May 26, 2025 | 22:05 GMT +7

May 26, 2025 | 22:05 GMT +7

Hotline: 0913.378.918

May 26, 2025 | 22:05 GMT +7

Hotline: 0913.378.918

MSc. Luong Ngoc Quang, Plant Protection Department (Ministry of Agriculture and Rural Development) presented regulations of key markets for products of plant origin imported from Vietnam. Photo: Nguyen Thuy.

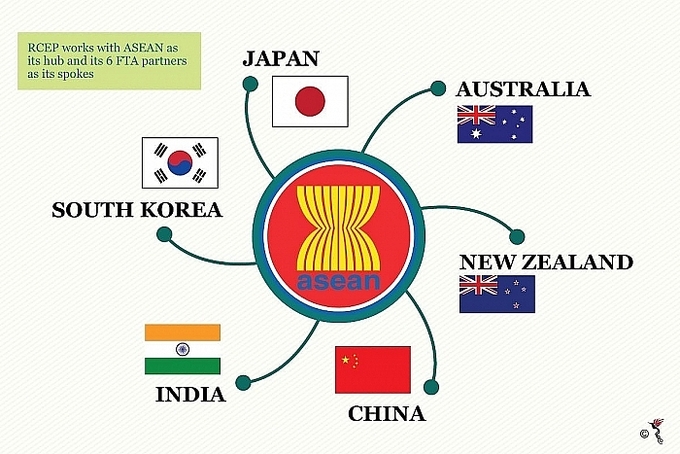

The Regional Comprehensive Economic Partnership (RCEP) is a free trade agreement (FTA) between 10 ASEAN countries (including Vietnam) and 5 non-ASEAN economic partners: Australia, South Korea, New Zealand, Japan, and China. It was signed on November 15, 2020, and took effect on January 1, 2022. The RCEP agreement aims to eliminate tariffs on about 90% of product groups within 20 years. The 10 ASEAN countries, as core members of RCEP, believe that with their growth, the EU and the US will strengthen negotiations and open their markets more in the future with the RCEP group.

The RCEP group currently accounts for one-third of the global population, representing a region with immense development potential and opportunities.

For RCEP countries, compliance with food safety and phytosanitary requirements is crucial when exporting goods to protect public health and prevent the entry of harmful organisms. Import regulations typically require measures to prevent the entry of dangerous pests or food safety hazards into the importing country. Phytosanitary measures are essential in mitigating the risk of spreading pests through trade, ensuring that exported products meet the food safety standards of the importing country.

Each country has its own regulations on safety standards and plant quarantine. Adhering to these regulations not only facilitates the acceptance of exported goods in the importing country but also helps avoid risks at the port of entry. Ensuring thorough quarantine and food safety procedures allows exporting businesses to feel more secure about the import-export process.

The RCEP Agreement aims to broaden and deepen ASEAN’s engagement with Australia, China, Japan, Korea and New Zealand. Photo: MOIT.

As a general rule, World Trade Organization (WTO) member countries must comply with plant quarantine regulations under the SPS Agreement and the International Plant Protection Convention (IPPC). For fresh fruit, the basic requirement is a Phytosanitary Certificate issued by a competent authority, ensuring that the shipment is free from plant quarantine pests.

Growers or packing facilities (PF) must register their codes and ensure compliance with the importing country’s requirements. This registration is a prerequisite for successfully exporting their products.

While registering a code for a plantation or PF is voluntary, it is necessary to demonstrate compliance with the standards of the importing country. Inspection and assessment are crucial steps in granting, maintaining, or reinstating a code. These assessments are conducted by competent authorities to ensure that the plantation or PF fully meets the importing country's requirements.

Once a code has been assigned, the plantation or PF must continuously ensure compliance with the importing country’s conditions. The assigned code will be monitored by the management agency to maintain adherence to regulatory requirements. The export code must be recognized or approved by the importing country, ensuring that products from the growing area or PF meet the necessary standards for import.

Therefore, implementing the code and maintaining compliance with the requirements are vital to ensure that products from the growing area or PF can be successfully exported and meet international standards. The agricultural sector is actively implementing this coding process locally. Here are the specific steps:

The Chinese market currently allows the export of several fruits, including traditional items such as mango, longan, lychee, rambutan, jackfruit, and dragon fruit. Additionally, some new fruits have been permitted for export in recent years, including mangosteen (2019), black jelly (2020), durian, sweet potato (2022), banana (2022), watermelon (2023), and coconut (2024). Passion fruit and chili are currently under temporary regulations, while items such as citrus (grapefruit), medicinal herbs, and frozen fruits are still in the process of market access negotiations.

It is crucial to implement code issuance and maintain compliance with requirements. Photo: Tung Dinh.

The Chinese market enforces strict control measures on goods crossing the border, particularly those traded on a small scale. To ensure successful exports, exporters need to negotiate market access for individual products and re-sign export protocols for traditional fruits. Similar controls are applied to new products such as mangosteen, durian, sweet potatoes, and bananas.

A new requirement is to declare the growing area code and packing facility code for agricultural products. Some agricultural products also need to be registered under Orders 248 and 249.

In the first half of 2024, the number of warnings from the EU market increased abnormally. Vietnam accounted for about 2% of the total number of warnings, mainly related to products such as vegetables, spices, seafood, and other foods. The warnings predominantly came from localities such as Ho Chi Minh City, Hanoi, Tien Giang, Khanh Hoa, Binh Duong, Can Tho, Hau Giang, Long An, and some other areas.

Some reasons for these warnings include: fruit and vegetable products exceeding the allowable pesticide residue level; contamination with microorganisms and mycotoxins; genetically modified rice; processed foods exceeding the allowable pesticide residue level; and various other violations.

Therefore, it is essential to strengthen the control of agricultural products based on Regulation (EU) 2024/1662 of 11 June 2024, which requires temporary reinforcement of official controls and management measures for certain goods entering the EU from specific third countries. Products such as dragon fruit, chili, okra, and durian will be subject to stricter controls.

Under Regulation 2019/1973, the EU will conduct a review every six months to assess the measures taken to enhance controls, import controls, and require additional food safety certificates and test results. Regulation (EC) 1829/2003 also applies to genetically modified foods, ensuring these products comply with strict safety standards.

The EU will conduct a review every six months to assess measures to strengthen import inspection and management and require additional food safety certificates and test analysis results. Illustrative photo.

The EU maintains a pesticide database that allows users to search for information on approved active substances and the maximum residue levels (MRLs) permitted in food products. If a particular pesticide has not established an EU MRL and is not included in this database, a default MRL of 0.01 mg/kg will apply. However, this default value may vary based on conventional analytical methods and other considerations.

It should be noted that contaminants in plant-based foods that are strictly controlled in the EU include mycotoxins, heavy metals (e.g., lead and cadmium), dioxins, and nitrates. Vietnamese fruit and vegetable producers and exporters need to pay special attention to lead and cadmium contamination.

Translated by Quynh Chi

(VAN) Amidst the current intense competition, businesses must establish sustainable linkages, prioritize technological investments, build brand identity, and obtain international certifications.

(VAN) As director of the Thuy Tuyet Bamboo and Rattan Handicraft Cooperative in Soc Trang, she has revitalized a traditional craft, generating sustainable livelihoods for hundreds of workers - particularly from the Khmer ethnic minority.

(VAN) Vietnam has been classified as a ‘low-risk’ country for deforestation under EUDR, granting local producers a strategic edge in sustainable market development.

/2025/05/19/2617-14-211139_18.jpg)

(VAN) Vietnamese bird's nest enterprises are eager to access the promising Chinese market; however, only those with thorough preparation, truthfulness, strict regulatory compliance, and consistent product quality will be positioned for success.

(VAN) For Vietnamese bird's nest products to penetrate deeply and sustainably into the Chinese market, it requires not only product quality but also strict compliance with the regulations on quarantine, traceability, and food safety.

(VAN) As one of Vietnam's most high-value products, bird's nest is asserting its position on the national agricultural export map. China, with an annual demand of hundreds of tons, is considered the most promising market.

/2025/05/22/5250-1-184853_288.jpg)

(VAN) According to a representative from the Central Retail Vietnam, Vietnamese products such as seafood, sweet potatoes, dragon fruit, coffee, and spices hold great potential in the Thai market.