May 24, 2025 | 16:27 GMT +7

May 24, 2025 | 16:27 GMT +7

Hotline: 0913.378.918

May 24, 2025 | 16:27 GMT +7

Hotline: 0913.378.918

Vietnam's sugar industry is still facing the problem of autonomy in raw material areas and a shortage of sugarcane supply to meet the growing domestic demand for sugar, especially in the field of food and beverage processing. According to the report "Assessment of Industrial Sugar Demand in Vietnam from a Survey of Food Processing Factories" (*), the picture of the current supply situation and demand for industrial sugar consumption of food and beverage processing enterprises will be clarified.

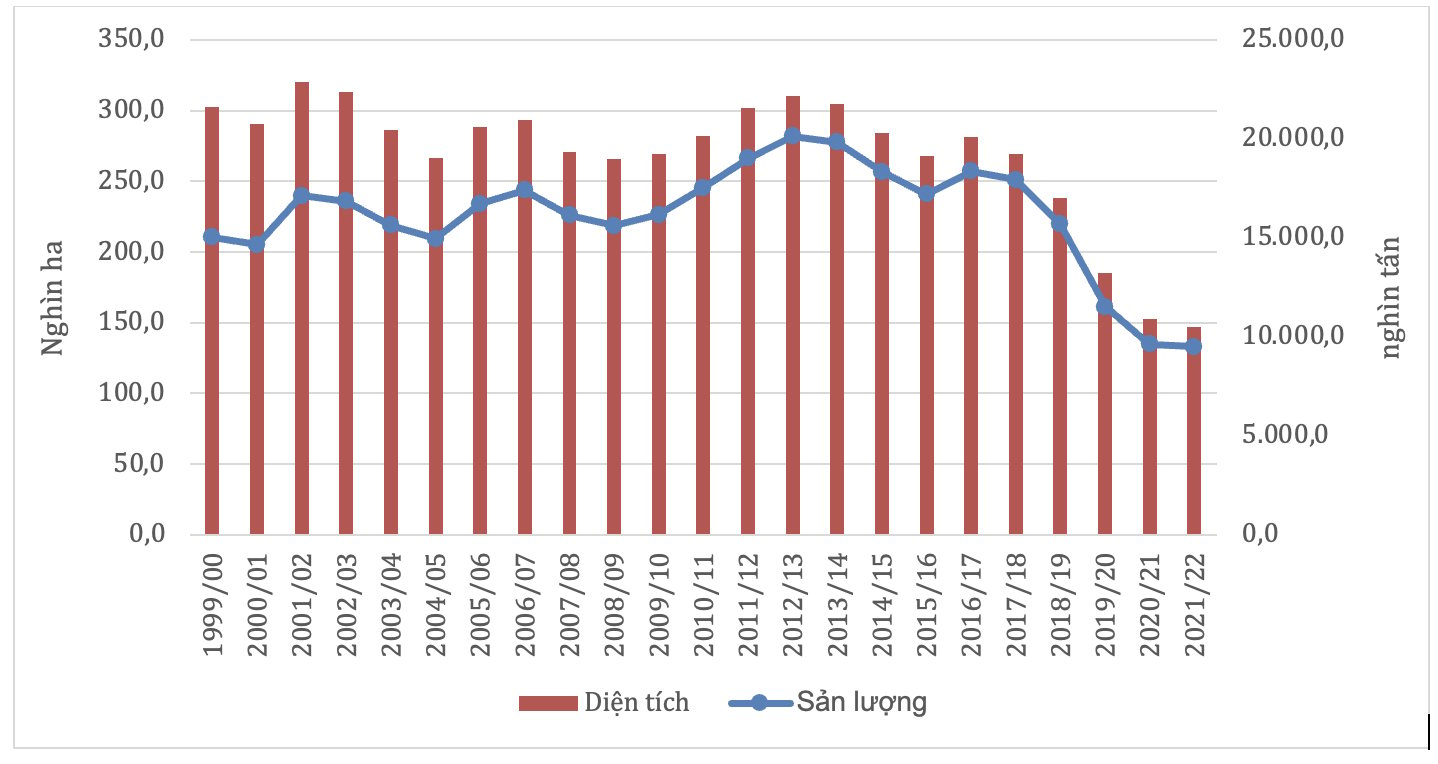

According to data from the Ministry of Agriculture and Rural Development, the total area of sugarcane cultivation in the 2021/22 crop is 146,938 ha, down 3.9% compared to the 2020/21 crop of 152,891 ha. The average sugarcane yield in the 2021/22 crop reaches 64.6 tons/ha, an increase of 2.5% compared to the 2020/21 crop of 63.0 tons/ha. Sugarcane output in the 2021/22 crop reached 9,496,358 tons, down 1.4% compared to 9,635,607 tons in the 2020/21 crop.

Compared to the 1999/2000 season, the sugarcane planting area in the 2021/2022 season has decreased by half compared to the 1999/2000 season, from 302 thousand ha to 146 thousand ha. The reason is due to the strong trend of crop conversion in recent years, people have switched to growing other crops with higher economic efficiency such as corn, cassava, hybrid acacia, and rice... In addition, because many sugar mills in the regions have reduced production, or dissolved, the merged consumption of sugarcane for people is not sustainable. People are forced to switch to other crops.

According to data from the Vietnam Sugarcane & Sugar Association (VSSA), it is estimated that the whole country will be in the 2022-2023 crop year (from December 2022 to May 2023) [1], total sugarcane output put into pressing will reach 9,372.3 thousand tons, sugar production in 2023 is expected to reach 915.8 thousand tons.

Domestic sugar supply also comes from imports. According to data from the General Department of Customs, in 2022 the amount of officially imported sugar will be 1.23 million tons, with a value of $ 1.08 billion, a decrease of 5.4% in output and an increase of 2.5% in value compared to the previous year. According to VASS's report, in addition to the amount of sugar imported officially within and outside the quota, there is also a large amount of smuggled sugar from Cambodia and Laos in 2022 of 816.53 thousand tons, an increase of 37.64% compared to 2021.

Changes in sugarcane area and output in 2000-2022. Source: General Statistics Office 2000-2021, MARD, 2022.

To study industrial sugar demand, the research team conducted a survey of 40 large sugar-consuming enterprises. These enterprises are leading enterprises in different fields, with a large concentration in the food, beverage, and milk and ice cream processing groups. The scale of these enterprises is large, with the number of enterprises with revenue of VND 500 billion or more accounting for 86.5%, and the number of enterprises with revenue over VND 1,000 billion is 51.4%.

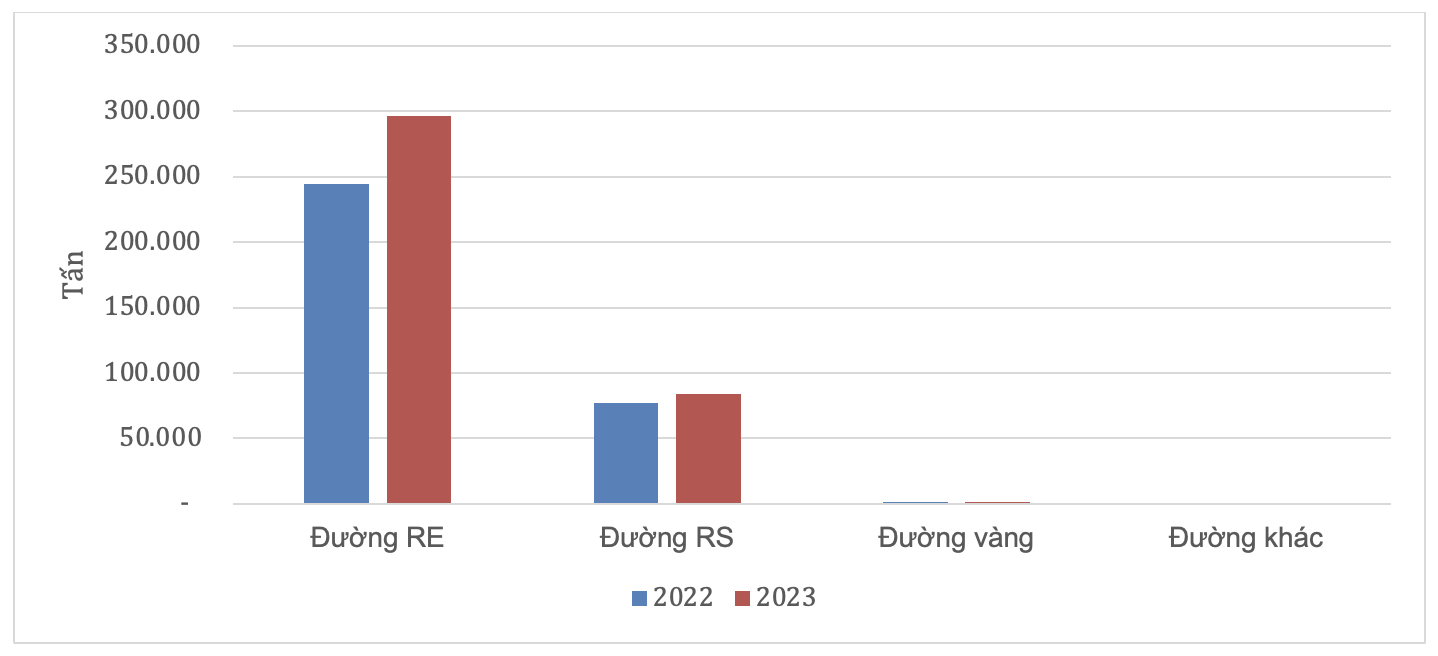

These businesses consume huge amounts of sugar. Survey data showed that 40 enterprises consumed 323.54 thousand tons, of which 75.6% (equivalent to 244.71 thousand tons) are RE sugars, 23.9% are RS sugars and other sugars account for only 0.5% [2]. The total amount of sugar used by these enterprises accounts for about 21% of industrial sugar.

In recent years, the demand for sugar from these businesses has increased even though the domestic supply level has decreased. The research team's survey data shows that in 2023, the sugar demand of these enterprises will increase to about 60 thousand tons compared to 2022 and reach about 382.66 thousand tons, of which RE sugar accounted for 77.5% (equivalent to 296.68 thousand tons). If classified by industry group, for RE sugar, the beverage industry consumes the largest amount of sugar, accounting for 70% (171.2 thousand tons), for RS sugar, the food industry accounted for the largest proportion, accounting for 65% (59.2 thousand tons).

Sugar consumption demand of surveyed businesses. Source: Enterprise Survey 2023.

The sugar supplies of the surveyed businesses mainly come from domestic sugar factories, imported sugar and third-party domestic companies. For RE sugar, 76.5% of surveyed businesses buy from domestic factories, only 2.03% import sugar, and the rest are provided by third parties. For RS sugar, 34.75% of businesses said they bought it from foreign sugar factories, the rest from imported sources.

With the strong development of the processing and beverage industry market, businesses said that the demand for industrial sugar consumption of businesses is forecast to increase in the coming years. The research team's survey data shows that, in the next 5 years, 98% of businesses expect to increase consumer demand. The volume that businesses need is an additional 128.14 thousand tons in the next 5 years, an increase of 40% compared to consumer demand in 2022 and an increase of 33.4% compared to 2023. The reason for the increase in demand is that 60% of respondents plan to expand their scale, 20% develop new products, and 10% will build more factories.

According to survey data of food processing factories, by 2028 it is expected that these 40 enterprises will have a consumption demand of 510.8 thousand tons (an increase of over 50% compared to the census year 2022), of which RE sugar accounted for 81.1% (414.26 thousand tons), RS sugar accounts for 18.6% (96.54 thousand tons). Assessing the ability of enterprises to supply sugar in the country, 65% of surveyed enterprises said that domestically produced sugar was not enough for their needs, and 40% assessed that the amount of imported sugar was not enough to meet their demand. Businesses also said that they faced some difficulties when buying sugar for food processing, the main difficulties are fluctuating sugar prices, having to rely on imported supplies, and unstable sugar quality.

The report uses two main data sources:

(i) Secondary data: includes data on area, sugarcane output, sugar output of factories, export and import status, consumer demand of people...) collected from reports of domestic units such as: the Ministry of Agriculture and Rural Development, General Statistics Office, General Department of Customs, Vietnam Sugarcane Association (VSSA), Ministry of Industry and Trade...

(ii) Primary data: including data on the current status and demand for industrial sugar from a survey of 45 food and beverage processing factories

(iii) Expert consultation: Interview sugar industry experts to assess the difficulties, prospects, and solutions of the sugar industry in the coming period.

REFERENCES

IPSARD, 2015, Value chain analysis and international competitiveness of some agricultural products of Vietnam

Sugarcane & Sugar Association, 2022, Sugarcane Production Report 2022

Sugarcane & Sugar Association, 2023, Sugar production report for the period of May 2023, August 2023

Tay Ninh Provincial National Assembly Delegation, 2023, Voters' recommendations on some sugar supply and demand issues for the Ministry of Industry and Trade.

[1] Vietnam Sugarcane & Sugar Association, Sugarcane production report May 2023[2] Research team survey in 2023.

Translated by Hoang Duy

/2025/05/22/5250-1-184853_288.jpg)

(VAN) According to a representative from the Central Retail Vietnam, Vietnamese products such as seafood, sweet potatoes, dragon fruit, coffee, and spices hold great potential in the Thai market.

(VAN) A multi-channel, multi-directional strategy only works when the agricultural value chain meets global transparency and SPS standards.

(VAN) Market expansion is a matter of survival for Vietnamese businesses amid fierce competition and global supply chain fluctuations.

(VAN) Global market prospects for U.S. long-grain rice for the upcoming marketing year.

(VAN) China’s General Administration of Customs started permitting fresh durian shipments from Cambodia after a phytosanitary protocol was signed with the Cambodian Ministry of Agriculture in late April.

(VAN) To operate carbon market, one of the key issues is determining which types of 'commodities' meet the standards to be traded on the market.

(VAN) Durian-producing localities need to coordinate more effectively with central authorities to improve the traceability, monitoring, and response systems in case of violations.