May 27, 2025 | 00:54 GMT +7

May 27, 2025 | 00:54 GMT +7

Hotline: 0913.378.918

May 27, 2025 | 00:54 GMT +7

Hotline: 0913.378.918

Source: Bloomberg

The stockpiles — about half the corn Ukraine had been expected to export for the season — have become increasingly difficult to get to buyers, providing a glimpse into the turmoil Russia’s war has wrought in the approximately $120 billion global grains trade. Already gummed up by supply-chain bottlenecks, skyrocketing freight rates and weather events, markets are bracing for more upheavals as deliveries from Ukraine and Russia — which together account for about a quarter of the world’s grains trade — turn increasingly complicated and raise the specter of food shortages.

Before Russia’s attack, Ukraine’s corn would have made its way to Black Sea ports like Odesa and Mykolaiv by rail and loaded on to ships bound for Asia and Europe. But with the ports shuttered, small amounts of corn are creakily winding their way westward by rail through Romania and Poland before being shipped out. An added aggravation: wheels on the wagons have to be changed at the border because unlike European rails, Ukrainian train-cars run on wider, Soviet-era tracks.

“Railways are not supposed to go that way with the grain,” Kateryna Rybachenko, deputy chair of the Ukrainian Agribusiness Club, said in an interview. “This makes the whole logistics very expensive and inefficient, and also very slow. Logistically, it’s a big problem.”

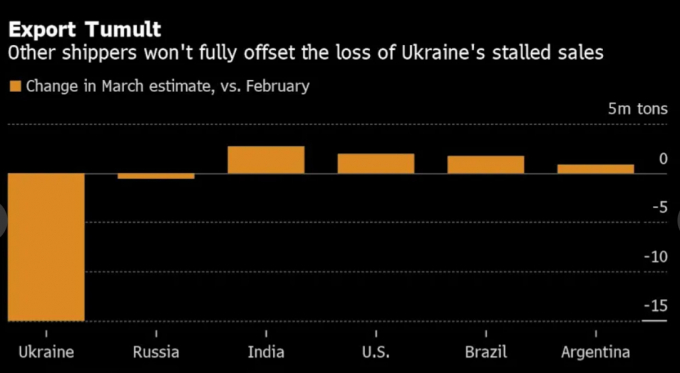

Ukraine is one of the world’s biggest exporters of corn, wheat and sunflower oil, flows of which are largely stalled. Grains exports are currently limited to 500,000 tons a month, down from as much as 5 million tons before the war, a loss of $1.5 billion, the country’s agriculture ministry says. Crops from Russia — the world’s biggest exporter of wheat — are still flowing, but questions persist over delivery and payment for future cargoes.

Disruptions in the flows of grains and oilseeds — staples for billions of people and animals across the world — are sending prices soaring. Countries fearing potential food shortages are scrambling to find alternative suppliers and new trades are emerging.

India, which historically kept its huge wheat harvests at home — thanks to a government-set price — is jumping into the export market, hawking record amounts across Asia. Brazil’s exports of wheat in the first three months have far surpassed those in all of last year. U.S. corn cargoes are heading to Spain for the first time in about four years. And Egypt is considering swapping fertilizer for Romanian grain and holding wheat talks with Argentina.

Even those efforts may not be good enough, said Dan Basse, president of AgResource, an agriculture markets research firm.

“We can move the deck-chairs around today,” he said. But if the conflict stretches into the summer, when wheat exports from the Black Sea usually accelerate, “then you start running into problems. That’s when the world starts to see shortfalls,” Basse said.

Alternative suppliers come with pricier freight, longer transits or differing quality, further accelerating food inflation. World supplies were already reeling from droughts in Canada and Brazil and transportation blockages in parts of the world, from rail logjams in the U.S. to trucker strikes across Spain. The added shock from the war sent a gauge of prices to a record, with corn and wheat futures in Chicago up more than 20% since the beginning of this year.

The $120 Billion Global Grain Trade Is Being Redrawn by Russia's War in Ukraine

The United Nations has warned food prices — already at an all-time high — could rise as much as 22% more. A severe drop in Black Sea exports could leave as many as 13.1 million additional people undernourished, it said, deepening the rise in global hunger in a world still recovering from the effects of the pandemic.

For now, other suppliers are stepping in. Drawn by the higher prices, India, the second-largest wheat grower after China, has boosted exports, which may have reached a record 8.5 million tons in the season ended last month. “I don’t remember the last time when open-market prices were higher than the government’s minimum support price,” said Nilesh Shivaji Shedge, 46, who grows wheat on a fifth of his family’s 15 acres.

India’s Kandla and Mundra ports in the western state of Gujarat, the main gateways for wheat exports, have been abuzz with activity as sales have surged. The government is making more railway capacity available to transport the wheat, while port authorities have been asked to increase the number of terminals and containers dedicated to the grain. Some ports on the Indian east coast and the Jawaharlal Nehru Port in Mumbai are also preparing to handle wheat cargoes.

“We will continue to export wheat in a big way to meet needs in countries who are not getting supplies from conflict areas,” Piyush Goyal, India's food and commerce minister, said on Sunday. “Our farmers are focused on increasing production.”

India is negotiating access to markets in Egypt, Turkey and China, three of the four largest importers, and other potential buyers, including Bosnia, Nigeria and Iran, according to the commerce ministry. Exports from the country could “easily” touch 12 million tons in the 2022-23 season that started this month, said Fauzan Alavi, a director with Allana Group, which has traded agricultural commodities since 1865.

Brazil — a net wheat importer — is also expecting its highest exports of the grain in a decade. Low river levels in neighboring Argentina pushed sales toward Brazil’s Rio Grande do Sul state. A bumper harvest, a weak currency and a delayed soybean crop that allowed extra time for wheat flows have buoyed sales, according to Walter Von Muhlen Filho, a trader with Serra Morena Commodities. Total wheat exports from the country are set to reach 2.1 million tons for the first three months of the year, almost double those in all of 2021. Destinations include Turkey, South Africa and Sudan, all for the first time in at least four years, according to data from the Secretaria de Comercio Exterior.

Sales for Australia, a large wheat exporter, are running at full tilt, with shipping slots booked for months and buyers purchasing the grain further out than usual.

Some governments are limiting trade to counter higher food prices. Serbia, the ninth-largest corn shipper, temporarily barred exports. Argentina and Indonesia increased taxes on vegetable oil exports, and Kazakhstan will limit wheat shipments. The global grains trade, not including rice, could shrink by 12 million tons this season, the most in at least a decade, the International Grains Council estimates.

“High prices more often than not, rather than just having more exporters, will result in protectionism,” said Michael Magdovitz, senior analyst at Rabobank.

Importers are meanwhile rolling back restrictions to get grain from more origins. Spain — Ukraine’s No. 2 corn buyer — relaxed rules on pesticides to allow for feed from Argentina and Brazil. It also got 145,000 tons from the U.S. in March, its first cargoes since 2018, and China, another major Ukraine corn customer, ramped up American purchases.

While that’s helping narrow the gap, there’s little room for error. The main Brazilian corn harvest is a few months off and any bad weather in the northern hemisphere could mean curtailed supplies for farmers who feed the grain to hogs and chickens, said Nathan Cordier, an analyst at Agritel in Paris.

Some feed mills in southern Italy have closed from a lack of grain, said Alexander Doring, secretary general at European feed-industry group FEFAC. Supply is being booked from the U.S. and Argentina, which needs 10 days of extra shipping time versus the Black Sea, he said. Italian industry group Assalzoo said some livestock farmers are culling their herds, starting with milk-producing cows.

The country gets more than 5 million tons of corn annually from abroad, and producers are struggling to pay their bills as the cost of the grain has skyrocketed, Giulio Usai, an executive at Assalzoo, said in an interview. Livestock farmers are getting almost no supplies now from either Russia or Ukraine due to the naval blockade in the Black Sea, Usai said. Efforts are being made to source from the Americas, but the process will “take time,” he said. Pig farmers could be next at risk, he said.

“These are the things we are trying to manage — how we can change the origin of our product in order to get what we need,” said Miguel Angel Higuera Pascual, director of Spanish pig-farming group Anprogapor. “This is the situation we have right now, to try to readjust.”

North African and Middle Eastern importers are particularly dependent on Russian and Ukrainian supplies and are grappling with finding alternatives. Algeria — which opened to Black Sea wheat just last year — is already reverting to French cargoes. Egypt, the world’s biggest wheat importer — with more than 80% of its imports coming from Russia and Ukraine over the past five years — is having to cut back purchases as prices soar. It scrapped two straight import tenders as offers dried up and prices shot up by about $100 per ton, including freight. It is holding off on further tenders until at least mid-May, according to its supply minister. The country is struggling to maintain a bread subsidy program used by about 70 million of its citizens.

With no signs the supply crunch will ease anytime soon, Rabobank forecast in March that wheat futures would average $11 or more per bushel through the end of the year, and corn about $7.75 a bushel or higher. That’s an increase of 30% or more than at the end of 2021.

Ukrainian President Volodymyr Zelenskiy on Thursday told Dutch lawmakers that the Russians are “doing everything to ruin our agriculture potential and to provoke a food crisis not only in Ukraine but in the world,” saying troops have placed land-mines in fields and that farm equipment has been destroyed.

On the ground, farmers are struggling to get fertilizers to wheat crops sown in the autumn as they emerge from winter dormancy. Plantings of key spring crops like corn and sunflowers are set to drop as producers deal with diesel shortages and stolen tractors.

“We all hope this war will end soon and ports will open,” said Rybachenko of the Ukraine club. “We’re feeling responsible — not only for the food safety inside of Ukraine, but also the food safety of the world.”

(Yahoo Finance/Bloomberg)

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.

(VAN) Fourth most important food crop in peril as Latin America and Caribbean suffer from slow-onset climate disaster.

(VAN) Shifting market dynamics and the noise around new legislation has propelled Trouw Nutrition’s research around early life nutrition in poultry. Today, it continues to be a key area of research.

(VAN) India is concerned about its food security and the livelihoods of its farmers if more US food imports are allowed.

(VAN) FAO's Director-General emphasises the need to work together to transform agrifood systems.

(VAN) Europe is facing its worst outbreak of foot-and-mouth since the start of the century.