May 24, 2025 | 12:04 GMT +7

May 24, 2025 | 12:04 GMT +7

Hotline: 0913.378.918

May 24, 2025 | 12:04 GMT +7

Hotline: 0913.378.918

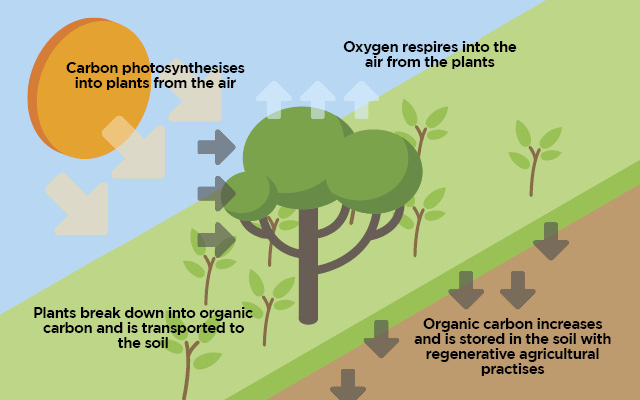

The art of carbon farming for regenerative agriculture. Photo: Getty

Like their baseball counterparts, farmers are neophytes in this new arena. The good news is that carbon markets can be a hit in terms of a new “crop” for farmers.

In carbon markets, firms help match businesses aiming to be carbon neutral with farmers. Farmers receive payments to raise crops or livestock in ways that sequester greenhouse gases that fuel climate change: carbon dioxide, nitrous oxide, and methane.

Examples include:

+Conservation tillage

+Cover crops

+Nitrification inhibitors

PROGRAM OFFERINGS

One example is Bayer’s program, in which it pays farmers up to $9 per acre based on practices the grower has implemented or plans to implement.

“Growers can select which fields they want to participate in the program and what practices they want to implement on those fields,” says Lisa Streck, Bayer carbon business model grower program lead.

Corteva Agriscience’s program offers payments that range between $6 and $30 per acre, depending on how much carbon is sequestered. Corteva recently entered into an agreement to verify and measure carbon credits through Indigo Ag.

Based on market projections, farmers could earn as much as $30 or more per carbon credit (one credit equals 1 metric ton of carbon) with a guaranteed minimum payment of $15 per registry-issued credit under this program. On average, farmers are estimated to generate 0.2 to 1 credit per acre ($6 to $30 per acre) in their first year and increase credit production over time, says Ben Gordon, Corteva carbon and ecosystem services global portfolio leader.

“Carbon payments help lessen the risk of a farmer’s investment into soil health and offset costs of practices that support carbon sequestration,” says Gordon.

The program focuses on carbon outcomes, says Chris Harbourt, global head of carbon for Indigo Ag.

“That’s important because there is so much variability [with carbon],” he says.

“Every farm is different, Harbourt says. “We encourage farmers to think about this in a long-term way: It is a multiyear process to learn about carbon markets and see the agronomic benefit. You first have to learn how to do it. So, it is important for farmers to start making decisions now with some of these practices before they enter a program.”

Other payoffs exist.

“There is a span of benefits that can be generated from strong agronomic and conservation practices,” says Liz Hunt, Syngenta head of sustainable and responsible business. “Markets also exist that quantify water quality or quantify benefits, along with biodiversity that can come from these practices.”

DIGITIZE DATA

Carbon markets are currently generating excitement in agriculture, says Hunt. (Syngenta doesn’t currently have a carbon program, but the company works with farmers to prepare for these programs.) First, though, farmers need to get their record-keeping house in order.

“All this comes down to agronomics and having the necessary production records,” she says. “Carbon markets are the cherry on top of sound conservation agronomics that come from data-managed solutions.”

Digital agriculture tools will play an enabling role in carbon markets, says Tom Eickhoff, chief science officer at The Climate Corporation, Bayer’s digital agriculture division.

“They can provide validation of carbon best management practices that will provide the most value to the farmer,” he says.

Although carbon market offerings differ in protocols, they require the same foundational data, Hunt says.

“They’re all going to have monitoring, reporting, and verification platforms,” she says. “Verification for carbon sequestration or reducing emissions will require something more than handwritten records.”

Farmers who digitize their farm’s agronomics records will be well-prepared to enroll in the carbon program that they choose, Hunt says.

“Grounding your farm in data will set yourself up for success in the long term,” she says.

QUESTIONS TO ASK

Farmers exploring carbon markets should first ask several questions, says Liz Hunt, head of sustainable and responsible business for Syngenta.

Will I be paid for previous practices?

“Many farmers have done practices like no-till and cover crops for a long time,” Hunt says. “How will these fit into different carbon programs?” Some pay for practices that a farmer adopted before the market’s start, while others don’t, she says.

How many years does the contract cover?

This not only can impact record keeping, but also the carbon verification process. Some require farmers to provide agronomic data before contract entry to support a model, she says.

How will carbon savings be measured?

“Understanding the number of soil samples required across a field and how they apply to the models that quantify carbon sequestration or emissions reductions is important,” Hunt says. “These programs are a combination of measurement and models."

How does the program cover unforeseen circumstances?

Sometimes, farming doesn’t go according to plan. A no-till field may need remedial tillage to alleviate compaction, for example. This may allow sequestered carbon for which a farmer has been paid to escape. Some markets offer “buffer pools” to allow for unexpected practice changes under which a farmer is not penalized, Hunt says.

Many carbon market programs are rooted in the forestry industry, which can sequester carbon undisturbed for decades. That’s harder to do in annual agricultural systems.

“Accounting for unforeseen circumstances is important for these marketplaces to succeed,” Hunt says. “With annual row crops, it’s something new every year that needs to be addressed.”

(SF)

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.

(VAN) Fourth most important food crop in peril as Latin America and Caribbean suffer from slow-onset climate disaster.

(VAN) Shifting market dynamics and the noise around new legislation has propelled Trouw Nutrition’s research around early life nutrition in poultry. Today, it continues to be a key area of research.

(VAN) India is concerned about its food security and the livelihoods of its farmers if more US food imports are allowed.

(VAN) FAO's Director-General emphasises the need to work together to transform agrifood systems.

(VAN) Europe is facing its worst outbreak of foot-and-mouth since the start of the century.