May 14, 2025 | 16:33 GMT +7

May 14, 2025 | 16:33 GMT +7

Hotline: 0913.378.918

May 14, 2025 | 16:33 GMT +7

Hotline: 0913.378.918

Production of wooden furniture for export at a factory in Binh Duong. Photo: Son Trang.

According to the Agency of Foreign Trade under the Ministry of Industry and Trade, in the first quarter of 2025, the United States remained the largest market for Vietnam's wood and wood products, with exports reaching USD 2.1 billion. This figure represents an increase of 12.9% compared to the same period in 2024 and accounts for 54.3% of Vietnam's total export value of wood and wood products.

Following the U.S., exports of wood and wood products to Japan reached USD 511 million, up 21.8%; exports to China totaled USD 413 million, down 13.4%; and exports to South Korea reached USD 186.6 million, marking a 5.3% increase.

The Agency of Foreign Trade noted that while export values to these markets show generally positive signs, the global geopolitical and economic landscape is expected to remain highly volatile and complex, which may impact both domestic and international commodity markets. Of particular concern is the U.S. announcement of a 46% reciprocal tariff on goods from Vietnam, which has caused significant anxiety and pressure for Vietnamese wood industry enterprises.

Mr. Ngo Sy Hoai, Vice Chairman of the Vietnam Timber and Forest Product Association (VIFOREST), stated that in addition to the reciprocal duties, Vietnamese wood and wood products exported to the U.S. are also under pressure from an investigation under Section 232 of the U.S. Trade Expansion Act of 1962. This section authorizes the U.S. president to adjust imports of goods or materials from other countries if their volume or circumstances are deemed a threat to national security. Such adjustments may be made through tariffs or other trade measures.

Most Vietnamese interior wooden furniture products exported to the U.S. fall under the scope of the reciprocal tariff investigation, which has currently been suspended for 90 days. Certain wood products, mainly industrial wood panels, are affected by Section 232 of the Trade Expansion Act of 1962.

According to the Agency of Foreign Trade, since former U.S. President Donald Trump announced a 90-day suspension of the reciprocal tariff plan, many Vietnamese wood enterprises have been less worried, as the delay provides them with more time to prepare response strategies. This temporary relief also allows businesses to boost short-term exports while working to diversify markets to reduce dependence on the U.S.

Mr. Ngo Sy Hoai shared that in the first four months of this year, although wood and wood product exports to various markets did not grow as expected, they still maintained a monthly value between USD 1.3 billion and USD 1.4 billion.

Vietnam is boosting the import of raw wood materials from the U.S. Photo: Son Trang.

For the U.S. market, Vietnamese businesses are currently focusing on exporting inventory stock and completing pending contracts to take advantage of the 90-day temporary suspension of reciprocal duties.

Mr. Hoai observed that it is almost certain the U.S. government will eventually impose reciprocal duties on imported goods from Vietnam, including wood and wood products.

Regarding wooden furniture, the imposition of such duties will have significant impacts on both sides. The U.S. is the largest market for Vietnam’s wood industry. Therefore, if high reciprocal duties are applied to Vietnamese wood and wood products, it will pose substantial challenges for the entire sector.

Vietnam is currently the largest supplier of wooden furniture to the U.S., accounting for over 40% of the country’s total furniture import turnover in 2024. As such, if Vietnamese wood products are unable to access the U.S. market due to excessive tariffs, it will leave a significant gap that will not be easy to fill in the short term, especially for mid-range consumer items such as kitchen cabinets, dining tables, chairs, living room tables, and bedroom furniture.

Finding an alternative supply source to replace Vietnam is not easy, given that for many years, Vietnamese wooden furniture has been highly valued by U.S. importers for its good quality, reasonable prices, strong delivery capabilities, and compliance with the U.S.’s stringent wood trade regulations.

As a result, the Vietnamese wood industry is hoping that negotiations between the two sides will lead to a tariff level that is mutually acceptable and beneficial. Vietnam is also paying attention to and actively promoting the import of raw wood materials from the U.S. In recent times, Vietnam has imported a considerable volume of wood materials from the U.S., and the Vietnamese wood sector has submitted numerous proposals to the government to facilitate even greater imports of raw wood from this key market.

Translated by Kieu Chi

(VAN) India's retail inflation remained below the central bank's 4% target for the third consecutive month as food prices rose at a slower pace, opening up room for more interest rate cuts.

![Multi-channel, multi-directional Vietnamese agricultural markets: [5] Safety is the key](https://t.ex-cdn.com/nongnghiepmoitruong.vn/608w/files/linhnhp/2025/05/13/trai-cay-viet-nam-170345_133-221148-0908330.jpg)

(VAN) The Middle Eastern market presents new opportunities for Vietnamese agricultural products, but safety in product quality, payment, and partnership relations is a fundamental principle.

(VAN) Vietnam's participation in the AGROALBA project helps open up broader investment opportunities for enterprises to access markets in the fields of agriculture.

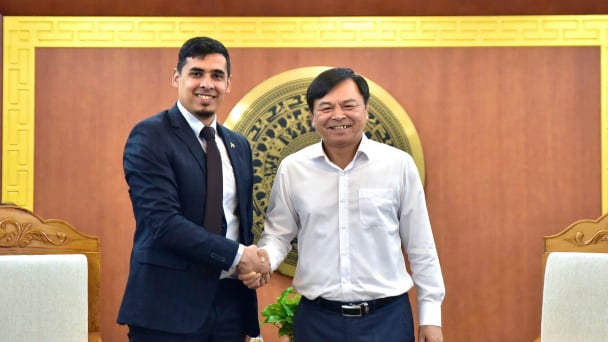

(VAN) On May 13, Deputy Minister of Agriculture and Environment Phung Duc Tien held a meeting with Cuban Deputy Minister of the Food Industry Javier Francisco Agular Rodriguez.

(VAN) Agriculture and environment sector experienced a 3.74% increase in growth during the first four months of 2025, with exports surpassing 21 billion USD. This growth was sustained by effective reforms and a trade surplus.

(VAN) Taiwan offers a promising market for Vietnamese turmeric; however, it enforces stringent standards, particularly concerning residual additives, colourants, and substances with potential carcinogenic effects.