March 6, 2025 | 17:12 GMT +7

March 6, 2025 | 17:12 GMT +7

Hotline: 0913.378.918

March 6, 2025 | 17:12 GMT +7

Hotline: 0913.378.918

A planter is planting cotton in Northwest China's Xinjiang Uygur Autonomous Region in April. Photo: cnsphoto

The quantity of Australian cotton that passed Chinese customs clearance remained low, while price quotation and purchasing remained sluggish for the commodity as Chinese businesses had become cautious about importing Australian cotton amid the two countries' fraught relations.

Experts said that Australian cotton is losing its once favored market status in China as demands soared for domestically produced cotton, particularly produced in Northwest China's Xinjiang Uygur Autonomous Region, which is of good quality.

In 2019 and 2020, the quantity of Australian cotton that passed customs clearance at major Chinese ports were low, and certain traders only had one to three containers of cotton to be sold, a report of Chinese cotton news portal cncotton.com said, citing port traders. The report said that most Chinese traders and middlemen were cautious about purchasing Australian cotton at present.

A manager surnamed Chen, of a cotton trading agency based in Qingdao, East China's Shandong Province, said that cotton imported from Australia has encountered problems with customs clearance in recent months and was at increased risk of being denied entry into China.

"Many [of our] clients are worried and don't want to order Australian cotton any more, their motivation in enquiring for the price of Australian cotton has been very low," he told the Global Times.

Data calculated by the China Cotton Association showed that the China's cotton import from Australia has been edging down since 2019, but the drop has intensified since 2020. Last year, China imported 40,170 tons of cotton from Australia in 2020, down 68 percent from 2019.

The association's statistics showed that cotton imports from Australia have continued to slump this year. In the first four months this year, China imported 12,706 tons of cotton from Australia, down 68.4 percent on a yearly basis.

China was the top destination for Australian cotton from September 2020 to March 2021, accounting at 36.5 percent of its total cotton exports. During the same period, the US accounted for 47 percent of China's total cotton imports, followed by 28.8 percent from Brazil and 13.1 percent from India. Australia only ranked the fourth at 2.7 percent.

The drop in China's imports of Australian cotton came amid increasingly fraying relations between the two nations. In 2020, China's imports from Australia decreased 4.6 percent on a yearly basis to 796 billion yuan ($123 billion), a Chinese customs spokesperson said in January.

Jiao Shanwei, editor-in-chief of cngrain.com, a website specializing in grain news, said that the cooling diplomatic relations has primarily caused the slumping exports of Australian cotton to China.

"Importers should be worried that China may impose anti-dumping and anti-subsidy duties on Australia cotton similar to barley, and shun the commodity's trade to prevent potential risks," he told the Global Times on Thursday.

Some Australian media have reported that there is speculation that a hefty punitive tariff might be slapped on Australian cotton.

Chinese experts said that Australia is "eating its own medicine" for losing market share in China, not only as a result of the country's growing hostility toward China in policymaking, but also because its products have lost edge in terms of price or quality.

Wang Zhankui, a senior industry analyst, told the Global Times that China's cotton has gained a reputation for being of high-quality, and can replace Australian imports.

"Previously, Australia's cotton had some edge, but with the rising quality of domestic cotton produced in Xinjiang and elsewhere, Australian cotton's advantages are lost," he said.

He added that another reason why high-yield domestic cotton is well placed to supplant Australian cotton.

Currently, domestic cotton produced in Xinjiang accounted for about 90 percent of China's cotton consumption, while the Australian cotton plantations are only around five million mu (333,000 hectares), which is even smaller than the cotton production field of Aksu Prefecture in Xinjiang, experts said.

Huang Tingyu, vice president of Chinese textile company Grace, told Global Times that they only use domestically produced cotton for knitting and had never used Australian cotton.

"When we began to build cotton processing base, we had compared the features and quality of cottons from US, Pakistan and India, and finally we settled on Xinjiang cotton," said Huang. "The cotton from Australia didn't appear on our candidates list."

According to the experts, China's annual production of cotton is about 6 million tons a year, but the country's annual consumption of cotton has hovered at about 8 million tons, which means that China needs to sustain that amount of imports every year to meet the demand. However, there are multiple alternatives to replace cotton imported from Australia.

"As China is a major grower of cotton, changes in imports wouldn't affect the country's cotton consumption and supply much. If cotton imports from Australia plummet, we can increase cotton growing area in the country or import it from other destinations like Brazil or the Black Sea countries," Jiao said.

(Global Times)

(VAN) Farmers should keep poultry houses dry, regularly disinfect them, replace bedding materials, and supplement with vitamins and electrolytes to boost the animals' immunity.

(VAN) In Vietnam, protective measures and standards for controlling Salmonella in livestock farming have not been fully updated or completed, making the risk of infection real.

(VAN) The ecological model 'Rice Calls the Cranes Back' in Dong Thap becomes a highlight in integrating agricultural production with habitat conservation in Tram Chim National Park.

(VAN) Bigger, tastier tomatoes and eggplants could soon grace our dinner plates thanks to Johns Hopkins scientists who have discovered genes that control how large the fruits will grow.

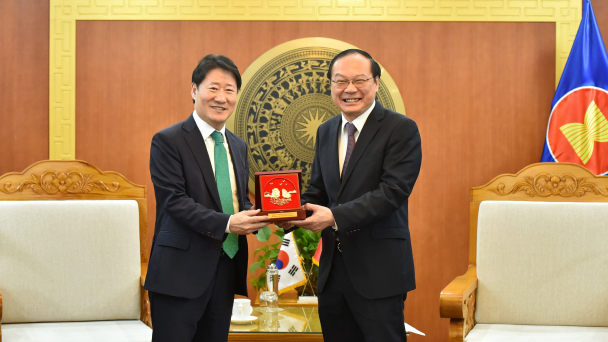

(VAN) Deputy Minister Le Cong Thanh states that Vietnam and South Korea need to strengthen cooperation in water resource management and river basin management.

(VAN) The rise in coffee prices has led to an increase in the level of investment in care from farmers. As a result, the amount of waste from pesticides and fertilizers has surged dramatically.

(VAN) HawaExpo 2025 opened at White Palace, Thu Duc City, on the evening of May 4, featuring 350 booths from Vietnam's leading exporters of interior and exterior furniture.