May 21, 2025 | 07:47 GMT +7

May 21, 2025 | 07:47 GMT +7

Hotline: 0913.378.918

May 21, 2025 | 07:47 GMT +7

Hotline: 0913.378.918

According to the China Fisheries Products Report 2022 completed by specialists of the Foreign Agricultural Service (FAS) in China under the US Department of Agriculture (USDA), China remains the world's largest fisheries producer in the world in 2022, with an estimated output of 67.5 million tons, an increase compared to 66.9 million tons in 2021 and 65.49 million tons in 2020.

This increase is thanks to growth in aquaculture output, reaching 54.6 million tons in 2022, up 1.2% compared to the same period in 2021. On the other hand, fishing output experienced a light drop, reaching only 12.9 million tons due to fewer resources and greater constraints in both domestic and international waters.

Aquaculture continues to be an important field for China to strengthen fisheries product supply to meet domestic demand. The country's aquaculture output is forecast to grow 1.1% annually from 2022 to 2031 with total output reaching 71.3 million tons.

Although China enters 2023 with a weakened economy, its fisheries industry still expects a significant increase in consumption demand for fisheries products in 2023 because many activities including tourism, major events, meetings and gatherings that have been restricted in 2021 and 2022 are gradually returning to normal.

China's fisheries imports also increased sharply in 2022, with the volume reaching 4.1 million tons, worth USD 18.7 billion; up 22% in volume and 35% in value compared to 2021. While still not reaching a record import of 4.4 million tons in 2019, the increase in 2022 marks a significant recovery.

This increase is due to many factors, such as increased consumption demand for processed fisheries products, the appearance of high-class fisheries products, difficulties in trading live fisheries products due to Covid-19 restrictions, and increases in online sales increased. At the same time, higher pork prices in the second half of 2022 also made consumer preferences shift to fisheries products.

China's demand for frozen and processed fisheries products is steadily increasing. Photo: Hong Tham.

Russia is still China's largest fisheries product supplier with nearly 1 million tons by volume, followed by Ecuador with 0.6 million tons, Vietnam 0.5 million tons, India 0.3 million tons and the USA nearly 0.3 million tons.

China is also a major exporter of fisheries products. The country's seafood exports in 2022 were stable at 3.5 million tons, a slight increase of 4% compared to 2021. However, the export volume is still significantly lower than in 2019, the last year before of the Covid-19 outbreak.

The China Fisheries Products Report 2022 also showed that the country is taking the lead in terms of fisheries product consumption, and Chinese consumers are increasingly preferring high-quality, value-added products.

In 2021, the average fisheries product consumption per capita of people in urban areas is 16.7 kg/person/year and 10.9 kg/person/year in the case of people in rural areas. Consumption of fishery products is at the highest rate in coastal regions, where fishery products are viewed as a traditional source of protein and the population has relatively high disposable income.

Chinese consumers prefer fresh fisheries products to frozen or processed ones, reflected by domestic consumption of processed fisheries products being very small compared to overall fisheries products consumption. But the demand for frozen and processed fisheries products is steadily increasing due to improvements in processing, distribution and cold chain system as well as the growing popularity of high-end supermarkets, consumer’s interest in a more varied and nutritious diet.

E-commerce boom has also contributed to boosting the consumption of fisheries products in the Chinese market. The most popular products on e-commerce platforms are fresh and frozen shrimp, instant fisheries products, fresh and frozen fish.

The most popular products on China’s e-commerce platforms are fresh and frozen shrimp. Photo: Hong Tham.

Chinese experts believe that Covid-19 and related control measures have promoted a change in Chinese consumers’ buying behavior, switching from fresh fisheries products at traditional markets to fresh and frozen food from e-commerce channels to limit direct contact. It is forecasted that most of this consumption trend will remain after the Covid-19 pandemic has passed because consumers, especially young consumers with disposable income prefer the convenience and the time-saving aspect of placing orders online.

With the development of China's economy and the improvement of the national purchasing power, Chinese consumers are more and more interested in healthy, pollution-free and high-quality fisheries products. In terms of popularity, the most consumed fisheries products in China are shrimp, promfet and squid.

Truong Dinh Hoe, General Secretary of the Vietnam Association of Seafood Exporters and Producers (VASEP), said, “Clearly identifying the consumption trend of China and the world, Vietnam’s fisheries enterprises have gradually become more proactive in building an appropriate development strategy to promote exports to international markets, especially exports to China, making it the largest import market of Vietnam’s fisheries products".

Translated by Samuel Pham

(VAN) Japan's grant aid project contributes to capacity building, promoting organic agricultural production, and fostering sustainable community development in Dong Thap province.

(VAN) For years, the CRISPR-Cas9 genome technology has been reshaping genetic engineering, a precision tool to transform everything from agriculture to medicine.

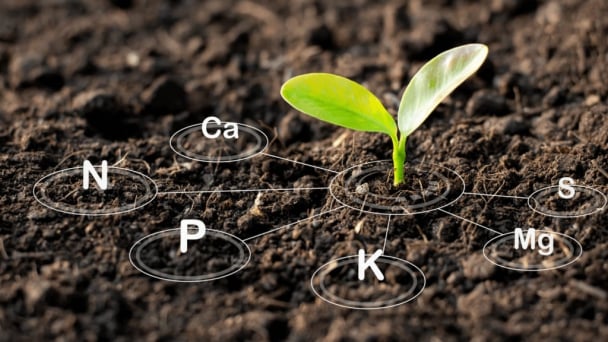

(VAN) Vietnam aims to become a 'leader' in the region in the capacity and managing effectively soil health and crop nutrition.

![Reducing emissions from rice fields: [Part 1] Farming clean rice together](https://t.ex-cdn.com/nongnghiepmoitruong.vn/608w/files/news/2025/05/05/z6509661417740_a647202949c539012a959e841c03e1d3-nongnghiep-143611.jpg)

(VAN) Growing clean rice helps reduce environmental pollution while increasing income, allowing farmers to feel secure in production and remain committed to their fields for the long term.

/2025/05/19/5136-1-144800_230.jpg)

(VAN) The Nghe An Provincial People's Committee has just approved the list of beneficiaries eligible for revenue from the Emission Reductions Payment Agreement (ERPA) in the North Central region for the year 2025.

(VAN) 14 out of 35 domesticated elephants in Dak Lak province have had their living conditions improved, with 11 of them currently participating in the non-riding elephant tourism model.

(VAN) Muong Nhe Nature Reserve hopes that being upgraded to a national park will lay the foundation for forest protection efforts to be carried out in a systematic, modern, and sustainable manner.