May 17, 2025 | 11:55 GMT +7

May 17, 2025 | 11:55 GMT +7

Hotline: 0913.378.918

May 17, 2025 | 11:55 GMT +7

Hotline: 0913.378.918

Vietnamese pangasius is subject to many objective impacts, affecting exports in 2023.

According to the Department of Fisheries, the area for pangasius farming in 2023 reached 5,700ha, equal to 2022. Output reached 1.71 million tons, up 0.6% compared to 2022 (1.7 million tons).

The Mekong Delta region has about 1,900 pangasius breeding establishments, with nearly 3,000ha of pangasius breeding nurseries. Fish fry production in 2023 is about 28 billion fish; fingerlings reached 3.9 billion.

As one of the leading exporters of Vietnamese seafood, pangasius brings in USD 1.9 billion in 2023, second only to shrimp (about USD 3.45 billion) and above mollusks (USD 800 million) and tuna (USD 900 million).

The target for 2024 is that the fisheries industry will strive to produce 1.75 million tons of pangasius, a slight increase compared to 2023; Exports reached USD 2 billion.

However, from the end of 2023, weak demand has caused the price of Vietnam's pangasius exports to plummet, especially in key markets. Typically, export turnover to the US market only reached USD 275 million, down 49% compared to 2022, Of which the average export price decreased by 30% to USD 3.2 per kg.

Similarly, export turnover to the Chinese market decreased by 19%, to USD 580 million, and the average export price reduced by 11%, reaching only 2.2 USD/kg.

The situation got better in early 2024. Mrs. Le Hang, Communications Director of the Vietnam Association of Seafood Exporters and Producers (VASEP), said that pangasius orders in January and February 2024 began to improve. At the same time, the price of raw pangasius had bottomed out, increasing from USD 25.000 - 26,000 per kg in 2023 to VND 28.000 - 29,000 per kg in early 2024.

"Although import customers are still cautious with purchase prices, pangasius exports this year are forecast to increase slightly compared to 2023, possibly reaching USD 2 billion," Mrs. Hang said.

Mrs. Le Hang believes that Pangasius will achieve its export target in 2024.

The basis for this growth is that consumer demand in some major importing countries of Vietnamese pangasius tends to recover. China - the number one market for importing Vietnamese pangasius - is expected to be a high-growth area for pangasius consumption in 2023.

Chinese businesses have been stockpiling goods early to supply the enormous demand of hotels, restaurants, and the service and tourism industry since the beginning of the year. This country's total seafood imports from Vietnam in January 2024 increased nearly three times compared to the same period in 2023.

In the US market, the amount of inventory that caused pangasius import prices to decline sharply last year is no longer the dominant issue. After a steady decline in the first 11 months of 2023, pangasius exports to the US grew positively by 21% in December 2023 and continued that trend in 2024.

FPT Securities Joint Stock Company (FPTS) agrees with the above point of view. This agency predicts that demand for pangasius will recover on a large scale from the second half of 2024. Driving that process, the pangasius supply in Vietnam may fall into a shortage.

In some markets, like the US, the uptrend appears even earlier. FPTS believes that from the second half of the second quarter of 2024, this country's consumers will open their wallets more after a long period of being affected by monetary adjustment and anti-inflation policies.

The Federal Reserve System (Fed) statistics show that wage growth of US workers in January 2024 reached 4.5% over the same period in 2023, much higher than previous forecasts. Meanwhile, the average number of working hours decreased. Real income in the US is forecast to increase by 2.5% this year.

The Fed also predicts the US GDP growth rate to increase to 2.1%, higher than the previous forecast of 1.4% in December 2023.

For the Chinese market, pangasius demand here is expected to recover positively thanks to the Government's policies to support the real estate market and stimulate consumption as early as January 2024.

FPTS also maintains an optimistic view of the demand for pangasius in China. This company believes that although consumer spending psychology may be harmful in the first half of the year, pangasius will grow by the fourth quarter of 2024. Part of the reason lies in the fact that the competitiveness of this product is low compared to other aquatic products, so it requires a longer recovery time.

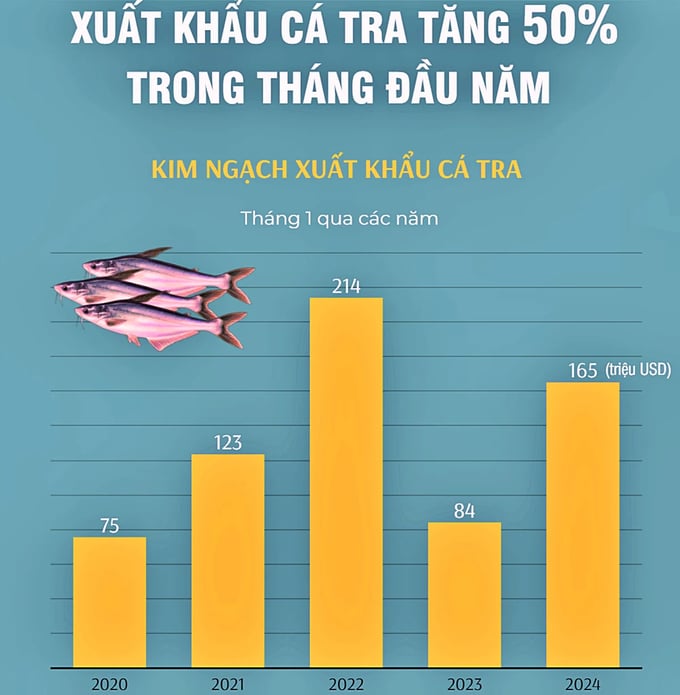

Pangasius exports in January, according to the most recent 5-year summary data.

In addition to the US and China, Mr. Truong Dinh Hoe, General Secretary of VASEP, recommends that businesses exploit various markets and consumer products. He cited that some smaller markets, such as Mexico, Canada, Brazil, and the United Kingdom, have good signals with Vietnam's pangasius.

Brazil is among the few markets that achieved positive growth in pangasius imports from Vietnam in 2023. In the fourth quarter of 2023 alone, the South American country imported nearly USD 42 million of Vietnamese pangasius, an increase of 78% compared to the same period in 2022.

According to the International Trade Centre (ITC), Vietnam is Brazil's number 1 supplier of white meat fish. This momentum will continue in 2024, especially with frozen pangasius fillets.

Along with Brazil, there is also the German market. According to VASEP, in 2023, Germany imported USD 38 million of Vietnamese pangasius, an increase of 31% compared to 2022. The main product exported to Germany is frozen fillets, with a value of nearly 37 million USD, a rise of 34% compared to 2022, accounting for 97% of the proportion.

After 2023 being affected by many factors across the EU, the German economy has shown signs of recovery in 2024.

Recently, Deputy Minister of Agriculture and Rural Development (MARD) Phung Duc Tien asked the Deputy Minister of Agriculture, Livestock and Food Supply (MAPA) Roberto Serroni Perosa, to allow the use of phosphate in pangasius meat, according to the regulations of the World Organization for Animal Health (WOAH).

Brazil checks phosphate additive norms, which are inconsistent with international practices, affecting two-way trade turnover.

Translated by Tuan Huy

(VAN) In the face of counterfeit and imitation products, Khanh Hoa Salanganes Nest Company hopes for the prompt completion of the legal framework, strict enforcement against violations, and protection of the bird’s nest brand.

(VAN) Japan's efforts to lower the price of rice through the release of its stockpile may finally be making some progress, albeit at a snail's pace.

(VAN) U.S. tariffs are not only a 'shock', but also an opportunity for Vietnamese businesses to renew their mindset toward comprehensive development.

(VAN) As Bac Giang lychee enters the harvest season, Minister Do Duc Duy expects that the fruit will contribute greatly to agricultural exports due to standardized production and deep processing.

(VAN) Consumers have shown a preference for free-range eggs, but those farming systems are more vulnerable to biosecurity risks like bird flu.

/2025/05/09/5701-1-184335_301.jpg)

(VAN) Vietnam’s eel exports nearly doubled thanks to a mud-free farming model, opening up new prospects while still facing numerous barriers related to international standards.

(VAN) Minister Do Duc Duy warned that if production is not professionalized and supply chains are not transparent, the U.S. market could become a growth bottleneck.