May 14, 2025 | 10:15 GMT +7

May 14, 2025 | 10:15 GMT +7

Hotline: 0913.378.918

May 14, 2025 | 10:15 GMT +7

Hotline: 0913.378.918

Tay Ninh farmers with a harvest of cassava. Photo: Son Trang.

According to cassava traders in Tay Ninh province, there is a slow growth of purchase orders from Chinese customers at the land border gates. As a result, Vietnamese businesses are shifting their focus to exporting cassava starch to the market by sea.

Cassava starch processing businesses have begun signing sea export contracts with prices ranging from 520 to 530 USD per ton (FOB price). Although demand from China is low, this year's cassava crops were harvested late in Vietnam and Thailand. On the other hand, fresh cassava root production decreased in both Vietnam and Thailand, so cassava starch exporters were cautious in offering products from the new crop.

Cassava starch processing businesses in Tay Ninh province raised the selling price of finished starch products by 200 VND per kilogram in early September due to the rising cost of raw cassava since the end of August. According to Mr. Le Van Bay, a fresh cassava trader in Tay Ninh province, shipments of fresh Cambodian cassava to Tay Ninh province were priced at 3,600 to 3,650 VND per kilogram in early September. On the other hand, fresh cassava produced in Tay Ninh was priced at 3,350 to 3,450 VND per kilogram.

According to the Import-Export Department under the Ministry of Industry and Trade, China remains as world's largest import market for cassava and cassava starch. The country is also Vietnam's largest market for cassava and cassava products in the first seven months of 2023. However, China's recent imports of cassava and cassava starch have slowly fallen compared to the same period in 2022 due to low demand and the sharp depreciation of the Chinese Yuan.

Consequently, Vietnam's cassava starch exports to China dropped in the first seven months of 2023. However, China is still Vietnam's largest cassava starch consumption market during this time period, with an export volume of approximately 933 thousand tons, accounting for 92.6% of the total cassava starch exports.

According to the General Department of Customs of Vietnam, exports of cassava and cassava products to China reached 1.47 million tons in the first seven months of 2023, which is valued at 589.27 million USD. This is a decrease of 15.9% in volume and 23.2% in value compared to the same period in 2022. During the first seven months of the year, China accounted for 89.8% of Vietnam's total exports of cassava and cassava products in terms of volume and 88.54% in terms of value.

Chinese traders' demand for cassava starch has increased recently whereas the new crop starch output in Thailand and Vietnam has decreased due to an unexpected delay in harvest.

In addition to China, Vietnam is promoting the export of cassava starch to other markets around, with a focus on Asian countries including South Korea, Taiwan, etc.

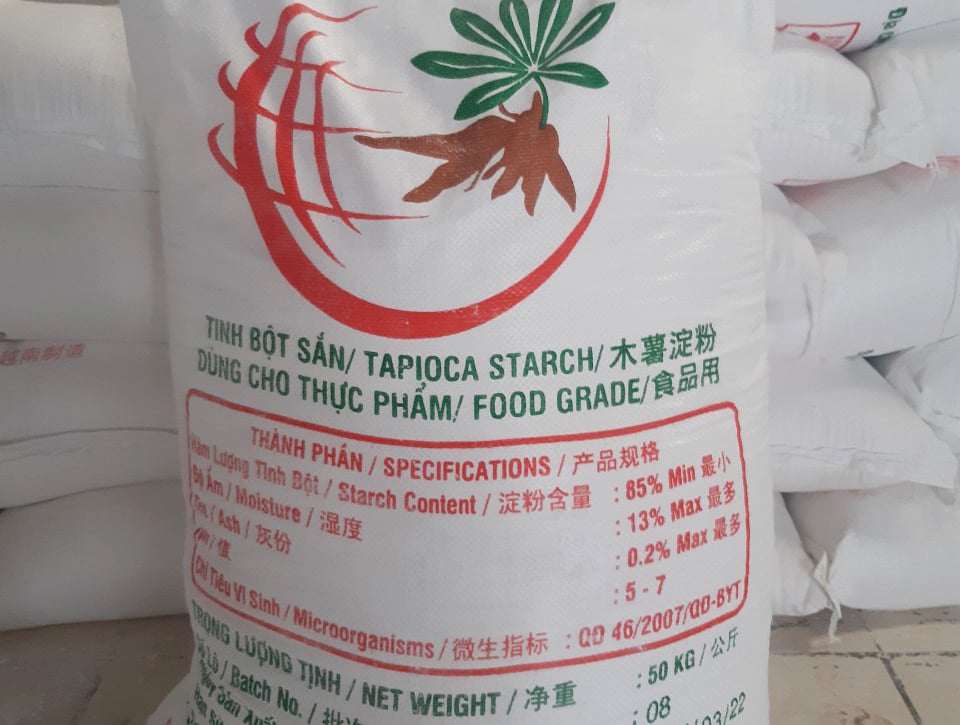

Cassava processing factories in Tay Ninh province recently increased the price of cassava starch. Photo: Son Trang.

According to the Korean Customs Service, South Korea imported 23.52 thousand tons of cassava starch in the first seven months of 2023, which is valued at 12.38 million USD. This is an increase of 18.5% in volume and 13.8% in value compared to the same period in 2022. Thailand, Vietnam, and Indonesia are three primary suppliers of cassava starch to the South Korean market. Additionally, cassava shipments from these countries have increased sharply compared to the same period in 2022.

Vietnam is the second largest supplier of cassava starch to the South Korean market in the first seven months of 2023 at 3.11 thousand tons and 1.73 million USD. This is an increase of 46.1% in volume and 40.2% in value compared to the same period in 2022. The market share of Vietnamese cassava starch accounts for 13.22% of the total imported cassava starch in the South Korean market, which is a sharp increase from 10.73% in the same period in 2022. On the other hand, the market share of Thailand's cassava starch accounts for 86.57%, which is a decrease from 89.26% in the same period in 2022.

According to the Taiwanese Financial Supervisory Commission, Taiwan imported 171.49 thousand tons of cassava starch in the first half of 2023, which is worth 87.37 million USD. This is a decrease of 3.6% in volume and 9.1% in value over the same period in 2022.

During this period, Vietnam was the second largest supplier of cassava starch to the Taiwanese market at 25.27 thousand tons and 12.68 million USD. This is an increase of 65.5% in volume and 50.5% in value compared to the same period in 2022. The market share of Vietnamese cassava starch accounts for 14.74% of the total imported cassava starch in Taiwan, which is an increase from 8.58% in the first half of 2022. On the other hand, the market share of Thailand's cassava starch accounts for 73.76%, which is a decrease from 88.13% in the first half of 2022.

Translated by Nguyen Hai Long

(VAN) Use of high-quality broodstock and biotechnology is regarded as the most effective approach to ensuring sustainable and economically viable shrimp aquaculture ahead of climate change and the emergence of increasingly intricate disease patterns.

(VAN) Carbon farming is a form of agricultural practices that helps absorb more greenhouse gases than it emits, through smart management of soil, crops, and livestock.

(VAN) This is a key content of the Memorandum of Understanding recently signed between the Vietnam Fisheries Society and Kunihiro Inc of Japan.

(VAN) To achieve the goal, local authorities and businesses in Kon Tum province have fully prepared the necessary conditions for the new Ngoc Linh ginseng planting season.

(VAN) Jiangsu province is gearing up to host training programs in Phnom Penh, the capital of Cambodia, this year to establish the Fish and Rice Corridor.

(VAN) Le Hoang Minh, representing Vinamilk, shared the company's experience in energy saving and green energy transition for production at a workshop held during the P4G Summit.

(VAN) Businesses emphasize fairness and equality when integrating social factors into their sustainable development strategies.