June 15, 2025 | 12:17 GMT +7

June 15, 2025 | 12:17 GMT +7

Hotline: 0913.378.918

June 15, 2025 | 12:17 GMT +7

Hotline: 0913.378.918

“Will I get another shot at $15 soybeans?”

That was the question from a young Illinois customer at my recent seminar. I gave my usual response: “Sure ... in my lifetime or yours!”

But seriously, it is a fair question. This was another very volatile year in the grain markets. Rallies increased corn prices $3 a bushel and soybeans $6 per bushel before moving sharply lower by harvest.

Why did the grain markets collapse?

3 REASONS

There were three main reasons that together drove soybean prices from over $16 a bushel to below $12 in just over six months.

The first reason: good to great yield results for most corn and soybean farmers in 2021. It is hard to believe that despite the hot, dry conditions this summer U.S. farmers had a record corn yield and one of the highest soybean yields ever. This resulted in larger than anticipated production.

Second: a slowdown in Chinese demand. China reported a record corn crop, a large wheat crop, and a large drop in hog numbers. Last year at this time, the Chinese bought corn and soybeans aggressively. However, this year, they have reduced soybean imports from the United States and have not bought any U.S. corn since May.

Third: the potential for large soybean and corn crops in Brazil this year. Brazilian farmers planted at a near-record pace last fall. This sets them up for a large soybean crop and timely planting of their double-crop corn acres. Currently, Brazilian soybean export prices (for exports starting in January) are 25¢ to 45¢ per bushel below U.S. prices. I think the USDA will be forced to lower U.S. export projections in future monthly supply/demand reports.

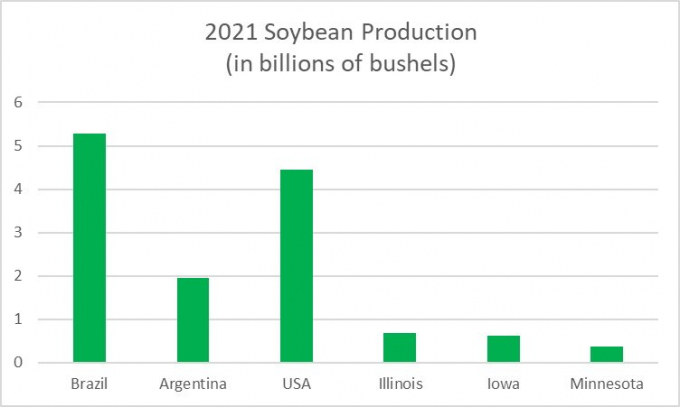

Soybean production

This chart shows how dominant Brazil has become in global soybean production. The soybean crop area continues to expand in Brazil. If favorable weather continues this year in the nation, then Brazilian farmers are likely to produce 800 million bushels more soybeans than the United States produces. If you are trading soybeans, then the main weather-scare time to watch is during the critical growing season in Brazil, from late January through mid-March.

3 MARKET SIGNALS

Looking ahead, I will be watching for three signals that will tell me when corn and soybean prices have bottomed (and may be heading higher).

#1: Alignment of the futures. When the corn and soybean markets turned higher in the first quarter of 2021, basis levels improved and the bull spreads started to work. Eventually both markets went from a carrying charge market to an inverted market. That signaled a major trend change and that we were in a bull market. Right now, the markets are in a carrying charge mode. Until that changes, it is difficult to forecast a sustained rally.

#2: A “basing” type of market action. (That is when the charts put in a series of “M” and “W” patterns on my daily continuation charts.) The grain markets all go through three trends: the uptrend (like we had in late 2020 through May 2021), a downtrend (like the path from the May 2021 highs to the harvest lows), and sideways. If prices can stabilize and move into a sideways trading channel, then it sets up a base that can launch the next uptrend. I think prices will turn higher by late 2022. However, first you have to get through the month of March.

#3: The first monthly close above the two previous months’ high. That bullish chart signal initially developed in the third quarter of 2020. By 2021, the corn and soybean charts showed a series of monthly higher highs and higher closes. The markets peaked in May 2021 and then reversed lower in June.

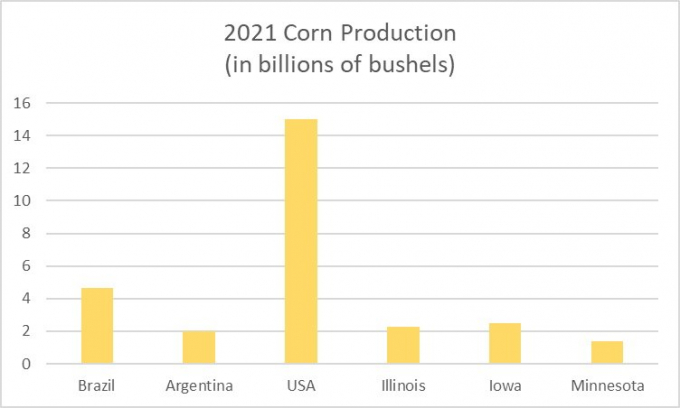

Corn in 2021

This chart shows how dominant the United States is in global corn production. The U.S. corn crop is 2.5 times larger than the Brazilian corn crop. The combined corn production of Iowa and Illinois is larger than the Brazilian corn crop. The main weather-scare time to watch each year is during the US growing season from late April through mid-July.

Now back to the original question: Can soybeans get back to over $15 a bushel? It is not impossible this year. However, it is also not very likely. The current change in global fundamentals suggests global soybean stocks are expanding.

If Brazil or the central United States develop weather problems in 2022, then I can target a rally back to $13 to $13.80. If that bullish weather pattern develops, then you will read a lot of wild price forecasts calling for $15 (or even $18) soybeans.

However, I want to stay realistic. With last year’s yields, I will recommend getting the last of my 2021 soybeans sold on any rally into early May. That strategy worked great in 2021 and it will work again in 2022.

I have a lot of chart patterns that project a low in March. That is the month I will be speaking for Successful Farming on the main stage at the Commodity Classic in New Orleans. Plan to attend and I will fine-tune my outlook that week.

(FP)

(VAN) Extensive licensing requirements raise concerns about intellectual property theft.

(VAN) As of Friday, a salmonella outbreak linked to a California egg producer had sickened at least 79 people. Of the infected people, 21 hospitalizations were reported, U.S. health officials said.

(VAN) With the war ongoing, many Ukrainian farmers and rural farming families face limited access to their land due to mines and lack the financial resources to purchase needed agricultural inputs.

(VAN) Vikas Rambal has quietly built a $5 billion business empire in manufacturing, property and solar, and catapulted onto the Rich List.

(VAN) Available cropland now at less than five percent, according to latest geospatial assessment from FAO and UNOSAT.

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.