May 22, 2025 | 13:44 GMT +7

May 22, 2025 | 13:44 GMT +7

Hotline: 0913.378.918

May 22, 2025 | 13:44 GMT +7

Hotline: 0913.378.918

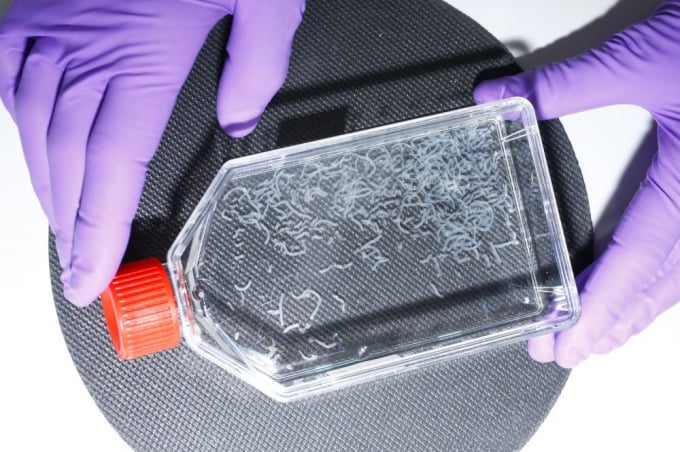

Mosa Meat has recruited a global team of lab technicians and biologists to develop, build and run its scaled-up operations. Rui Hueber, checks the health of recent cell samples. Photo: Ricardo Cases

Tawny brown, compact and muscular, they are Limousins, a breed known for the quality of its meat and much sought-after by the high-end restaurants and butchers in the nearby food mecca of Maastricht, in the southernmost province of the Netherlands. In a year or two, meat from these dozen cows could end up on the plates of Maastricht’s better-known restaurants, but the cows themselves are not headed for the slaughterhouse. Instead, every few months, a veterinarian equipped with little more than a topical anesthetic and a scalpel will remove a peppercorn-size sample of muscle from their flanks, stitch up the tiny incision and send the cows back to their pasture.

The biopsies, meanwhile, will be dropped off at a lab in a nondescript warehouse in Maastricht’s industrial quarter, five miles away, where, when I visit in July, cellular biologist Johanna Melke is already working on samples sent in a few days prior. She swirls a flask full of a clear liquid flecked with white filaments—stem cells isolated from the biopsy and fed on a nutrient-dense growth medium. In a few days, the filaments will thicken into tubes that look something like short strands of spaghetti. “This is fat,” says Melke proudly. “Fat is really important. Without fat, meat doesn’t taste as good.”

On the opposite side of the building, other scientists are replicating the process with muscle cells. Like the fat filaments, the lean muscle cells will be transferred to large bioreactors—temperature- and pressure-controlled steel vessels—where, bathed in a nutrient broth optimized for cell multiplication, they will continue to grow. Once they finish the proliferation stage, the fat and the muscle tissue will be sieved out of their separate vats and reunited into a product resembling ground hamburger meat, with the exact same genetic code as the cows in Farmer John’s pasture. (The farmer has asked to go by his first name only, in order to protect his cows, and his farm, from too much media attention.)

That final product, identical to the ground beef you are used to buying in the grocery store in every way but for the fact that it was grown in a reactor instead of coming from a butchered cow, is the result of years of research, and could help solve one of the biggest conundrums of our era: how to feed a growing global population without increasing the greenhouse-gas emissions that are heating our planet past the point of sustainability. “What we do to cows, it’s terrible,” says Melke, shaking her head. “What cows do to the planet when we farm them for meat? It’s even worse. But people want to eat meat. This is how we solve the problem.”

When it comes to the importance of fat in the final product, Melke admits to a slight bias. She is a senior scientist on the Fat Team, a small group of specialists within the larger scientific ecosystem of Mosa Meat, the Maastricht-based startup whose founders introduced the first hamburger grown from stem cells to the world eight years ago. That burger cost $330,000 to produce, and now Melke’s Fat Team is working with the Muscle Team, the (stem cell) Isolation Team and the Scale Team, among others, to bring what they call cell-cultivated meat to market at an affordable price.

They are not the only ones. More than 70 other startups around the world are courting investors in a race to deliver lab-grown versions of beef, chicken, pork, duck, tuna, foie gras, shrimp, kangaroo and even mouse (for cat treats) to market. Competition is fierce, and few companies have allowed journalists in for fear of risks to intellectual property. Mosa Meat granted TIME exclusive access to its labs and scientists so the process can be better understood by the general public.

Livestock raised for food directly contributes 5.8% of the world’s annual greenhouse-gas emissions, and up to 14.5% if feed production, processing and transportation are included, according to the U.N. Food and Agriculture Organization. Industrial animal agriculture, particularly for beef, drives deforestation, and cows emit methane during digestion and nitrous oxide with their manure, greenhouse gases 25 and 298 times more potent than carbon dioxide, respectively, over a 100-year period.

In 2019, the U.N.’s International Panel on Climate Change issued a special report calling for a reduction in global meat consumption. The report found that reducing the use of fossil fuels alone would not be enough to keep planetary temperature averages from going beyond 1.5°C above preindustrial levels, at which point the floods, droughts and forest fires we are already starting to see will negatively impact agriculture, reducing arable land while driving up costs. Yet global demand for meat is set to nearly double by 2050, according to the World Resources Institute (WRI), as growing economies in developing nations usher the poor into the meat-eating middle class.

Growing meat in a bioreactor may seem like an expensive overcorrection when just reducing beef intake in high-consuming nations by 1.5 hamburgers per week, per person, could achieve significant climate gains, according to the WRI. But denying pleasure, even in the pursuit of a global good, is rarely an effective way to drive change. Earlier this year the U.N. published the largest ever opinion poll on climate change, canvassing 1.2 million residents of 50 countries. Nearly two-thirds of the respondents view the issue as a “global emergency.” Nonetheless, few favored plant-based diets as a solution. “For 50 years, climate activists, global health experts and animal-welfare groups have been begging people to eat less meat, but per capita consumption is higher than ever,” says Bruce Friedrich, head of the Good Food Institute, a nonprofit organization promoting meat alternatives. The reason? It tastes too good, he says. “Our bodies are programmed to crave the dense calories. Unfortunately, current production methods are devastating for our climate and biodiversity, so it’s a steep price we’re paying for these cravings.” The best solution, says Friedrich, is meat alternatives that cost the same or less, and taste the same or better. Melke and her fellow scientists at Mosa say they are getting very close.

According to Mark Post, the Dutch scientist who midwifed the first lab-grown hamburger into existence, and who co-founded Mosa Meat in 2015, one half-gram biopsy of cow muscle could in theory create up to 4.4 billion lb. of beef—more than what Mexico consumes in a year. For the moment, however, Mosa Meat is aiming for 15,000 lb., or 80,000 hamburgers, per biopsy. Even by those modest metrics, Farmer John’s little herd could supply about 10% of the Netherlands’ annual beef consumption. Eventually, says Post, we would need only some 30,000 to 40,000 cows worldwide, instead of the 300 million we slaughter every year, without the environmental and moral consequences of large-scale intensive cattle farming. “I admire vegetarians and vegans who are disciplined enough to take action on their principles,” says Post. “But I can’t give up meat, and most people are like me. So I wanted to make the choice for those people easier, to be able to keep on eating meat without all the negative externalities.”

Even as it sets out to change everything about meat production, cellular agriculture, as the nascent industry is called, will in theory change nothing about meat consumption. This presents a tantalizing opportunity for investors, who have thrown nearly $1 billion at cultivated-meat companies over the past six years. Participating in the high-profile stampede to invest in the industry: Bill Gates, Richard Branson, Warren Buffett and Leonardo DiCaprio. Plant-based burger companies such as Impossible and Beyond already paved the way by proving that the market wants meat alternatives. Cellular agriculture promises to up that game, providing the exact same experience as meat, not a pea-protein facsimile.

While private investment has been vital for getting the industry off the ground, it is not enough given the immense benefits that the technology could provide the world were it developed at large scale, says Friedrich of the Good Food Institute. Cultivated-meat production could have as much impact on the climate crisis as solar power and wind energy, he argues. “Just like renewable energy and electric vehicles have been successful because of government policies, we need the same government support for cultivated meat.”

Once stem cells are isolated from the biopsy and fed a nutrient-dense growth medium, they thicken into filaments of fat. Once mature, they can be blended with cultivated muscle cells to create a product similar to ground beef. Photo: Ricardo Cases

In the meantime, regulatory approval helps. In December 2020, GOOD Meat, the cultivated-meat division of California-based food-technology company Eat Just Inc., was granted regulatory approval to sell its chicken product to the public in Singapore, a global first. Later that month, a tasting restaurant for cell-based chicken produced by Israeli startup SuperMeat opened in Israel. Cultivated meat could be a $25 billion global industry by 2030, accounting for as much as 0.5% of the global meat supply, according to a new report from consulting firm McKinsey & Co. But to get there, many technological, economic and social hurdles must be tackled before cultivated cutlets fully replace their predecessors on supermarket shelves.

When Austrian food-trends analyst Hanni Rützler appeared onstage to taste Mark Post’s burger at its public debut in London, on Aug. 5, 2013, her biggest fear was that it might taste so bad she would spit it out on the live video broadcast. But once the burger started sizzling in the pan and the familiar scent of browning meat hit her nose, she relaxed. “It was closer to the original than I even expected,” she says. At the tasting, she pronounced it “close to meat, but not that juicy.” That was to be expected, says Mosa co-founder, COO and food technologist Peter Verstrate—the burger was 100% lean meat. And without fat, burgers don’t work. In fact, without fat, he says, you’d be hard-pressed to tell the difference between a piece of beef and a cut of lamb. Fat isn’t necessarily harder to create than muscle. It’s just that as with protein cells, getting the process right is time-consuming, and Verstrate and Post prioritized protein. The technology itself is relatively straightforward and has been used for years in the pharmaceutical industry to manufacture insulin from pig pancreases: identify and isolate the stem cells—the chameleon-like building blocks of animal biology—prod them to create the desired tissue, and then encourage them to proliferate by feeding them a cell-culture medium made up of amino acids, sugars, salts, lipids and growth factors. Scientists have been trying for years to use the same process to grow artificial organs, arteries and blood vessels, with mixed results.

Post, a vascular cardiologist, used to be one of those scientists. He jokes that stem-cell meat, unlike organs, doesn’t have to function. On the other hand, it has to be produced in massive amounts at a reasonable cost, and pharmaceutical companies have spent decades and billions of dollars attempting—and largely failing—to scale up stem-cell production to a fraction of what it would take to make cultivated meat affordable. If cellular-agriculture companies succeed where so many others have failed, it could unlock a completely new way of feeding human beings, as radical a transformation as the shift from hunting to domesticating animals was thousands of years ago. Despite investor enthusiasm, that’s still a big if; Eat Just, the company closest to market, is producing only a couple hundred pounds of cultivated chicken a year.

Many of the scientists at Mosa reflexively attribute sentience to the cells they are working with, discussing their likes and dislikes as they would those of a family pet. Fat tissue can handle temperature swings and rough handling; muscle is more sensitive and needs exercise. “It’s like producing cows on a really microscopic scale,” says Laura Jackisch, the head of the Fat Team. “We basically want to make the cells as comfortable as possible.” That means fine-tuning their cell-culture medium in the same way you would regulate a cow’s feed to maximize growth and health. For one biopsy to reach the 4.4 billion lb. of meat in Post’s theoretical scenario, it would have to double 50 times. So far, Jackisch’s team has made it to the mid-20s.

A lot of that has to do with the quality of the growth medium. Until recently, most cultivated-meat companies used a cell culture derived from fetal bovine serum (FBS), a pharmaceutical-industry staple that comes from the blood of calf fetuses, hardly a viable ingredient for a product that is supposed to end animal slaughter. The serum is as expensive as it is controversial, and Jackisch and her fellow scientists spent most of the past year developing a plant-based alternative. They have identified what, exactly, the cells need to thrive, and how to reproduce it in large amounts using plant products and proteins derived from yeast and bacteria. “What we have done is pretty breathtaking,” she says. “Figuring out how to make a replacement [for FBS] that’s also affordable means that we can actually sell this product to the masses.” In May, the Fat Team fried up a couple of teaspoons. Though they could tell from the cell structure and lipid profile that they had created a near identical product, they were still astonished by the taste. “It was so intense, a rich, beefy, meaty flavor,” says Jackisch, a vegan of six years. “It was an instant flashback to the days when I used to eat meat. I started craving steak again.” She nearly picked up a couple on her way home from the lab that night.

For all the successes that cultivated-meat companies have broadcast over the past few years, biotechnologist Ricardo San Martin, research director for the UC Berkeley Alternative Meats Lab, is skeptical that lab-bench triumphs will translate into mass-market sales anytime soon, if at all. Not one of the companies currently courting investment has proved it can manufacture products at scale, he says. “They bring in all the investors and say, ‘Here is our chicken.’ And yes, it is really chicken, because there are chicken cells. But not very many. And not enough for a market.”

The skepticism is justified—very few people outside of Israel and Singapore have actually been able to try cultivated meat. (Citing a pending E.U. regulatory filing, Mosa declined to let TIME try its burger. Eat Just offered a tasting but would not allow access to its labs.) And the rollout of Eat Just’s chicken nuggets in Singapore raises as many questions as it answers. At the moment, the cost to produce cultivated meat hovers around $50 a pound, according to Michael Dent, a senior technology analyst at market-research company IDTechEx. Eat Just’s three-nugget portion costs about $17, or 10 times as much as the local McDonald’s equivalent. CEO Josh Tetrick admits that the company is losing “a lot” on every sale, but argues that the current production cost per pound “is just not relevant.” At this point, says Dent, making a profit isn’t the point. “It is not in itself a viable product. But it’s been very, very successful at getting people talking about cultured meat. And it’s been very successful in getting [Eat] Just another round of investments.”

On Sept. 20, Eat Just announced that its GOOD Meat division had secured $97 million in new funding, adding to an initial $170 million publicized in May. The company also recently announced that it was partnering with the government of Qatar to build the first ever cultivated-meat facility in the Middle East outside of Israel. In June, Tetrick confirmed that the company, which also produces plant-based egg and mayonnaise products, was mulling a public listing in late 2021 or early 2022, with a possible $3 billion valuation. But all that investment still isn’t enough to scale the production process to profitability, let alone to make a dent in the conventional meat industry, says Tetrick. “You can make the prettiest steak in the world in the lab, but if you can’t make this stuff at large scale, it doesn’t matter.”

The biggest obstacle to getting the cost per pound of cell-cultivated meat below that of chicken, beef or pork, says Tetrick, is the physical equipment. GOOD Meat is currently using 1,200- and 5,000-liter bio-reactors, enough to produce a few hundred pounds of meat at a time. To go large scale, which Tetrick identifies as “somewhere north of 10 million lb. per facility per year, where my mom could buy it at Walmart and my dad could pick it up at a fast-food chain,” would require 100,000-liter bioreactors, which currently do not exist. Vessels that big, he says, are an engineering challenge that may take as long as five years to solve. GOOD Meat has never been able to test the capacity of cell proliferation to that extent, but Tetrick is convinced that once he has the necessary bioreactors, it will be a slam dunk.

San Martin, at UC Berkeley, says Tetrick’s confidence clashes with the basics of cellular biology. Perpetual cell division may work with yeasts and bacteria, but mammalian cells are entirely different. “At a certain point, you enter the realm of physical limitations. As they grow they excrete waste. The viscosity increases to a point where you cannot get enough oxygen in and they end up suffocating in their own poo.” The only way San Martin could see cellular agriculture working on the kind of scale Tetrick is talking about is if there were a breakthrough with genetic engineering. “But I don’t know anyone who’s gonna eat a burger made out of genetically modified lab-grown cells,” he says. Mosa Meat, based in the GMO-phobic E.U., has absolutely ruled out genetic modification, and Tetrick says his current products don’t use GMOs either.

That said, his rush to market has led him to rely on technologies that go against the company’s slaughter-free (or cruelty-free) ethos. Not long after the company’s cultivated chicken nugget was released for sale in Singapore, Tetrick revealed that FBS had been used in the production process, even though he concedes that it is “self-evidently antithetical to the idea of making meat without needing to harm a life.” The company has since developed an FBS-free version, but it is not yet in use, pending regulatory review.

Eat Just’s initial bait and switch left a bad taste, says Dent. Cell-cultured meat technology may be sound, but if consumers start having doubts about the product and what’s in it, there could be a backlash against the industry as a whole, particularly if FBS continues to be used. “The first products are what everybody will judge the whole industry on,” says Dent. He points to the botched rollout of genetically modified seeds in the 1990s as a precedent. “Despite the science pointing to GMOs being a safer, more reliable option for agriculture, they’re still [a] pariah. It could go the same way with cultured meat. If they get it wrong now, in 20 years, people will still be saying, ‘Cultured meats, uh-uh, freak meats, we aren’t touching it.’”

For the moment, Mosa is focused on re-creating ground beef instead of whole cuts. A ground product is easier, and cheaper, to make—the fat and muscle come out of the bioreactor as an unstructured mass, already fit for blending. Other companies, like Israel’s Aleph Farms, have opted to go straight for the holy grail of the cellular-agriculture world—a well-marbled steak—by 3-D printing the stem cells onto a collagen scaffold, the same process medical scientists are now using to grow artificial organs. So far, Aleph has only managed to produce thin strips of lean meat, and while the technology is promising, a market-ready rib eye is still years away.

Small thin slabs are exactly what Michael Selden, co-founder and CEO of the Berkeley-based startup Finless Foods, which is producing cell-cultivated tuna, wants. Few people would pay $50 for a pound of cultivated beef—15 times the cost of the conventional version—but consumers are already paying more for high-grade sushi. “Bluefin tuna sells in restaurants for $10 to $20 for two pieces of sashimi. That’s $200 a pound,” he says. Sashimi, with its thin, repeatable strips and regular fat striations, is much easier to create than a thick marbled steak, and Selden says Finless Foods has already produced something “close to perfect.” His cell-cultivated bluefin tuna is nearly identical to the original in terms of nutrition and taste profile, he says, but the texture still needs work. “It’s just a little bit crunchier than we want it to be.” But he’s confident that by the time the product makes it through the regulatory process—he’s hoping by the end of the year or early 2022—his team will have perfected the texture. If they do, it could be the first cultivated meat product on the U.S. market.

Cell-cultivated luxury products could be the ideal thin end of the wedge for the market, attracting conscientious—and well-heeled—consumers who want an environmentally friendly product, and thus creating space for the technological advances that will bring down the cost of commodity meat alternatives like cultivated beef and chicken. “People who are buying ethical food right now are doing the right thing, but the vast majority of people are never going to convert” when it’s only about doing the right thing, says Selden. “So we want to make stuff that competes not on morals or ethics—although it holds those values—but competes on taste, price, nutrition and availability.” Assuming they can, it will revolutionize the meat business.

“If I was in the beef industry, I would be shaking in my boots, because there’s no way that conventionally grown beef is going to be able to compete with what’s coming,” says Anthony Leiserowitz, director of the Yale Program on Climate Change Communication. There are many reasons people eat meat, ranging from the taste to religious and cultural traditions. But the bulk of meat consumption is not cultural, says Verstrate of Mosa Meat. “It’s just your average McDonald’s every day. And if for that type of consumption, if you can present an alternative that is not just similar but the same, without all those downsides that traditional meat has, then it simply makes no sense to kill animals anymore.”

Four of the world’s five largest meat companies (JBS, Cargill, Tyson and BRF) are already embracing the technology. From a market point of view, it makes sense, says Friedrich of the Good Food Institute. “These companies want to feed high-quality protein to as many people as possible, as profitably as possible. That is their entire business model. If they can make meat from plants that satisfies consumers, if they can cultivate meat from cells that tastes the same and costs less, they will shift.”

A transition to a lab-grown meat source doesn’t necessarily mean the end of all cows, just the end of factory farming. Ground beef makes up half the retail beef market in the U.S., and most of it comes from the industrial feedlots that pose the greatest environmental threats. Eliminating commodity meat, along with its ugly labor issues, elevated risks of zoonotic disease spread and animal-welfare concerns, would go a long way toward reining in the outsize impact of animal-meat production on the planet, says Friedrich. “The meat that people eat because it is cheap and convenient is what needs to be replaced. But there will always be the Alice Waterses of the world—and there are lots of them—who will happily pay more for ethically ranched meat from live animals.”

Small herds like Farmer John’s could provide both. John feeds his cows on pasture for most of the year—rather than on cattle feed, which is typically more environmentally intensive—and rotates them through his orchards in order to supplement the soil with their manure, a natural fertilizer. When he needs to feed them in the winter, he uses leftover hay from his wheat and barley crops. It’s a form of regenerative agriculture that is impossible to replicate on the large scale that industrial meat production requires to overcome its smaller margins. “We want good food for everybody. But if we do this [the old] way, we only have good food for some people,” John says. That’s why he’s willing to embrace the new technology, even if it is a threat to his way of life. “This is the future, and I’m proud that my cows are part of it.”

It’s likely to be more than a year before John can finally taste the lab-grown version of meat from his cows. Mosa is in the process of applying for regulatory approval from the E.U. In the meantime, the company is already expanding into a new space with roughly 100,000 liters of bioreactor capacity, enough to produce several tons of meat every six to eight weeks. Richard McGeown, the chef who cooked Post’s first burger on the live broadcast, is already dreaming about how he will cook and serve the next one at his restaurant in southern England. He’d like to pair it with an aged cheddar, smoky ketchup and house-made pickles. “It would do great,” he says. “Everyone loves a good burger.” More important, he’d love to serve something that is as good for the environment as it is good to eat.

But for those in the $386 billion-a-year cow business, a battle is brewing. As production moves from feedlot to factory, cattle ranchers stand to lose both jobs and investments. Like coal country in the era of clean energy, entire communities are at risk of being left behind, and they will fight. “The cattle industry will do everything they can to call lab-grown meat into question,” says Leiserowitz. “Because once it breaks through to grocery stores, they’re competing on basic stuff, like taste and price. And they know they won’t be able to win.”

The U.S. Cattlemen’s Association has already petitioned the U.S. Department of Agriculture to limit the use of the terms beef and meat exclusively to “products derived from the flesh of a [bovine] animal, harvested in the traditional manner.” A decision is pending, but if it comes down in the favor of the cattle industry, it could create a significant barrier to market adoption of cell-cultured meat, says Dent. “For a new product that consumers don’t know and don’t trust, the terms you can use make a critical difference. Who’s going to buy something called ‘lab-grown cell-protein isolates’?”

“It’s meat,” says Tetrick. “Even down to the genetic level, it is meat. It’s just made in a different way.” Tetrick, who won a similar naming battle in 2015 when his company, then known as Hampton Creek, successfully maintained the right to call its eggless mayonnaise substitute Just Mayo, says the U.S. Cattlemen’s Association’s complaint is as senseless as if the U.S. automotive industry had argued that Tesla couldn’t use the word car to describe its electric vehicles, on the basis that they lacked an internal combustion engine. Still, he says, naming is critically important. As the technology has gathered speed over the past several years, terms including cell-cultured, cultivated, slaughter-free, cell-based, clean, lab-grown and synthetic have been variously used, but consensus is gathering around cultivated meat, which is Tetrick’s term of choice.

Verstrate, at Mosa, is ambivalent. “Ultimately we’re going to produce a hamburger that is delicious. We can call it meat or we can call it Joe, but if a meat lover consumes it and has the same experience as when consuming a great Wagyu burger, then we’re good to go.”

(Time)

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.

(VAN) Fourth most important food crop in peril as Latin America and Caribbean suffer from slow-onset climate disaster.

(VAN) Shifting market dynamics and the noise around new legislation has propelled Trouw Nutrition’s research around early life nutrition in poultry. Today, it continues to be a key area of research.

(VAN) India is concerned about its food security and the livelihoods of its farmers if more US food imports are allowed.

(VAN) FAO's Director-General emphasises the need to work together to transform agrifood systems.

(VAN) Europe is facing its worst outbreak of foot-and-mouth since the start of the century.

(VAN) The central authorities, in early April, released a 10-year plan for rural vitalization.