May 25, 2025 | 17:37 GMT +7

May 25, 2025 | 17:37 GMT +7

Hotline: 0913.378.918

May 25, 2025 | 17:37 GMT +7

Hotline: 0913.378.918

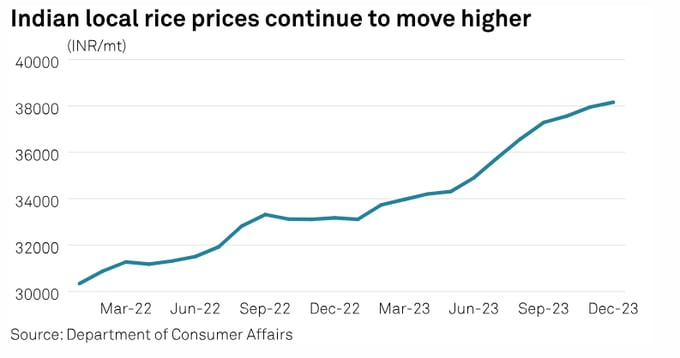

In response to the increasing domestic prices and exports, in 2023 the Indian government banned the export of non-Basmati white rice, imposed 20% duty on parboiled rice exports and fixed a minimum export price of Basmati at $950/mt.

India imposed curbs on rice exports that rocked the global market in 2023, sending prices to multi-year highs, prices are likely to last at least till the first half of 2024, according to market sources.

Most trade sources said that they do not see the government easing the restrictions before the general election that is expected to take place in April-May 2024. The government might want to be sure about achieving a good rice harvest in 2024 kharif season before it decides to lift the export curbs.

The fall in rice production in 2023-24 kharif season due to dry weather conditions caused by El Nino weather phenomenon and a slow start to the rabi sowing have ruled out improvement in supply conditions in the near term.

The US Department of Agriculture's India attache has forecast the country's total rice production at 128 million mt in the MY 2023-24 (October-September) as compared to 135.5 million mt a year ago.

Despite the trade curbs, local rice prices have remained firm even in the middle of the harvesting season in 2023 which prompted the government to issue a warning to retailers to reduce prices.

However, millers and exporters said that they do not see a sharp fall in prices at least till the next kharif harvest season due to the high procurement prices promised by a few state governments and strong demand from the states in southern India.

"I think we have to wait till September-October 2024 to see 5% PB IR 64 to hit $430-$450/mt level...Till then we believe price will stay high," a Singapore-based trader said.

"The markets need to stabilize to build on order book, which is not happening," an exporter based in Kakinada said. "There is a fear in the minds of both buyer and seller. No one is willing to take risks...We need to take small steps and make sure we don't make losses, at the same time be in business and also make a decent turnover before financial year end. More or less business looks to be dull for the next 6 months."

West Africa is one of the major consumers of Indian white and parboiled rice. The region is price sensitive and generally high prices tend to reduce demand considerably unlike some major buyers in Southeast Asia where the purchasing power capacity is relatively higher.

In 2023, many buyers in Africa imported large volumes of rice, anticipating export curbs in India. However, with the restrictions already in place, that option is not available anymore for rice buyers.

Buying in West Africa has already slowed down and if rice prices remain high, India's non-Basmati parboiled rice export is unlikely to reach the level seen in 2023, the Singapore-based trader said.

"Demand from Southeast Asia and some Gulf countries are not going to be under threat," a Delhi-based exporter said. "But West African demand can definitely remain subdued...if prices are above $500/mt FOB levels. Plus keep in mind that directionally West African countries are producing/milling more rice themselves each year."

Meanwhile, most trade sources indicated that Basmati rice demand is likely to be steady in the coming season, but higher logistics costs and the presence of minimum export price could be a dampener.

An exporter said that generally Basmati demand is not hit by moderate increase in prices, but if the shipping disruption at the Red Sea continues for a prolonged period of time, then that could force exporters to reduce prices.

However, many exporters were of the view that even if the Red Sea issues persist, Basmati export is likely to adjust to the new reality without a big hit to the overall trade.

"Business as usual...Even I am sending cargo to Israel, only it is taking [a] longer route and 10 days extra time," a source said.

Out of the 22.3 million mt of rice exported from India in MY 2022-23 (April-March), 10.4 million mt was shipped to West, East and North Africa, while 4.4 million mt was sent to the West Asian countries, which includes Gulf Cooperation Council countries.

The rice stocks in the Food Corporation of India's central pool totaled 56 million mt as of Dec. 1, up 15% year on year.

Milled rice stocks were up 59% year on year at 18.4 million mt, while paddy stocks were up 1.3% year on year at 37.6 million mt.

The current rice stock level with FCI is well above the government's buffer stock norm of 7.61 million mt of rice, including the strategic reserve and operational stock.

India is the largest exporter of rice in the world and, with such huge stocks in its reserves, at some point the government needs to relax the restrictions as it is not sustainable, a trade source said.

Moreover, exporters are hopeful that sluggish procurement so far this season would improve availability of paddy for exports.

So far, the government has procured over 45 million mt of paddy in 2023-24 kharif season, which is equivalent to a little over 29 million mt of rice and below 35.51 million mt of rice procured by the government by the end of December 2022.

spglobal

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.

(VAN) Fourth most important food crop in peril as Latin America and Caribbean suffer from slow-onset climate disaster.

(VAN) Shifting market dynamics and the noise around new legislation has propelled Trouw Nutrition’s research around early life nutrition in poultry. Today, it continues to be a key area of research.

(VAN) India is concerned about its food security and the livelihoods of its farmers if more US food imports are allowed.

(VAN) FAO's Director-General emphasises the need to work together to transform agrifood systems.

(VAN) Europe is facing its worst outbreak of foot-and-mouth since the start of the century.