May 21, 2025 | 07:55 GMT +7

May 21, 2025 | 07:55 GMT +7

Hotline: 0913.378.918

May 21, 2025 | 07:55 GMT +7

Hotline: 0913.378.918

Virgil Shockley’s chicken houses near Snow Hill, Md. grows birds for industry giant Tyson Foods. The Biden administration is looking into consolidation and anticompetitive practices in the poultry industry. Photo: Lois Raimondo

As consumers chafe at growing food price inflation, the Biden administration is pointing a finger at some of the country’s largest meat companies, suggesting pandemic profiteering may be responsible for the steep rise in the prices of beef, pork and poultry.

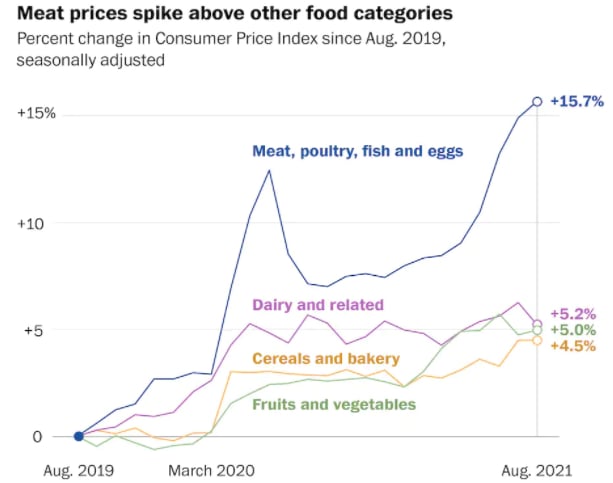

Recently, the prices for beef, pork and poultry have all increased far more than other kinds of food, accounting for as much as half of price inflation at grocery stores.

National Economic Council Director Brian Deese has drawn connections between consolidation in the meat industry and increasing prices of meat. A July executive order focused on antitrust enforcement, directly addressing meat industry consolidation.

Unsurprisingly, the meat industry has pushed back against the White House’s allegations. So have some economists, saying consolidation is not entirely to blame for higher prices. As with other industries, escalating costs in the meat business have driven up prices: Rises in feed, labor, transportation and packaging costs — along with pandemic-related labor shortages — have caused beef, chicken and poultry producers to pass those increases along to consumers.

“The White House is trying to distract attention in any way possible,” said Don Close, senior animal protein analyst for RaboResearch Food & Agribusiness group, which analyzes agricultural data. He said President Biden’s executive order cracking down on consolidation in the meat industry contained inaccurate or biased information about the meat industry. He adds that the largest beef packing companies haven’t changed much in 20 years.

In recent years, several meat companies have been accused of antitrust violations, from inflating prices to wage fixing, by the Justice Department. Some of the accusations predate the coronavirus pandemic. The pace has picked up this year: In May, a federal grand jury in Denver indicted Claxton Poultry Farms for participating in a nationwide conspiracy to fix prices and rig bids for broiler chicken products. In July, a federal grand jury in Denver indicted Koch Foods and four Pilgrim’s Pride executives in the same nationwide conspiracy.

Growers, restaurant chains and retailers have also sued major meat companies over anticompetitive practices like price fixing. In June, Tyson and Pilgrim’s Pride agreed to pay $80 million and $75 million, respectively, to settle a class-action lawsuit. In August, Tyson and Perdue Farms agreed, without admitting wrongdoing, to pay nearly $35 million to settle a lawsuit that accused them and several other firms of conspiring to fix the prices paid to their contract growers, pushing them into debt.

“Big ag is putting a squeeze on farmers,” Biden said when signing the July executive order. “Small and family farms, first-time farmers — like veterans coming home and Black and Latino and Indigenous farmers — they are seeing price hikes for seed, lopsided contracts, shrinking profits and growing debt.”

The White House aims to clamp down on meat industry practices by strengthening the enforcement of an obscure 100-year-old law, enacted in 1921 in response to concerns about the clout of the “Big Five” meatpackers at the time.

That consolidation hasn’t been curbed in the ensuing century. Eighty percent of beef in America is now controlled by just four companies: JBS, Tyson, Cargill and National Beef. Nearly 70 percent of the pork business is controlled by that same number: JBS, Tyson, Smithfield and Hormel. Plus, more than half of the chicken processing is by four companies: JBS, Tyson, Perdue and Sanderson.

The White House appears especially focused on busting up consolidation in the poultry industry, experts say. The U.S. Department of Agriculture has announced two rule changes to make it easier for farmers to sue companies if they feel like they’re not getting a fair deal for their animals, and a third rule that is specific to the poultry industry. It will minimize how much processors can reward and punish growers, and pit them against each other.

Of beef, pork and chicken, the poultry industry is the most vertically integrated, with every step of the supply chain owned or controlled by the big processors. Chicken farmers are like Uber drivers, who don’t own anything but the car. The farmers own their barns and provide their own labor, but they don’t own the chicks, their feed or their medicine. All of these are provided by the processors, who can also dictate precisely how the birds are raised and even what equipment a farmer has to use.

Farmers’ share of every dollar spent on food has declined consistently from 35 cents in the 1970s to around just 14 cents in recent years, according to the USDA.

Source: Labour Department

But the squeeze on poultry growers is the toughest, said Mike Callicrate, a cattle rancher and meat processor in Colorado and former board member of the nonprofit Organization for Competitive Markets.

“The biggest problems are in the poultry industry, which is so powerful. That vertical-integration model is abusive — to the animals, to the workers, to the consumers. Now that the conglomerates have taken over, this is the model we can expect more of in pork and beef,” Callicrate said.

Chicken farmers whose mature flocks are deemed superior get more money, which is moved away from the farmers whose flocks are deemed inferior. Without a known payday amount, it’s hard to plan and budget for contract growers, and bankruptcies among growers are common.

While the USDA focuses on expanding the rights of ranchers and growers, and in July committed $500 million to expanding meat and poultry slaughter and processing capacity, they also continue to work with other agencies — the Justice Department’s Antitrust Division, the Department of Commerce and the FBI — to target antitrust issues and consolidation in the poultry industry.

Yet even with this multipronged effort to rein in poultry power, mega-mergers continue. In August, Cargill, one of the nation’s largest private agricultural companies, and Continental Grain Company announced an agreement to jointly buy Sanderson Farms, the third-largest poultry producer, for $4.53 billion. The upshot would be seriously Big Bird.

Antitrust experts say the sale, which regulators are reviewing, is a litmus test of how serious the Biden administration is about breaking up anticompetitive monopolies, because Cargill is already a big player in beef as well as feed production for animals.

“It’s challenging from an antitrust and competition perspective when you have these companies that are players in multiple proteins. If you put it all together, they have a dominant position,” said Ben Lilliston, director of rural strategies and climate change at the Institute for Agriculture and Trade Policy.

Farmers Trina McClendon and her son, Dallas, raise about 800,000 chickens annually through a contract with Sanderson in Gillsburg, Miss. Dallas McClendon said the day after the Cargill purchase was announced, Sanderson told the McClendons they would be paid less per flock, a loss of about $70,000 a year, Dallas McClendon said.

He said his mother refused to sign this contract and Sanderson management wrote that “grower refused to sign.” She asked for a written explanation of the pay decrease and was told it had to do with demographics in Mississippi — the market for chicken, the hurricane and the pandemic were all factors. The new price dropped below pre-pandemic prices, Dallas McClendon said.

He said there were 60 growers in Mississippi who did not sign their contracts. He and his mother, as well as three other growers he knows, were placed on smaller birds after not signing. “Tray pack” birds are the kind that end up as cut-up grocery store pieces and they command a lower price.

“It seemed like punishment or retaliation,” Dallas McClendon said.

Sanderson Farms’ chief financial and legal officer, Mike Cockrell, said that the company’s decisions were not punitive. He said that at the beginning of the pandemic, when restaurants shut down, the company decided to reduce its total production of chickens. They had their contract growers raise fewer birds, he said, but in order to have growers maintain their income levels, they increased their rate of pay across the board.

“When we return to full production post-pandemic, we will adjust those rates back down to pre-pandemic levels, but our growers will still be made whole,” he said.

Zippy Duval, president of the American Farm Bureau Federation, said almost across the board, consumers are paying more while ranchers and growers are being paid less than they were last year: “We’re getting less for our products and, as you know, when you go to the grocery store, when you go buy gas, when you go to buy materials at Home Depot, everything’s costing more.”

But he’s philosophical. Consolidation isn’t good for farmers and ranchers, but capitalism allows for consolidation, he said.

“The fewer companies there are, the less competition there is. And we can’t say shame on y’all, because agriculture is consolidating, too, probably for different reasons. But we don’t feel like this is really something you can stop.”

(Washingtonpost)

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.

(VAN) Fourth most important food crop in peril as Latin America and Caribbean suffer from slow-onset climate disaster.

(VAN) Shifting market dynamics and the noise around new legislation has propelled Trouw Nutrition’s research around early life nutrition in poultry. Today, it continues to be a key area of research.

(VAN) India is concerned about its food security and the livelihoods of its farmers if more US food imports are allowed.

(VAN) FAO's Director-General emphasises the need to work together to transform agrifood systems.

(VAN) Europe is facing its worst outbreak of foot-and-mouth since the start of the century.

(VAN) The central authorities, in early April, released a 10-year plan for rural vitalization.