June 18, 2025 | 11:17 GMT +7

June 18, 2025 | 11:17 GMT +7

Hotline: 0913.378.918

June 18, 2025 | 11:17 GMT +7

Hotline: 0913.378.918

Now that the industry is being cut back bit by bit, this position is under pressure. Spain’s position, however, is expected to grow. What is going on in Germany?

A piglet and a sow kept together without iron in the farrowing pen. Photo: Henk Riswick

Only 1 decade ago, there was a strong belief that the emphasis of Europe’s pig production would shift to the east – with Germany being a stable, centrally located engine. Fast forward to 2022 and things appear to have been shaken up. Eastern Europe’s pig industry has not proven to be as leading as expected; Germany’s swine industry is shrinking and a new player has emerged in the south: Spain.

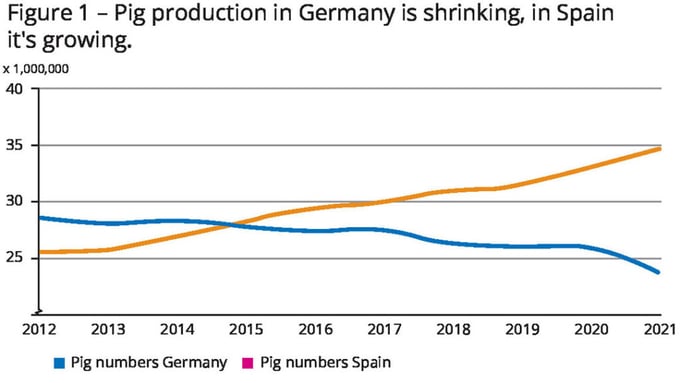

34,5 million pigs in Spain

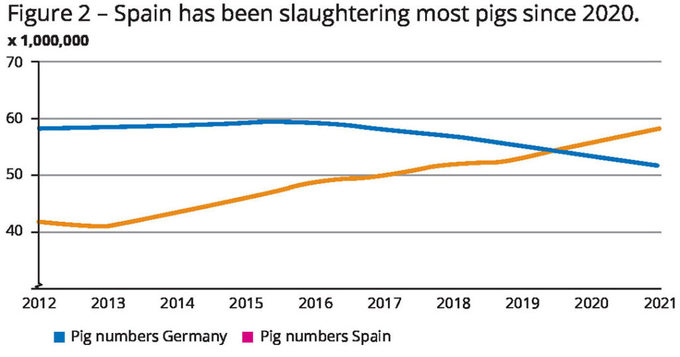

The numbers speak for themselves. In just 10 years, the number of pigs produced in Germany has gone from 28 million to fewer than 24 million pigs (see Figure 1). In the same period, the number of pigs in Spain grew from 25 million to 34.5 million, with pigs in Spain mostly being produced with lower costs and in very efficiently organised integrations. Spain overtook Germany in 2014. Kill numbers were initially still higher in Germany, but since 2020 Germany has lost that leading position as well. Germany decreasing, the number of pigs in Spain growing: that trend has continued ever since (see Figure 2).

Germany affected by ASF

Obviously, Germany was affected by a number of simultaneous developments. African Swine Fever (ASF) caused export problems, leading to a devaluation of German pig meat. That market situation was aggravated by the occurrence of Covid-19. Simultaneously, a renewed focus on welfare (ITW, 5D) may provide additional challenges for some and opportunities for others. The end result is that the German pig industry is shrinking quickly. This happens especially in Eastern Germany, leading to a market situation that verges on self-sufficiency.

In summary, Germany is becoming an inward-looking market, whereas surrounding markets like the Netherlands and Denmark are still focusing on exports, serving European markets as well as the rest of the world.

New European prices

The question is what that new reality means for the importance of Germany’s pig prices. How relevant will that price be? One possible alternative is to keep an eye on the Spanish market, which analists watch with more interest than it was a few years back, by slaughterhouses for instance.

Jan Schuttert is director of pig trading company Schuttert in the Netherlands, and he is very interested in pig prices across Europe. “It is clear that pig prices in key pig countries are converging; Spain as an exporting nation is one of them.”

He acknowledges that Germany’s role is dwindling. “In recent years, Germany negatively influenced price development in surrounding countries. Now the German pig industry is changing fast. We shall have to say goodbye to the German pig price as a major index.” Schuttert says he hopes that eventually there will be one European price.

Future development of Germany

Dr Eva Gocsik, analyst animal protein at Rabobank Food & Agribusiness Research, says further reduction of the German swine inventory is to be expected, by 20–30%. She thinks that the German influence will wane. “The more the German swine industry is shrinking, the less important it will be for pig price development in Europe. Yet it will continue to be a big, important market in Europe.”

She also expects the number of pigs in Spain to continue to grow, especially since pork sales to China have fluctuated in recent years. That is advantageous for Spain, where production prices are generally lower than elsewhere in Europe. She says, “Competing with Spain in terms of volumes will be increasingly difficult.”

(Pig Progress)

(VAN) Extensive licensing requirements raise concerns about intellectual property theft.

(VAN) As of Friday, a salmonella outbreak linked to a California egg producer had sickened at least 79 people. Of the infected people, 21 hospitalizations were reported, U.S. health officials said.

(VAN) With the war ongoing, many Ukrainian farmers and rural farming families face limited access to their land due to mines and lack the financial resources to purchase needed agricultural inputs.

(VAN) Vikas Rambal has quietly built a $5 billion business empire in manufacturing, property and solar, and catapulted onto the Rich List.

(VAN) Available cropland now at less than five percent, according to latest geospatial assessment from FAO and UNOSAT.

(VAN) Alt Carbon has raised $12 million in a seed round as it plans to scale its carbon dioxide removal work in the South Asian nation.

(VAN) Attempts to bring down the price of the Japanese staple have had little effect amid a cost-of-living crisis.