May 20, 2025 | 22:44 GMT +7

May 20, 2025 | 22:44 GMT +7

Hotline: 0913.378.918

May 20, 2025 | 22:44 GMT +7

Hotline: 0913.378.918

As a result of the competitive pressure from Ecuador, India, and Indonesia, Vietnam's export of fisheries products in general and shrimp in particular to China was unable to make a breakthrough in the first 6 months of 2023. Photo: HT.

Although China has reopened since early 2023, the country's economy is still unstable after taking a long time to control the Covid-19 pandemic. Domestic production has yet to recover, fisheries consumption experiences a sharp drop, and inventories remain high. One thing to note is that China has other issues to worry about than the fisheries industry during this period.

"China traditionally favors fresh fisheries products, but now businesses exporting to this market are limited by regulations concerning official export. These are the restrictions for businesses wishing to expand their market share in the Chinese market,” said Truong Dinh Hoe, General Secretary of the Vietnam Association of Seafood Exporters and Producers (VASEP).

According to Tran Van Linh, Chairman of the Board of Directors of Thuan Phuoc Seafoods and Trading Corporation (Da Nang), the business has not yet exported products to the Chinese market because of many obstacles. Firstly, the payment does not go through the letter of credit. Secondly, in terms of language, China still mainly uses Chinese as the language for negotiation. Thirdly, Chinese partners conduct trades using the Chinese yuan instead of USD, but the currency value is constantly unstable.

“The Chinese people are masters of food processing, so they prefer raw materials. Laborers do not have high incomes at the moment, so the demand for processed fisheries products is thus not high. As for the raw materials, especially shrimp, it is very difficult for Vietnam to compete with other countries such as India or Indonesia. Particularly in the case of Ecuador, the price of this country's shrimp is 2 - 3 USD/kg cheaper than Vietnam's, equivalent to 20-30%, so it is very difficult to compete. But Vietnam still has pangasius with ample opportunities for export,” Tran Van Linh said.

Le Duy Hiep, Chairman of the Vietnam Logistics Business Association (VLA) mentioned some difficulties in terms of logistics services when exporting Vietnamese fisheries products to China. “Regarding logistics services, we have almost mastered the production, storage, and transportation to loading ports, but the international shipping part still depends on foreign container shipping lines. Having enough specialized cold containers plus competitive freight rates is an important factor in promoting fisheries exports to China. That is how we will be able to compete with other strong exporters”.

The VLA chairman believed that In order to promote Vietnam's fisheries exports to China, a number of issues in logistics should be put into consideration: The Government, the Ministry of Industry and Trade, and the Ministry of Agriculture and Rural Development need to quickly realize agreements with the Chinese side related to regulations, technical barriers, then make frequent updates so that businesses can be more proactive in marketing and sales activities.

It is necessary to improve the quality of services from production, processing, and preservation through the development of cold supply chains. Photo: TQ.

China is increasingly improving the quality of goods imported into the country, so logistics also need to improve the quality of services from production, processing, and preservation through the development of cold chain logistics.

China, a potential market, also holds certain challenges for seafood enterprises. Putting aside the regulations on product quality and barriers from China's management policies, businesses need to understand the needs and trends of Chinese consumers so that Vietnam’s fisheries exports can grow strong.

At present, most of China's fisheries products are traceable, each item has a QR code on the package, allowing consumers to easily find all they need to know about the product, including chain certificates, certificates of origin, production specifications, processing methods, etc. Producers can also trace back consumer data and use it intelligently to optimize production and business activities, thereby strengthening the connection between parties.

China's seafood e-commerce sales continue to grow. Photo: TQ.

Another thing to add is that big seafood restaurant chains in China are also on the rise. Fast food chains, food delivery, hot pot models, and collective meals rapidly developing will be potential segments for Vietnamese businesses to increase market share in the Chinese market. “Intelligent, digital and innovative services have become central to the future development of the service industry in this country,” said VASEP General Secretary Truong Dinh Hoe.

Translated by Samuel Pham

(VAN) Japan's grant aid project contributes to capacity building, promoting organic agricultural production, and fostering sustainable community development in Dong Thap province.

(VAN) For years, the CRISPR-Cas9 genome technology has been reshaping genetic engineering, a precision tool to transform everything from agriculture to medicine.

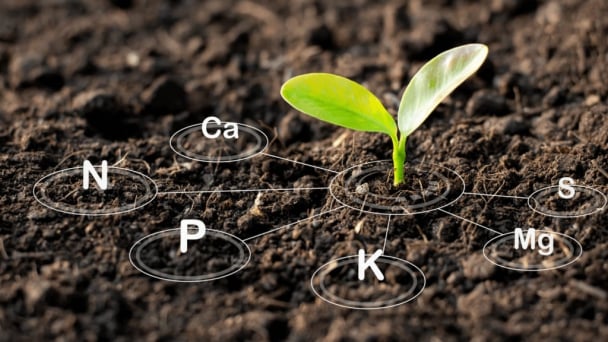

(VAN) Vietnam aims to become a 'leader' in the region in the capacity and managing effectively soil health and crop nutrition.

![Reducing emissions from rice fields: [Part 1] Farming clean rice together](https://t.ex-cdn.com/nongnghiepmoitruong.vn/608w/files/news/2025/05/05/z6509661417740_a647202949c539012a959e841c03e1d3-nongnghiep-143611.jpg)

(VAN) Growing clean rice helps reduce environmental pollution while increasing income, allowing farmers to feel secure in production and remain committed to their fields for the long term.

/2025/05/19/5136-1-144800_230.jpg)

(VAN) The Nghe An Provincial People's Committee has just approved the list of beneficiaries eligible for revenue from the Emission Reductions Payment Agreement (ERPA) in the North Central region for the year 2025.

(VAN) 14 out of 35 domesticated elephants in Dak Lak province have had their living conditions improved, with 11 of them currently participating in the non-riding elephant tourism model.

(VAN) Muong Nhe Nature Reserve hopes that being upgraded to a national park will lay the foundation for forest protection efforts to be carried out in a systematic, modern, and sustainable manner.