April 15, 2025 | 02:18 GMT +7

April 15, 2025 | 02:18 GMT +7

Hotline: 0913.378.918

April 15, 2025 | 02:18 GMT +7

Hotline: 0913.378.918

Some sugar brands imported from Cambodia, Indonesia, Malaysia, Laos and Myanmar will be subject to anti-dumping duty.

The Ministry of Industry and Trade (MoIT) has issued Decision No. 1514/QD-BCT on the application of measures to prevent evasion of trade remedies for a number of cane sugar brands imported from Cambodia, Indonesia, Laos, Malaysia and Myanmar.

Accordingly, sugar imported from Cambodia, Indonesia, Laos, Malaysia and Myanmar, if using Thai sugar materials, will be subject to the same anti-dumping and anti-subsidy tax rates applied to Thai sugar.

The total applicable tax rate is 47.64 per cent, of which the anti-dumping tax is 42.99 per cent and the anti-subsidy tax is 4.65 per cent.

Sugar imported from the five aforementioned countries will not be subject to anti-circumvention measures if proven to be produced from sugarcane harvested in the host countries.

Measures against trade remedy circumvention will take effect seven days after the Decision is issued until June 15, 2026, unless it is changed or extended according to other decisions.

“The decision to apply anti-circumvention measures is issued on the basis of an objective and transparent investigation process in accordance with domestic laws and international commitments", the MoIT informed.

According to the Ministry, the contents of the investigation conclusions have been sent in advance to relevant state management agencies as well as many businesses for comments.

This measure aims to ensure a fair competitive environment between domestically produced goods and imported goods, and to protect the legitimate interests of the domestic sugarcane producers and farmers.

In the coming time, the MoIT commits to coordinate with the Ministry of Agriculture and Rural Development, the General Department of Customs (Ministry of Finance) and relevant agencies to monitor and assess the impact of trade remedies, as well as production situation, supply-demand, price... of sugar. From there, appropriate management tools will continue to be deployed to harmonize the interests of sugarcane growers, producers as well as consumers.

Prior to the issuance of Decision No. 1514, the MoIT had twice extended the investigation against evasion of safeguard measures for cane sugar products of Cambodia, Indonesia, Laos, Malaysia and Myanmar. The first investigation took place in March 2022 and ended on May 21. The second investigation ended on July 21.

On the basis of collecting and synthesizing information and opinions provided by the relevant parties, the MoIT concluded that the use of sugar materials originating from Thailand to produce and export a number of cane sugar brands to Vietnam by enterprises from Cambodia, Indonesia, Laos, Malaysia and Myanmar is an act of evading anti-dumping and anti-subsidy measures.

Statistics of the General Department of Customs show that the volume of sugar imported from these five ASEAN countries has increased sharply after Vietnam initiated an anti-dumping and anti-subsidy investigation into sugar from Thailand from October 2020 to June 2021 compared to the previous nine-month period.

Specifically, the import volume has increased from 107,600 tons to 527,200 tons. Meanwhile, the import volume of sugar originating from Thailand into Vietnam has decreased by nearly 38 per cent, from 955,500 tons to 595,000 tons.

Notably, all of this volume of imported sugar enjoy a preferential tax rate of 5 per cent (or lower for sugar originating from Laos under the Vietnam-Laos Border Agreement, on the basis of the certificate of origin C/O form D of the ASEAN Trade in Goods Agreement (ATIGA).

Vietnam Sugarcane and Sugar Association (VSSA) and domestic cane sugar refineries have submitted evidence that Thai cane sugar products subject to anti-dumping and anti-subsidy taxes have entered the Vietnamese market through five ASEAN countries of Laos, Cambodia, Indonesia, Malaysia, and Myanmar.

According to VSSA, most of the above refined sugar is produced at sugar refineries in Indonesia and Malaysia but mainly with imported raw materials, as Malaysia does not grow sugarcane and Indonesia does not grow sufficient material for domestic production.

The Trade Remedies Authority of Vietnam under the MoIT and related organisations have taken the initiative in investigating the issue. The MoIT has actively coordinated with the VSSA and domestic cane sugar refineries to monitor the import of cane sugar products and actively consulted and assisted the VSSA, as well as the domestic cane sugar industry, in collecting information and data and making a petition to request an investigation into the behavior before issuing the Decision.

Translated by Phuong Ha

(VAN) This represents the most significant growth in the first quarter in the past four years. From January to March 2025, the export turnover of AFF products was 15.72 billion USD.

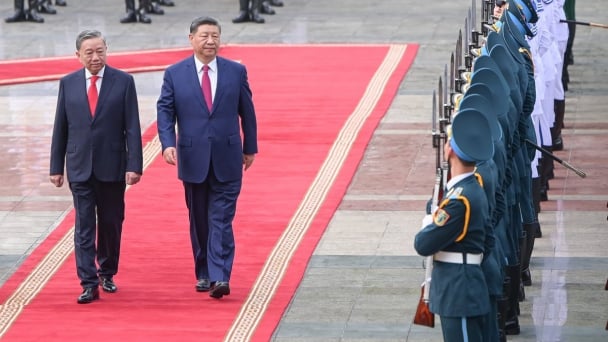

(VAN) On April 14, at the Presidential Palace, Vietnam General Secretary To Lam chaired the welcoming ceremony for General Secretary and President of China Xi Jinping, who is on a two-day state visit.

(VAN) The Vietnam-Cuba technical cooperation project to develop rice production phase 5 (2019-2025) has supported Cuba in improving varieties, increasing rice yield and quality.

(VAN) The Deputy Minister of Agriculture and Environment underscored the necessity of addressing IUU fishing at the grassroots level and linking it to the accountability of local authorities.

(VAN) According to Deputy Prime Minister Bui Thanh Son, through this P4G Summit, Vietnam aims to convey the message of transforming its growth model towards rapid and sustainable development.

(VAN) Soybean production has been a priority for China to ensure food security, with increased soybean cultivation and yields highlighted in the annual No. 1 Central document.

(VAN) Vietnam Sea and Islands Week 2025 is expected to take place in Quang Binh, featuring a series of meaningful activities aimed at protecting the ocean through green technology solutions.