May 28, 2025 | 18:01 GMT +7

May 28, 2025 | 18:01 GMT +7

Hotline: 0913.378.918

May 28, 2025 | 18:01 GMT +7

Hotline: 0913.378.918

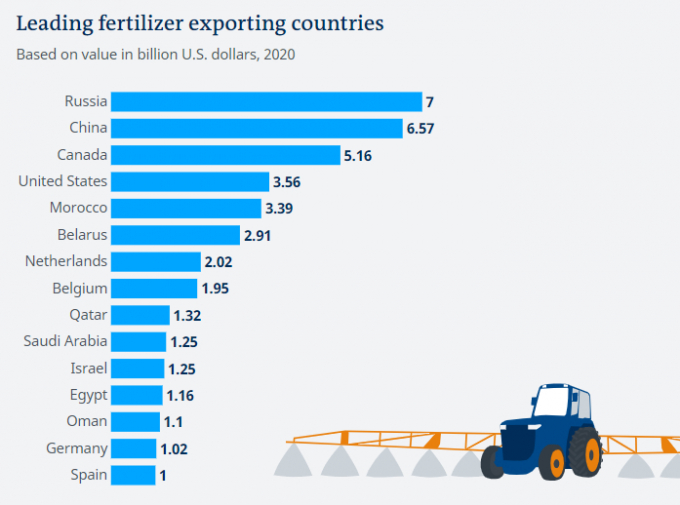

Source: US Comtrade

For several centuries, the Conzen family has farmed in the district of Heinsberg — the westernmost tip of Germany, near the Dutch border. With his son, Bernhard Conzen grows cereals, sugar, beets and corn to sell to cooperatives. But the family business is being stifled as fertilizer prices spike.

"The effects are fatal. Production costs have risen exponentially," Conzen, who also presides over the Rhineland Agricultural Association, told DW. "The cost recovery is questionable and we have high liquidity needs."

Strong demand and higher input costs had already driven up fertilizer prices in 2021, resulting in food security concerns and increasing inflation in agriculture commodity prices. Analysts projected the pressure would ease this year, but Russia's unprovoked invasion of Ukraine has swollen prices even more.

A top fertilizer producer, Russia accounts for 15% of global trade in nitrogenous fertilizers and 17% of global potash fertilizer exports, according to the Food Policy Research Institute. The country is also responsible for 20% of the global natural gas trade, a key component in manufacturing fertilizers.

Many countries in Europe and Central Asia rely on Russia for over 50% of their fertilizer supply. The German agricultural sector gets 30% of its supply from Russia, an amount that domestic producers, local organizations warn, cannot replace in the short or medium term.

"At the moment, prices for operating resources, such as fertilizers, diesel and feed, are rising to record highs," said Johann Meierhoefer, a spokesperson from the German Farmers' Association. "Even though producer prices have risen sharply at the same time, the high prices of these resources not only mean increased liquidity needs for farmers, but also increased risks, as farmers are always dependent on the weather."

As a consequence, farmers expect the high costs of operating will result in bottlenecks and reduced production.

Food prices on the rise

The increase in energy prices and the surcharge in logistics costs also represent higher expenses for consumers as food prices are expected to keep rising.

"A portion of this increase will also be passed on to the end consumer," Meierhoefer warned. "We should keep in mind that primary agricultural production has already been operating with very small profit margins, so there is not much of a buffer here."

Like Conzen, many German farmers have already secured enough fertilizers until the end of the current vegetation period. But the reliance on supplies from third countries raises concerns for future harvests.

The global reference price of fertilizers is expected to soar 13% by 2023, according to the United Nations' Food and Agriculture Organization, threatening to increase production costs, while reducing yields and outputs for the 2022-2023 crop seasons.

With operating costs set to continue rising, Meierhoefer said German authorities can help farmers by lifting the tax burden on diesel and pushing EU policymakers to temporarily halt tariff barriers on fertilizer imports.

"[Guaranteeing] a long-term supply of fertilizers is also important. Otherwise, we will have to expect considerable declines in yields over the next few years," he added.

Prayers from the tropics

The invasion of Ukraine and the economic sanctions on Russia have also raised concerns in the Brazilian agricultural sector, which imports 85% of the raw materials it needs to produce fertilizers and relies on Russia and Belarus for part of this supply.

An agricultural powerhouse, Brazil's agribusiness exports in 2021 amounted to $120.6 billion (€109.2 billion), a 20% increase over the previous year. But operating costs and the need to find alternative suppliers to secure the next crops pose a new challenge.

"Soybean, corn and sugarcane alone represent 73% of the fertilizer consumption in Brazil," the director of the Brazilian Agribusiness Association (ABAG), Eduardo Daher, explained.

With enough fertilizer stocks to cover the next four months, Brazil's agricultural minister Tereza Dias has turned to Canada and the Middle East to look for new suppliers. Last week, Dias also led a proposal backed by the Mercosur bloc and submitted to FAO requesting the exclusion of fertilizers from sanctions on Russia amid food security concerns.

"Agribusiness all over the world has a huge problem. Everybody is trying to look for different fertilizer suppliers," Daher said. "In the sector, we're praying for the war to end soon and for a good summer season with the right amount of rain, because inflation will be a key problem.”

(DW)

(VAN) Vikas Rambal has quietly built a $5 billion business empire in manufacturing, property and solar, and catapulted onto the Rich List.

(VAN) Available cropland now at less than five percent, according to latest geospatial assessment from FAO and UNOSAT.

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.

(VAN) Fourth most important food crop in peril as Latin America and Caribbean suffer from slow-onset climate disaster.

(VAN) Shifting market dynamics and the noise around new legislation has propelled Trouw Nutrition’s research around early life nutrition in poultry. Today, it continues to be a key area of research.

(VAN) India is concerned about its food security and the livelihoods of its farmers if more US food imports are allowed.