May 16, 2025 | 10:02 GMT +7

May 16, 2025 | 10:02 GMT +7

Hotline: 0913.378.918

May 16, 2025 | 10:02 GMT +7

Hotline: 0913.378.918

The shrimp industry creates jobs for millions of people. However, this industry is currently facing many major challenges that need to be recognized and resolved promptly. How to optimize the shrimp industry value chain and improve the competitiveness of Vietnamese shrimp in the international market?

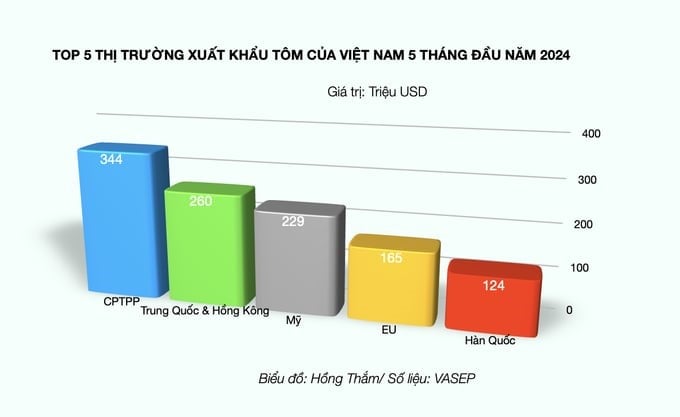

According to data from the Vietnam Association of Seafood Exporters and Producers (VASEP), in the first 5 months of 2024, Vietnam's shrimp export turnover increased by 6.5% over the same period last year, reaching approximately USD 1.3 billion.

This growth is thanks to the breakthrough in exports to a number of major markets. For example, exports to China reached nearly USD 260 million, up 21.4% over the same period last year; the US reaching nearly USD 229 million, up 0.6%; the EU reaching more than USD 165 million, up 7.8%; and many other markets, such as the UK increasing by 11.2%, Canada increasing by 52.5%, and Russia increasing by 328.7%.

However, exports to a number of other important markets still declined. Specifically, the value of Vietnamese shrimp exports to South Korea only reached approximately USD 134 million, down 9.1% over the same period last year; to Japan, it reached just over USD 183 million, down 4.3%.

Vietnam's top 5 shrimp export markets in the first 5 months of 2024.

Whiteleg shrimp exports still account for the dominant proportion, nearly 71.8% of total shrimp export turnover, with a value of approximately USD 931 million. Meanwhile, giant tiger prawn exports decreased by 10.8%, reaching nearly USD 159 million and accounting for only 12.2% of shrimp export value.

General Secretary of VASEP Truong Dinh Hoe assessed: "Although the shrimp industry is experiencing positive growth in the first months of 2024, this does not accurately assess the current situation of the shrimp industry. Never before has Vietnam's shrimp industry faced difficulties at the same time in all major markets such as the US, EU, and Japan."

Talking about the advantages and challenges of Vietnam's shrimp industry in 2024, Mr. Hoe analyzed that Vietnam's shrimp industry has the opportunity to compete with shrimp from India and Ecuador in the value-added and deep-processed goods segment, which is the strength of Vietnamese shrimp.

"In addition, Vietnamese shrimp also have more growth opportunities when importers, especially in the US market, have increased control over shrimp from India and Ecuador on labor, environmental, and food safety issues," Mr. Hoe added.

However, according to Mr. Hoe, Vietnam's shrimp exports this year will continue to face many difficulties and challenges due to the impact of the prolonged Russia-Ukraine war. The world economic crisis and rising inflation in the major export markets of Vietnamese shrimp have caused a reduction in consumption demand in those markets.

Most recently, political instability in the Middle East region has affected Vietnam's seafood export situation in 2023 and will continue to have an impact on it in 2024. Besides, trade barriers such as anti-dumping and anti-subsidy taxes in the US market, quota regulations in South Korea, etc. are also important reasons that directly impact Vietnam's shrimp exports.

"Domestic raw material production will also encounter many difficulties as climate change becomes increasingly harsh, such as prolonged hot sun, saltwater intrusion, and heavily polluted water sources; rising input costs; poor quality seed sources, etc. Thus, aquaculture in general and shrimp farming in particular face many difficulties due to many diseases appearing, poor farming productivity, and high prices. There will likely be a serious shortage of raw materials that will last until the last months of the year," Mr. Hoe predicted.

According to Mr. Hoe, in the last 2 years, Vietnamese shrimp exports have faced fierce competition with Indian and Ecuadorian shrimp, especially price competition.

"Indian shrimp export prices are always 10-15% lower than Vietnamese shrimp on average, while Ecuadorian shrimp prices are 30–35% lower on average. This is a huge difference in price, and it is very difficult to convince customers to buy Vietnamese shrimp when it is the same product," emphasized the General Secretary of VASEP.

According to Mr. Hoe, the price of Vietnamese shrimp is higher than in other countries due to a number of reasons, such as higher input costs, low farming efficiency, small farming scale, etc. All of these factors have limited the competitiveness of Vietnamese shrimp.

Vietnam's shrimp industry has the opportunity to compete with shrimp from India and Ecuador in the value-added and deep-processed goods segment, which is the strength of Vietnamese shrimp. Photo: Hong Tham.

Sharing the same opinion, Dr. Nguyen Tan Sy, COB of SA-BIO Aquarius Technology Solution JSC, said that Vietnam is one of the most developed countries in the commercial shrimp production industry, supplying the world market. However, the cost of shrimp production in Vietnam is often considered higher than that of some other countries in the region. This comes from many factors, such as:

The quality of shrimp seed has not been strictly managed. A large amount of poor-quality shrimp seed is still circulating in the market and reaching farmers, so there is a potential risk of disease outbreaks, leading to high death rates and forcing farmers to stock many times, causing costs to increase highly.

Shrimp feed in Vietnam is often higher than in other countries due to rising input raw materials, and farmers often buy on credit, so feed costs also increase significantly.

Disease outbreaks frequently occur, with many new diseases becoming more serious and dangerous, such as TPD (translucent post-larvae disease), EHP (Enterocytozoon hepatopenaei disease), IMNV (infectious myonecrosis disease), and IHHNV (necrosis of hematopoietic and epithelial organs disease), causing shrimp farmers to spend a lot of money on prevention and treatment.

The farming environment is increasingly degraded, risks are increasingly high, the success rate is low, and economic efficiency is low, leading to increased costs in the production process.

Labor costs in Vietnam are increasing, especially in large-scale shrimp farming areas. Rising energy costs in operating farming systems, water treatment systems, aeration systems, and other equipment also contribute to increased costs.

To improve productivity and quality, shrimp farmers need to invest in new technologies, closed management systems, and modern infrastructure, which require large investment capital. Lack of advanced technologies and incomplete infrastructure also lead to higher maintenance and operating costs.

“In addition, regulations on environmental protection, food safety, and disease management are increasingly strict, requiring shrimp farmers to comply with higher standards, leading to increased production costs,” Dr. Nguyen Tan Sy analyzed further.

Translated by Thu Huyen

(VAN) Japan's efforts to lower the price of rice through the release of its stockpile may finally be making some progress, albeit at a snail's pace.

(VAN) U.S. tariffs are not only a 'shock', but also an opportunity for Vietnamese businesses to renew their mindset toward comprehensive development.

(VAN) As Bac Giang lychee enters the harvest season, Minister Do Duc Duy expects that the fruit will contribute greatly to agricultural exports due to standardized production and deep processing.

(VAN) Consumers have shown a preference for free-range eggs, but those farming systems are more vulnerable to biosecurity risks like bird flu.

/2025/05/09/5701-1-184335_301.jpg)

(VAN) Vietnam’s eel exports nearly doubled thanks to a mud-free farming model, opening up new prospects while still facing numerous barriers related to international standards.

(VAN) Minister Do Duc Duy warned that if production is not professionalized and supply chains are not transparent, the U.S. market could become a growth bottleneck.

(VAN) Delegating surveillance responsibilities to local authorities is a cost-saving and efficiency-boosting measure that removes a key bottleneck for enterprises, according to Director General Duong Tat Thang.