May 21, 2025 | 04:51 GMT +7

May 21, 2025 | 04:51 GMT +7

Hotline: 0913.378.918

May 21, 2025 | 04:51 GMT +7

Hotline: 0913.378.918

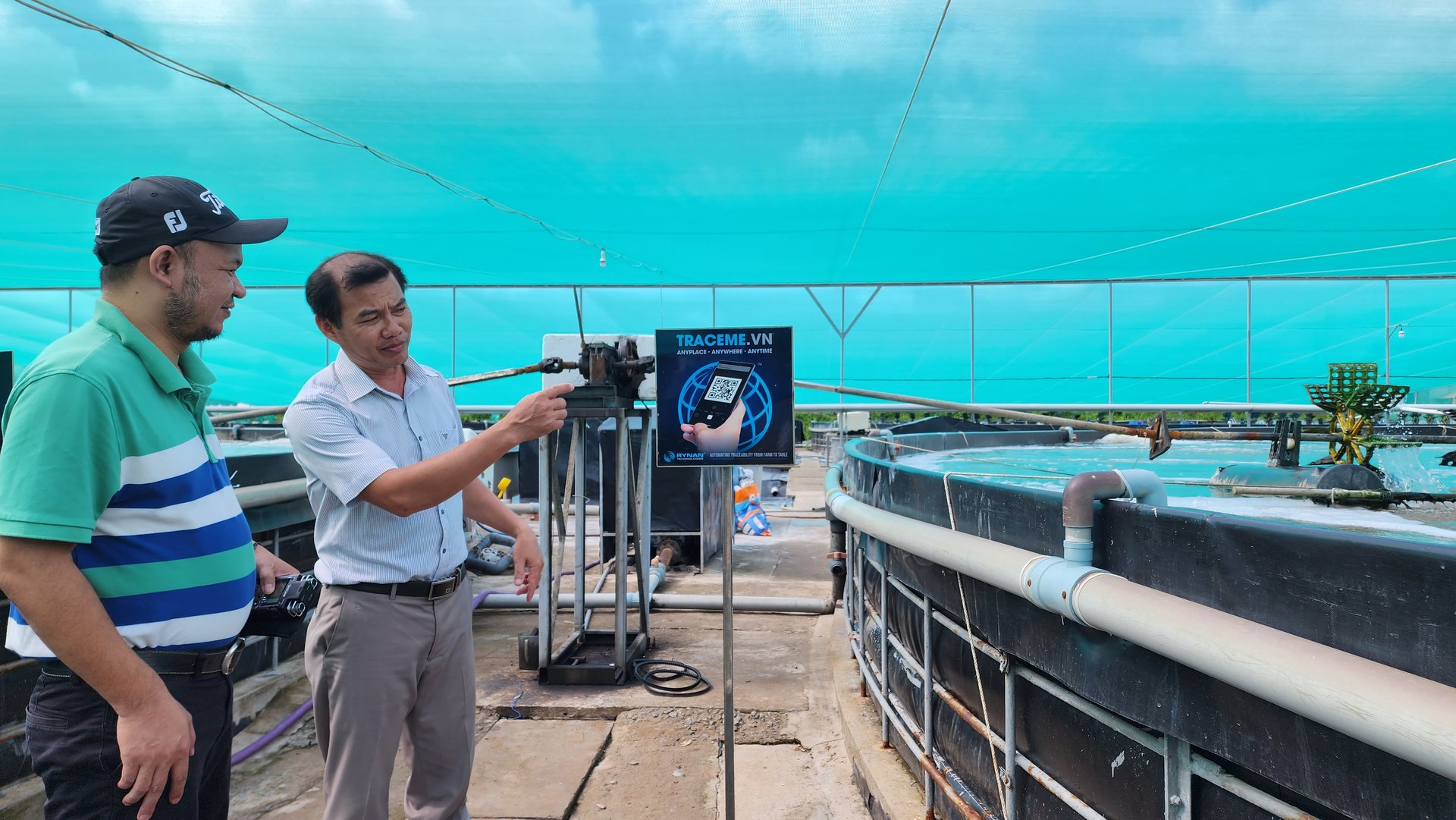

The VND 15,000 billion credit package for the forestry and fisheries sector has been deployed slowly, only reaching more than 30%, equivalent to about VND 5 trillion. Photo: Kim Anh.

With a credit package of VND 15,000 billion for the forestry and fisheries sector, Mr. Ngo Minh Hien, General Director of Nam Can Seafood Import-Export Joint Stock Company (Ca Mau), assessed that it is currently being implemented slowly, only reaching more than 30%, equivalent to about VND 5 thousand billion.

In addition, Mr. Hien said that banks' lack of flexibility and failure to grant credit limits promptly also make it difficult for businesses to purchase raw shrimp. This reason is one of the factors leading to the phenomenon of farmers being pressured by traders while companies must buy shrimp at high prices.

"Banks need to flexibly grant limits depending on the time, to avoid when businesses need them, they cannot borrow, and when they want to lend, businesses do not need them anymore," Mr. Hien emphasized.

Loc Troi Group has built a closed supply chain with the rice industry from input material areas to product output, with a production capacity of about 2 million tonnes of rice/year. They are operating continuously, forcing capital investment costs for production to be very high.

In 2023 alone, this enterprise's investment need is about VND 8 trillion. By 2024, this enterprise plans to purchase about 4 million tonnes of rice in the Mekong Delta, with total capital needs also reaching about VND 32 trillion.

Photo 2 According to Mr. Le Thanh Hao Nhien, Finance Director of Loc Troi Group, the business's capital source only meets about 10% of the total investment needs for the entire rice market in the Mekong Delta. Photo: Kim Anh.

However, according to the assessment of Mr. Le Thanh Hao Nhien, Chief Financial Officer of Loc Troi Group, the enterprise's current capital source only meets about 10% of the total investment needs for the entire rice market in the Mekong Delta, a relatively modest number.

Wishing to "inject capital" from credit institutions, Mr. Nhien asked the State Bank to have a short-term support policy to extend the loan term. Because according to the current 6-month limit, it is not enough for capital flow to return.

In the long term, representatives of Loc Troi Group asked the State Bank to increase the loan limit so that businesses have enough investment capital for farmers to participate in production links with businesses. At the same time, there is a mechanism for farmers to borrow money when participating in partnerships with companies. Facing the difficulties of industries, Mr. Dao Minh Tu, Permanent Deputy Governor of the State Bank of Vietnam, affirmed that the policy mechanism for the rice and fisheries sectors in the Mekong Delta is not a big problem. There currently is plenty of bank capital. The State Bank will not let businesses lack money. Create conditions for companies to maximize benefits from favorable rice export conditions and solve difficulties for the seafood sector due to inventory and lack of orders.

Deputy Governor of the State Bank of Vietnam Dao Minh Tu requested that banks be severe and flexible in lending activities linked to production seasons, creating favorable business conditions. Photo: Kim Anh.

"It must be said frankly that the bank has excess money in terms of capital. But treating a lack of money is also difficult; curing excess money is more difficult. In other words, businesses have an inventory of goods, and banks have an inventory of money. This problem is a reality that affects the economy and businesses. How to promote this credit and increase credit further is what the State Bank is concerned about," Mr. Tu affirmed.

According to Mr. Tu, businesses have an inventory of goods, and banks have a money stock. Meanwhile, companies need to borrow capital, but banks cannot lend. This problem affects the enterprise's production and business, investment and development resources, and growth goals for the year.

Therefore, Mr. Tu requested that the State Bank of Localities direct commercial banks to take credit activities seriously, flexibly, linked to the season, and create favorable customer conditions.

The State Bank of Vietnam has granted vast powers to credit institutions. Regulations on the mortgage of assets are optional, depending on assessing the bank's credibility with the business. Businesses that want to borrow must pay back, have no bad debt, and even be "faithful" to a bank.

Banks participating in the VND 15,000 billion credit package for the forestry and fisheries sector must proactively lend and comply with their commitment to lower interest rates. At the same time, continue to lower interest rates on new loans and consider reducing interest rates on old loans for customers.

On the business side, Mr. Tu said that this difficulty is a condition for businesses to restructure production, business, and the market. Bank capital is just support; companies must increase resources in the current context.

Translated by: Ha Phuc

(VAN) Dong Thap farmers attained an average profit margin of 64% during the summer-autumn 2024 crop (first season), while An Giang and Kien Giang farmers followed with 56% and 54%, respectively.

(VAN) As a doctoral student doing research on renewable energy and electrification at Harvard University, the author shares his musings on electricity, nature, and countryside memories.

(VAN) The decree on Extended Producer Responsibility (EPR) ensures transparent management and disbursement of support funds, avoiding the creation of a “give-and-take” mechanism.

(VAN) Hue City rigorously enforces regulations regarding marine fishing and resource exploitation, with a particular emphasis on the monitoring of fishing vessels to prevent illegal, unreported, and unregulated (IUU) fishing.

(VAN) Hanoi People's Committee has issued a plan on reducing greenhouse gas emissions in the waste management sector with 2030 vision.

(VAN) Vietnam's draft amendment to Decree No. 156 proposes a mechanism for medicinal herb farming under forest canopies, linking economic development to population retention and the sustainable protection and development of forests.

(VAN) In reality, many craft village models combined with tourism in Son La have proven effective, bringing significant economic benefits to rural communities.