May 24, 2025 | 16:29 GMT +7

May 24, 2025 | 16:29 GMT +7

Hotline: 0913.378.918

May 24, 2025 | 16:29 GMT +7

Hotline: 0913.378.918

Food is essential for every life. But the prolonged coronavirus pandemic, coupled with severe climate events, the crisis in Ukraine, and most recently food protectionism by countries including Indonesia, Malaysia and India, have caused shocks across the global food supply chain.

The Food Commodity Price Index surged 15% in the two months to April 30 and is more than 80% higher than it was two years ago, according to the World Bank. Domestic food price inflation is also being seen across most regions, it added. The Food Price Index compiled by the UN Food and Agriculture Organization (FAO) was 28% higher in April than a year earlier.

The agriculture industry might benefit on some levels from increasing prices but it surely has its own challenges in the longer term. In 2050, the global population will reach 10 billion, versus about 7 billion now, and the agriculture sector will need to produce 60% more food to feed them all, according to the FAO.

This means agricultural productivity needs to increase by 200% on small farms and by 20% on commercial farms to ensure food security.

Climate change, environmental degradation, ageing farmers and labour shortages, lack of farming space, food loss and waste are among the many problems the industry will need to solve.

"The crisis is a global crisis because food is a global business that's going into different households and different markets," said Ho Ren Hua, the CEO of SET-listed Thai Wah Plc, a leading manufacturer of tapioca flour and related products, rice and bean vermicelli and other noodle products, biodegradable packaging and more.

In Mr Ho's view, the sector is trying to respond to such crises on three fronts. First, given the surging prices of staples such as potatoes, corn and wheat, it's important for companies to localise supply chains as it will be a determining factor for success in a volatile market.

The second front is agricultural productivity. The industry needs to improve farm productivity in order to benefit farmers in the long term as crises will continue to come and go.

Lastly, to create a more resilient food supply chain in the long run, scientific research and innovation must be stepped up on a broader scale. "We need to see how we can encourage a lot more collaboration between the public and private sectors," said Mr Ho.

"Agriculture historically has depended a lot on the technological discoveries that have disrupted (traditional) practices," Paul Teng Piang-Siong, managing director of NIE International Pte Ltd, the consultancy arm of the National Institute of Education in Singapore, said at a recent forum held by the Asian Development Bank (ADB).

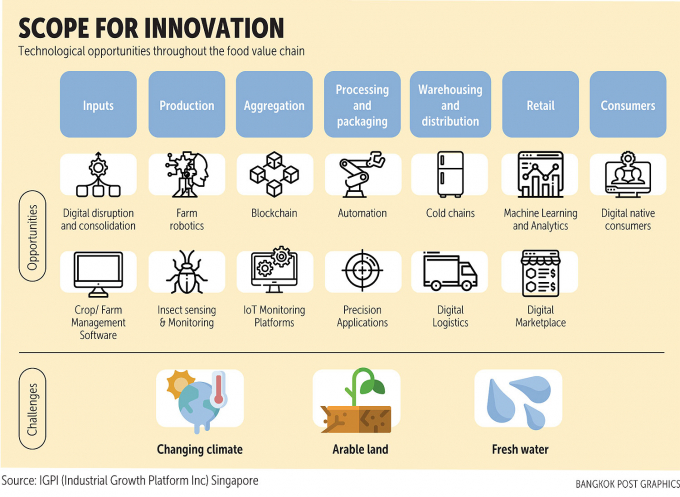

For the 21st century, agricultural innovations include digital technologies, biotechnologies, new farming environments such as indoor farms, supply chain logistics and infrastructure and risk management, novel foods such as alternative proteins, waste reduction and value addition.

Disruptive innovations are needed to increase farm productivity, make more food available, improve agricultural sustainability and nutrition security, said Mr Teng, who is also the dean of Nanyang Technological University.

Investing in these innovations will help solve current and emerging problems in the agrifood system, while helping to address big-picture challenges such as climate change and sustainability.

THAILAND HUB GOALS

Public sector bodies and businesses in Thailand are now working to transform the country into a regional hub for food and agritech.

"Thailand has an abundance of raw material feedstocks, biodiversity and some of the best-developed food processing safety and quality standards in Asia-Pacific," said Mr Ho. The country is already well-known as a top global exporter of rice, canned and processed seafood and cassava products.

"Thailand has a significant comparative advantage when it comes to food and agriculture. … There is a positive attitude towards the food that comes from Thailand. The source matters," Anuj Maheshwari, head of agrifood investment at the Singapore state investment firm Temasek, said at the SEA Agri Food Summit held recently by Thai Wah.

"Agriculture is ingrained into the Thai economy in a major way," said Mr Maheshwari. Agriculture accounts for eight percent of Thailand's gross domestic product (GDP) yet it employs one-third of the country's labour force. In his view, there is a large window of opportunity that has yet to be fully exploited.

"I think these are the two things that allow Thailand to build innovation muscle," said Mr Maheshwari, noting that in the past, agritech was detached from agriculture. But the paradigm has changed in the last five years as the benefits of technological innovation become more apparent to both farmers and companies.

"The BCG (Bio-Circular-Green economy) model is one of the policies we have right now to support the transformation of Thailand to become a hub of the agrifood industry in Asia," noted Dr Wonnop Visessanguan, executive director of the National Science and Technology Development Agency.

Introduced by the Thai government to create sustainability and inclusiveness in the economy, society and the environment, the model focuses on four strategic sectors: agriculture and food; wellness and medicine; energy, materials and biochemicals; and tourism and the creative economy.

In Dr Wonnop's view, to achieve such ambitious goals, Thailand must increase its GDP and then create inclusive growth that distributes income to stakeholders across the value chain.

"In the agriculture area, what we are looking for is how we can transform traditional agriculture to premium agriculture, which is the way we can increase income for all stakeholders," he pointed out.

Where food processing is concerned, it is about trying to add value to create more high-end products.

Based on his experience working with the BCG model for the past two years, Dr Wonnop finds that government agencies are doing the work separately from each other, as there is no central agency that could integrate the work and reduce duplication. Laws and regulations are also a bottleneck for the private sector, he said.

"What entrepreneurs and the private sector want is for the government to be a good and sensible regulator," said Mr Maheshwari. "What the government can do in terms of enabling is steer the discussion and resources towards the areas where innovation can happen."

INNOVATION IS THE FUTURE

As the world emerges from Covid-19, consumers' changing demands have created new trends in the agriculture sector. Health and nutrition have been highlighted more than ever. "Consumers want to make sure that they have products that are clean and high in nutrition," said Mr Ho.

Consumers also want traceability -- not only in terms of where the raw materials come from but also in the production process, such as whether fertiliser is used.

While some innovations such as gene editing and genetically modified organisms (GMO) are the subject of debate, others are gaining attention, such as synthetic biology (SynBio). The Mills Fabrica, a Hong Kong-based startup incubator, defines SynBio as "a new discipline within modern biotechnology that aims to precisely design and redesign new and existing biological systems".

It will open new windows to help resolve ongoing global issues such as food insecurity and the climate crisis.

Other digital agricultural technologies have already been adopted across the value chain from production and post-production to distribution and marketing and even financing.

For a large and diversified company like Thai Wah, investments in hardware, software and data analytics have created a series of resources for farmers and for the company.

The technology that Thai Wah adopted runs on a platform developed by Ricult, an agritech startup founded by two Massachusetts Institute of Technology graduates -- one from Pakistan and one from Thailand. It includes a mobile app that farmers can download to track weather conditions, yields, terrain conditions as well as other information about their plots.

The RicultX farm management tool, meanwhile, is a comprehensive platform that enables agribusiness companies to gain deep insights into all of the farms in their supply chain. It uses satellite remote sensing and satellite imagery to help firms monitor crop development in real time, detect pests and prevent disease, as well as assess soil conditions. All of this helps to improve farmers' decision-making and ensure greater efficiency.

Although some farmers have adopted agritech to improve crop quality and productivity, the trend is not yet widespread. One problem is that the technology is considered expensive for many, especially smallholders who still make up the majority of the country's farmers, according to the Economic Intelligence Center (EIC) of Siam Commercial Bank.

A paper by the EIC calls for more government support in terms of finance, knowledge sharing and research to make agritech more affordable and accessible.

CROSS-REGIONAL EFFORTS

Food moves from one place to another, hence cross-regional collaboration is needed. Mr Maheshwari suggests that standards, which must include food safety, should be an area for collaboration.

"We can share learning about standards which allows for more collaboration so technology can proliferate faster," he said, adding that building similar standards and sharing knowledge on food safety could help unleash Southeast Asia's potential as an agritech hub.

Investing to build an ecosystem in which agricultural innovation can thrive is important. Thai Wah is among the major companies that has started investing in startups across the region.

"Over the past few years we have seen a clear inflection point with a new generation of talent, entrepreneurs and food scientists willing to take a leap of faith to build new, scalable businesses in food and agritech," said Mr Ho.

Venture capital companies play an important role in sourcing and identifying these startups. What they are looking for in a startup is an ability to work across different countries to create scale.

"When it comes to startups, they want to work between Thailand and Vietnam, Thailand and Singapore, Thailand and Cambodia, so there's a lot of interesting collaboration between the different countries. So really, it's about connecting the dots between the different entrepreneurs and different VC funds," he said.

Mr Maheshwari predicts that unicorn innovations will happen in Asia-Pacific because local startups understand farmers' pain points, customers and local nuances.

Mr Ho shares that optimism. "The next decade will be one of innovation and scalability as the cost of innovation is lower than ever and we have a new and exciting generation of students, scientists and entrepreneurs willing to tackle some of the most important challenges we face," he said.

But all of this effort could be wasted if governments and regulators are not on board for transformation, be it in terms of investment, research, policies, financing and infrastructure. Investment in education and training is also crucial.

"Regional scaling is an inevitable step for many entrepreneurs: Thailand itself is a large addressable market but over the medium term, agrifood is inherently a regional and even globally scalable business given the importance of regional supply chains, growing demographics across Southeast Asia and increased cross-border connectivity and exchanges," he added.

(BKP)

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.

(VAN) Fourth most important food crop in peril as Latin America and Caribbean suffer from slow-onset climate disaster.

(VAN) Shifting market dynamics and the noise around new legislation has propelled Trouw Nutrition’s research around early life nutrition in poultry. Today, it continues to be a key area of research.

(VAN) India is concerned about its food security and the livelihoods of its farmers if more US food imports are allowed.

(VAN) FAO's Director-General emphasises the need to work together to transform agrifood systems.

(VAN) Europe is facing its worst outbreak of foot-and-mouth since the start of the century.