June 17, 2025 | 09:28 GMT +7

June 17, 2025 | 09:28 GMT +7

Hotline: 0913.378.918

June 17, 2025 | 09:28 GMT +7

Hotline: 0913.378.918

Loc Troi Group Joint Stock Company (stock code: LTG) issued a letter to the State Securities Commission and the Hanoi Stock Exchange (HNX) to clarify the fluctuations in the audited financial statements compared to the company's separate financial statements for the year 2023.

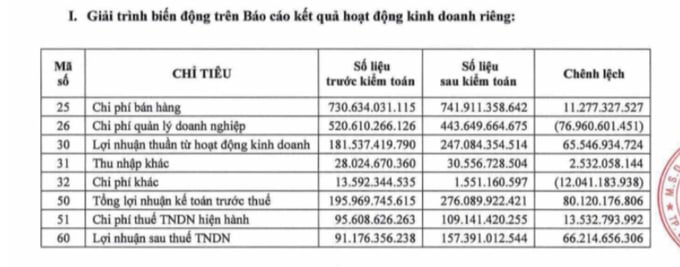

Accordingly, after the audit of its separate financial statements for the year 2023, Loc Troi increased selling expenses by 11.27 billion dong, and reduced management expenses by 76.96 billion dong.

Other expenses were also adjusted downwards by 12 billion dong. The adjustments resulted in Loc Troi's net profit from business operations in 2023 increasing by an additional 65.54 billion dong to 247.08 billion dong.

Loc Troi Group successfully completed a 100,000-ton rice export order for Bulog - Indonesia's logistics agency.

Accordingly, these adjustments primarily consist of reductions in the provision for doubtful debts from a number of Loc Troi's clients, which have been recovered after the fiscal year (73 billion), reductions in remuneration for the Management Board and the Supervisory Board (3.6 billion), and adjustments to accounting entries within the fiscal year.

The total pre-tax accounting profit for the year 2023 was also adjusted upwards by 80.12 billion dong to 276.09 billion dong. Additionally, the corporate income tax expense was also adjusted upwards by an additional 13.5 billion dong to 109.14 billion dong. However, Loc Troi's post-tax profit was also adjusted upwards by an additional 66 billion dong to 157.39 billion dong.

Clarification for the fluctuations in Loc Troi Group's separate financial statements for the year 2023.

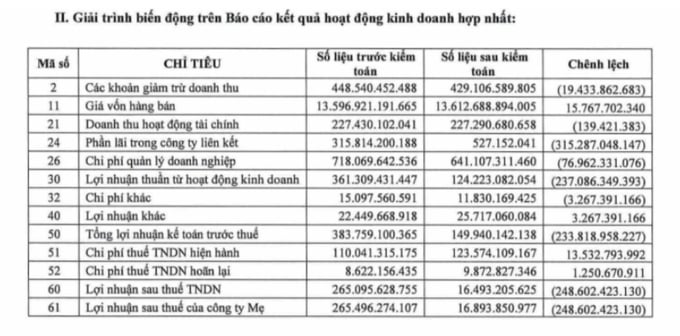

According to the consolidated financial statements for the year 2023, Loc Troi Group made a series of adjustments to key indicators.

Namely, the Company reduced deductions from revenue by 19.43 billion dong, and deductions from cost of goods sold by 15.76 billion dong. These adjustments were made due to the exclusion of trade discounts and cost of sales from intra-group transactions that were not accurately reflected in the separate financial statements.

Loc Troi reduced profits from associated companies by 315.28 billion dong due to the exclusion of gains from bargain purchases. Accordingly, the impact of reassessing the related companies' net asset fair value at the acquisition date was not accurately reflected in the separate financial statements. Additionally, the adjustment was influenced by a portion of the unexecuted gain exclusions from internal transactions.

The downward adjustment in the fair value of Loc Nhan at the acquisition date resulted from reassessing the recoverability of receivables and inventory.

After negotiating with clients and completing the inventory count process, Loc Troi decided to adjust the fair value of receivables and inventory in accordance with the standards.

The auditing firm requested Loc Troi to reduce management expenses by 76.96 billion dong, to 641 billion dong in the consolidated financial statements for 2023, in accordance with the adjustment of this indicator in the separate financial statements.

Clarification for the fluctuations in the consolidated financial statements for the year 2023.

With these adjustments, Loc Troi's consolidated pre-tax profit for the year 2023 unexpectedly decreased by 233.82 billion dong, down to 149.94 billion dong. Correspondingly, post-tax profit decreased to 16.49 billion dong, whereas the separate financial statements recorded a profit of 265 billion dong.

Consequently, 2023 marked a successful year for Loc Troi Group with record revenue of 16.088 trillion dong and pre-tax profit of nearly 150 billion dong.

Sicne 2022, Loc Troi Group has increased its ownership in a company, and restructured to rapidly expand market share, support business activities and product consumption, thereby working towards the target revenue of 1 billion USD in the near future.

The process of business restructuring incurred significant costs. Furthermore, the income from interest was not fully reflected in the consolidated results, resulting in a decline in profit in the consolidated financial statements.

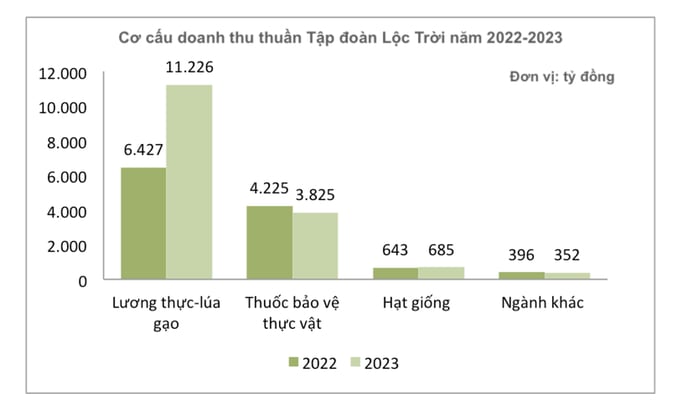

Despite the challenging global economy, Loc Troi Group maintained a strong growth momentum with a record high revenue in 2023 at 16.088 trillion dong, which is an increase of 38% compared to that of 2022. With over 11,000 billion dong, or 70% of the total revenue, the food industry was the largest contributor to this impressive growth.

Loc Troi Group has maintained a relatively stable operational efficiency with an EBITDA above 1,000 billion dong. Additionally, the Group has recorded a consistently high EBITDA growth rate within the last few years.

Although the company's revenue increased significantly in 2023, its EBITDA only saw a slight increase due to the restructuring of product composition with a strong focus on the food industry to serve as a foundation for other sectors in the agricultural service chain.

Loc Troi Group's revenue structure from 2022 to 2023.

Loc Troi Group's business prospects are favorable as the company receives a significant influx of large orders for various types of rice, slated for export within 2024.

Quang Chau Food Group and Loc Troi Group signed a framework cooperation agreement on April 3, whereby Loc Troi will be a rice supply partner with a scale of at least 100,000 tons.

Additionally, both parties will simultaneously expand and enhance collaboration in their respective key fields, such as market expansion, development of deep-processed products from agricultural produce, among others.

Moreover, Loc Troi is a preferred partner of various international financial institutions such as FMO, DEG, as well as sustainable development organizations in Europe such as SAP, SNV. These organizations are the Group's crucial companions on its sustainable development journey for farmers and agriculture.

Regarding business develop directions, Loc Troi Group is determined to achieve the target revenue of 1 billion USD by leveraging the core business operations and exceptional growth in the food industry, agricultural supplies, and EBITDA.

The Group maintains a high revenue growth rate over the years, demonstrating its commitment to realizing business goals for shareholders and partners.

The Group will focus on improving cash flow from business activities by shortening the receivables cycle, facilitating payment for rice purchases from farmers, and settling debts.

Regarding business develop directions, Loc Troi Group is determined to achieve the target revenue of 1 billion USD by leveraging the core business operations and exceptional growth in the food industry, agricultural supplies, and EBITDA.

In 2024, the Group will enhance sales in the agricultural supply industry, and the seed industry. Concurrently, it will balance its financial structure to ensure capital adequacy, improve capital utilization efficiency, and increase equity capital through stock issuance.

Regarding investment and development activities, Loc Troi is planning to mobilize long-term capital to construct a rice mill in Long An province with a daily capacity of 10,000 tons.

This project has obtained investment licenses, and the project site has been cleared. When the mill begins operation, the Group aims to increase its daily rice production capacity to 15,000 tons by 2028.

Translated by Nguyen Hai Long

(VAN) The political and cultural insulation of Japan’s beloved grain is falling apart, and experts warn the country’s relationship with the staple will have to adapt.

(VAN) Noting risks, report examines impacts of avian influenza, changing trade patterns since 2022, fish fraud, and shipping industry’s net-zero goals.

(VAN) Mr. Tran Quang Bao, General Director of the Forestry and Forest Protection Department, met and worked with the International Wood Products Association to promote cooperation in the field of timber trade.

(VAN) China's outbound shipments of rare earths in May jumped 23% on the month to their highest in a year, though Beijing's export curbs on some of the critical minerals halted some overseas sales.

(VAN) To sustain capital flow, administrative reform alone is not enough; what farmers truly need is an ecosystem where both government and businesses grow together in support.

(VAN) Vietnam and the United States are proactively working together, each in their own way, to ensure that every container of agricultural goods carries not just products, but also long-term trust and value.

(VAN) Stores have started selling rice from the government’s stockpile to feed demand for the staple.