer in Asia and the third-largest in the world, has postponed harvesting activities for its current coffee crop to June instead of April due to the delayed ripening of coffee cherries. The low coffee yield is exerting significant pressure on this country's coffee export operations. As a result, Indonesia exported 9,500 tons of coffee during the first three months of 2024, representing less than one-third of the coffee it exported during the corresponding period in 2023.

In terms of demand, the consumption of Vietnamese coffee, and Robusta coffee as a whole, remains at high levels.

Robusta coffee inventories in Europe and the United States have reduced compared to previous years. Consequently, countries may increase coffee imports to fulfill domestic demand, particularly against the backdrop of volatility in supply from exporting countries. Europe, the world's largest Robusta coffee import market, reported a Robusta coffee inventory of 114,117 tons as of the end of February 2024, marking the ninth consecutive month of decline and the lowest level since January 2020 (when the compilation of coffee statistics by classification began).

Regarding price trends in the near future, Mr. Nguyen Ngoc Quynh commented: "Coffee prices are likely to continue this downward trend in the following weeks, potentially reaching the levels reported at the end of 2023, which hovered around the 80,000 Vietnamese dong per kilogram mark. Following this decline, prices are expected to gradually recover by the end of 2024 due to the unstable supply."

Amidst significant price fluctuations, careful observation of fundamental market information is crucial. This practice aids in stabilizing market sentiment, and in determining suitable trading strategies.

In addition to monitoring the domestic market, investors, traders, and farmers must study the developments of the global market, with a focus on fluctuations in key coffee producing countries such as Brazil and Indonesia.

As the yearly cycle progresses, the focus of the global coffee market will gradually shift from Vietnam to Brazil and Indonesia starting from May. This transition corresponds with the main harvesting season in the latter countries.

Information regarding the harvesting and production of coffee in these two countries will directly influence price trends in the market.

Notably, on May 23, the National Supply Company of Brazil (CONAB) will release its second survey report, which includes estimates of the coffee supply for the 2024-2025 crop in Brazil. This information will be for market observers. Accordingly, substantial changes in CONAB's latest estimates can potentially cause shifts in market dynamics.

Translated by Nguyen Hai Long

(VAN) Noting risks, report examines impacts of avian influenza, changing trade patterns since 2022, fish fraud, and shipping industry’s net-zero goals.

(VAN) Mr. Tran Quang Bao, General Director of the Forestry and Forest Protection Department, met and worked with the International Wood Products Association to promote cooperation in the field of timber trade.

(VAN) China's outbound shipments of rare earths in May jumped 23% on the month to their highest in a year, though Beijing's export curbs on some of the critical minerals halted some overseas sales.

(VAN) To sustain capital flow, administrative reform alone is not enough; what farmers truly need is an ecosystem where both government and businesses grow together in support.

(VAN) Vietnam and the United States are proactively working together, each in their own way, to ensure that every container of agricultural goods carries not just products, but also long-term trust and value.

(VAN) Stores have started selling rice from the government’s stockpile to feed demand for the staple.

(VAN) Omaha Steaks CEO says rebuilding cattle herds will take about a year to ease price pressures.