May 13, 2025 | 08:48 GMT +7

May 13, 2025 | 08:48 GMT +7

Hotline: 0913.378.918

May 13, 2025 | 08:48 GMT +7

Hotline: 0913.378.918

The European Union (EU) is the third-largest consumer market for agricultural, forestry, and fishery (AFF) products in the world. Annual food and beverage consumption reaches approximately EUR 1 trillion, accounting for 21.4% of total household spending (Eurostat, 2020). Each year, Europe imports around USD 300 billion worth of AFF products.

By product category, the EU is the largest importer of seafood, fruits and vegetables globally, accounting for approximately 34% of the world’s total seafood import value and about 45–50% of total fruit and vegetable imports.

It is also the largest coffee import market, making up over 60% of global coffee imports and more than 30% of global consumption. In terms of wood and wood products, the EU represents over 32% of global import value, ranking second only to the United States.

Additionally, Europe imports around 40% of the world’s total cashew kernel volume and is the second-largest consumer market for pepper, accounting for 8.6% of global consumption (ITC, 2021).

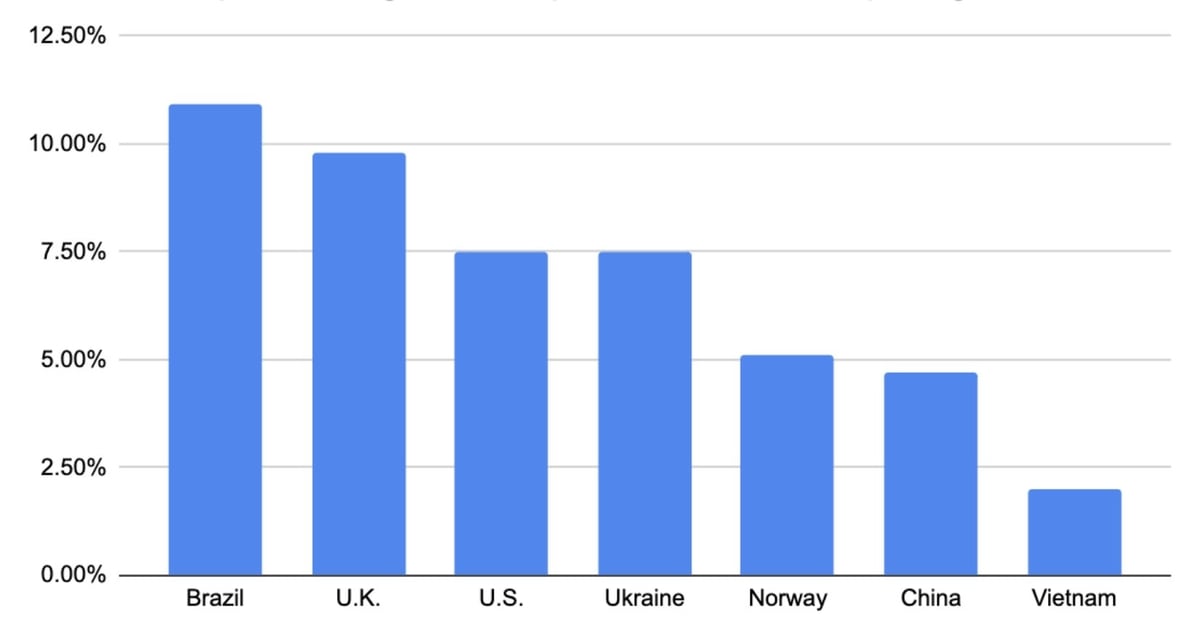

Chart of the market share structure of agricultural products imported from selected countries into the EU.

Vietnam ranks 12th among exporting partners to the EU and holds several advantages compared to other ASEAN countries. However, in terms of agricultural export market share, there remains significant untapped potential. Vietnam’s share is still modest, accounting for only about 2% of the EU’s total agricultural, forestry, and fishery product imports. In contrast, major exporters such as Brazil (10.9%), the UK (9.8%), the US (7.5%), Ukraine (7.5%), Norway (5.1%), and China (4.7%) hold considerably larger shares.

For Mr. Tran Van Cong, Agricultural Counselor of Vietnam delegation in the EU, Vietnam has yet to fully tap into the potential of this market. While geographic distance is one challenge, the more critical factor lies in the EU’s approach, which demands long-term investment and strict compliance with complex regulations and high technical standards.

Vietnam is the fourth Asian country to sign a Free Trade Agreement (FTA) with the European Union, following South Korea, Japan, and Singapore.

As soon as the EU-Vietnam Free Trade Agreement (EVFTA) took effect on August 1, 2020, the EU eliminated import tariffs on approximately 85.6% of tariff lines, equivalent to 70.3% of Vietnam’s export value to the EU. After seven years, tariff reductions will apply to 99.2% of tariff lines, covering 99.7% of export value.

Milled rice products, including fragrant rice, benefit from the EVFTA. Illustrative photo.

The remaining 0.3% of export value is subject to tariff-rate quotas with a 0% tariff, covering 14 specific products such as: poultry eggs and egg yolks, garlic, sweet corn, various types of rice (milled, husked, aromatic), cassava starch, tuna, surimi, sugar (including specialty sugars and high-sugar content products), mushrooms, ethanol, mannitol, sorbitol, dextrin, and modified starches.

The near-complete elimination of import duties for Vietnamese goods represents the highest level of commitment the EU has ever offered a partner in any FTA it has signed. This is particularly significant given that the EU consistently ranks among Vietnam’s top three export markets.

Accordingly, the EVFTA not only expands market access for Vietnam’s key agricultural, forestry, and fishery products but also helps diversify input sources for agricultural production from the EU. At the same time, it creates opportunities to attract high-quality investment into the agricultural sector, thereby improving both the quality and efficiency of production.

This is an economic strategy proactively adopted by many Vietnamese enterprises. It aims to gradually diversify product portfolios and contribute significantly to the country’s export turnover.

Although the EU market is known for its strict requirements, European consumers are open-minded and curious about new products, especially tropical agricultural goods. They tend to seek out and experience products they’ve encountered through travel or cuisine. As a result, Vietnamese tropical fruits and related products have made a strong impression and are gaining popularity.

The EU has a comprehensive, transparent, and regularly updated legal framework for food safety and animal and plant health. This system's primary goal is to protect the health of humans, animals, plants, and the environment holistically.

Western countries’ approach to food management is integrated and applied throughout the supply chain, following a “from farm to table” model. This includes products of plant and animal origin as well as animal feed.

Only countries and enterprises that have been approved by the EU and operate under appropriate national control programs are allowed market access.

The criteria include disease control, chemical residues, antibiotics, harmful microorganisms, heavy metals, and more, especially for seafood and livestock products.

Agricultural products and food imported into the EU may be required to meet higher standards regarding pesticide residue levels. Photo: Tung Dinh.

Vietnam’s processed coffee industry has undergone a clear transformation. Since the EVFTA took effect, many tariff lines on processed agricultural products, especially coffee, have been reduced to 0%. Previously, some products were subject to tariffs ranging from 7.5% to 11.5%, which posed significant barriers to exports. The removal of these tariffs has created a major competitive advantage for Vietnam over other coffee-exporting countries such as Brazil and Indonesia.

By effectively leveraging this opportunity, Vietnam has surpassed India to become the second-largest exporter of instant coffee to the EU, after the United Kingdom, accounting for 18% of the market share in this product category.

This is a favorable time for Vietnam to accelerate the export of processed coffee, shift its product structure toward higher value, and gradually penetrate the roasted and ground coffee segment in the European market.

In addition, several rice-based processed products, such as rice noodles, pho, rice paper rolls, and spring roll wrappers, have become increasingly common in European retail systems and supermarket chains, meeting consumer demand and catering to a growing interest in diverse cuisines.

For fruit and vegetable products, domestic enterprises are not only focusing on fresh fruit exports - a traditional strength- but are also intensifying deep processing efforts to enhance value.

Frozen, canned, dried, and concentrated products (such as fruit purées) from Vietnam are becoming more widely available in the EU market, meeting high standards for quality and food safety.

Enterprises need to increase investment in modern processing technology and techniques. Photo: Minh Phuc.

In reality, fully meeting the EU’s stringent standards remains a major challenge for Vietnam’s agricultural sector. A significant barrier to expanding market share in the EU is the lack of large-scale production zones capable of ensuring traceability and consistent quality control, key requirements for a market that emphasizes supply chain consistency and sustainability.

To improve the food supply chain, both the government and businesses need to collaborate in professionalizing production processes, aligning with the EU’s distinct approach and its specific criteria for food safety, sustainable development, and social responsibility. Diversifying product varieties will also help cater to various segments within the EU market.

Additionally, greater focus must be placed on building strong brands and organizing well-structured trade promotion activities. Current efforts often lack coordination, leading to fragmented, small-scale exports and unstable distribution channels. As a result, many Vietnamese products have yet to establish a solid market presence or achieve strong consumer recognition in the EU.

If the barriers are overcome, conquering the EU market will not only expand export scale but also elevate the value of Vietnamese agricultural products on the global market.

Translated by Phuong Linh

(VAN) Deputy Minister Phung Duc Tien hopes that China will facilitate the entry of Vietnamese agricultural products into its market and accelerate customs clearance at border gates.

(VAN) On May 10, the Animals Asia Foundation and the Hai Phong Crop Production and Forest Protection Department successfully rescued a nearly 20-year-old sun bear that was being kept by locals.

(VAN) Does Hungary have an opportunity to expand poultry production in the coming years despite the pressure from avian influenza and challenges of the trade war?

(VAN) Nine recommendations were put forward to address bottlenecks and promote science and technology in the livestock and aquaculture sectors, aiming to bring Resolution No. 57-NQ/TW into practical implementation.

(VAN) Scientific and technological activities in the fisheries sector have shown signs of improvement, but they are still not commensurate with their potential to become a true driving force for the industry's development.

(VAN) Director General of the Department of Livestock Production and Animal Health, Duong Tat Thang, outlined solutions to drive scientific and technological breakthroughs in the livestock and veterinary sectors in the near future.