June 21, 2025 | 01:26 GMT +7

June 21, 2025 | 01:26 GMT +7

Hotline: 0913.378.918

June 21, 2025 | 01:26 GMT +7

Hotline: 0913.378.918

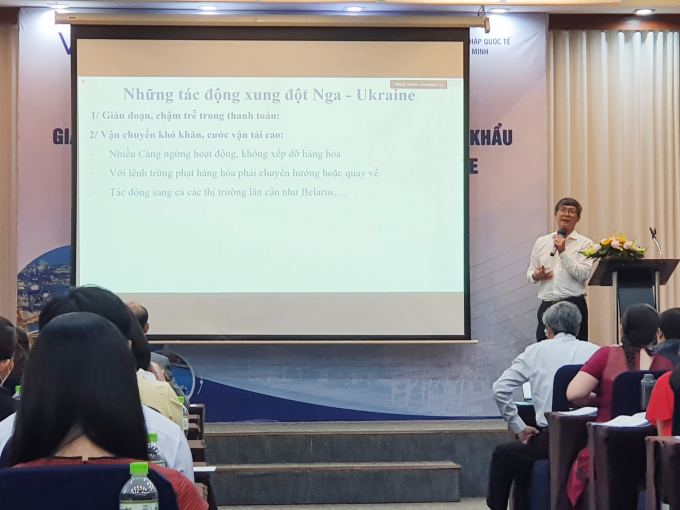

Mr. Truong Dinh Hoe, General Secretary of the Vietnam Association of Seafood Exporters and Producers (VASEP). Photo: Nguyen Thuy.

Sharing at the workshop on "Adaptive solutions for import - export activities in the context of the Russia - Ukraine conflict" organized by the Vietnam International Arbitration Center (VIAC) in collaboration with the Center for International Integration Support in Ho Chi Minh City (CIIS), General Secretary Truong Dinh Hoe of the Vietnam Association of Seafood Exporters and Producers (VASEP) said that although Russia and Ukraine are not among the top seafood export markets, they are still important seafood export markets with strong growth and recovery potential.

Specifically, in the Russian market, Vietnamese seafood accounts for 2% of the market share with the main export items being whiteleg shrimp, pangasius, surimi, tuna, yellowtail, anchovies... In 2021, exports to Russia reached 164 million USD, up by 21% compared to 2020.

Meanwhile, Ukraine is the 53rd largest market for Vietnamese seafood, but the amount of exports to this market is still quite modest. The main export items to Ukraine are mainly shrimp, pangasius, tuna...

When the Russia-Ukraine conflict occurred, many activities were delayed, payments were interrupted, old contracts were backlogged, new contracts could not be signed. Particularly, one of the difficulties lies in difficult transportation, the freight charges are high.

Specifically, many ports stopped working and did not handle cargoes. In the early stages of the Russia-Ukraine conflict, many shipments were stuck at the port, making payment for these orders very difficult. Not only that, it also affects other neighboring markets such as Belarus.

With the goods sanctions, many businesses have to redirect or return. "Transportation was at a standstill, partners proposed to move to other ports in Poland, Turkey, then they tried to bring it back to Russia, but it was all very risky," said Mr. Hoe.

The Russia-Ukraine conflict also makes it impossible for Vietnamese businesses to sign new contracts due to problems with exchange rates, payment guarantees, and cargo transportation. All these issues cause seafood businesses to become increasingly worried and concerned.y

Workshop on "Adaptive solutions for import - export activities in the context of the Russia - Ukraine conflict" organized by Vietnam International Arbitration Center (VIAC) in collaboration with Center for International Integration Support (CIIS) in Ho Chi Minh city was held on the morning of April 20. Photo: Nguyen Thuy.

According to Mr. Hoe, the disruption of the supply chain in these two markets is a strong blow to seafood businesses in Vietnam as well as many other countries when most of the raw materials are imported from Russia.

Because Vietnam imports from Russia for processing and consumption totalling at about 20 million USD, of which salmon accounts for 90%; Russia is also a seafood exporter to the world, reaching 6 billion USD in 2021, mainly in the form of raw materials to China and South Korea (about 1 million tons) for export processing.

The impact causes orders to be continuously delayed or cancelled, leading to congestion, high costs and many other losses for businesses.

In response to this stressful circumstances, Mr. Hoe said, the seafood business community also had solutions to adjust business activities in a timely manner. For delivered orders, expedite payment measures through channels of foreign banks and private banks.

Orders that are on the way or with delivery planned are pulled back, postponed or cancelled. Orders are still delivered at the request of the customer on the payment stage, port of delivery adjustment with the customer bearing the costs incurred...

In addition, according to Mr. Hoe, businesses should also look for opportunities to increase market share of pangasius in the face of a shortage in European countries. Businesses need to adjust the plan to import aquatic materials, pay more attention to the processing, export processing capacity of Pollock fish, Cod fish of Russia.

Study the possibility of utilizing the advantages of Trade Agreements in the Eurasian Union and other Agreements to increase exports to neighboring markets. Additionally, develop trade promotion programs to expand exports to markets that previously consumed a lot of Russian seafood indirectly.

However, in order to be able to develop an effective and long-term strategy, Mr. Hoe said that businesses still need comprehensive guidance from competent authorities and organizations supporting businesses.

Facing the impact of the Russia-Ukraine conflict, Dr. Vu Tien Loc, President of the Vietnam International Arbitration Center (VIAC) said that instead of insecurity, businesses should look at the situation from a more positive, proactive perspective.

Vietnam has many advantages and benefits from signing FTAs with countries around the world. Besides, with economic, political stability and good control of the Covid-19 pandemic, Vietnam is an investment destination, a potential and prestigious investment cooperation partner.

Dr. Vu Tien Loc emphasized, businesses need to have long-term strategies to cope with the volatile situation of the market. Additionally, businesses also need to be equipped and guided with solutions on risk management, damage reduction, handle dispute with competence, more resilient and recover operations more quickly in the future.

Translated by Nguyen Hai Long

(VAN) Last week, the U.S. Department of Agriculture (USDA) released its June World Agricultural Supply and Demand Estimates (WASDE), raising projections for both Indian rice production and U.S. rice imports for the 2025/2026 marketing year.

/2025/06/17/2344-1-131758_261.jpg)

(VAN) Amid tariff risks and growing trade barriers in the U.S. market, Australia is emerging as a promising destination to sustain the growth momentum of Vietnam's shrimp exports.

/2025/06/17/2013-1-nongnghiep-112009.jpg)

(VAN) This notable growth trend reflects the global taste for fresh, nutritious fruits and the expanding use of lychees across various sectors.

(VAN) The political and cultural insulation of Japan’s beloved grain is falling apart, and experts warn the country’s relationship with the staple will have to adapt.

(VAN) Noting risks, report examines impacts of avian influenza, changing trade patterns since 2022, fish fraud, and shipping industry’s net-zero goals.

(VAN) Mr. Tran Quang Bao, General Director of the Forestry and Forest Protection Department, met and worked with the International Wood Products Association to promote cooperation in the field of timber trade.

(VAN) China's outbound shipments of rare earths in May jumped 23% on the month to their highest in a year, though Beijing's export curbs on some of the critical minerals halted some overseas sales.