May 16, 2025 | 10:14 GMT +7

May 16, 2025 | 10:14 GMT +7

Hotline: 0913.378.918

May 16, 2025 | 10:14 GMT +7

Hotline: 0913.378.918

Implementing VAT as a basis for fertilizer price reductions

In response to concerns over price increases due to the 5% VAT rate on fertilizers, data from the consultation seminar "Effects of a 5% VAT Rate on the Fertilizer Industry," organized on October 17, 2024, by the General Association of Agriculture and Rural Development of Vietnam, the Vietnam Tax Consulting Association, and Foreign Trade University, shows detailed calculations by experts. According to their analysis, the transition to a 5% VAT rate for fertilizer products can reduce the prices of domestically produced Urea, DAP, and phosphate fertilizers by 2% and 1.13%, respectively. Similarly, phosphate fertilizers can see a reduction of 0.87%.

The price of NPK fertilizer may increase marginally (by 0.09%) or remain unchanged. Imported fertilizers such as Urea, DAP, NPK, SA, and Potassium can see price increases, with imported NPK potentially rising by 5%.

With the current structure of the fertilizer market, where over 70% of consumption comes from domestically produced fertilizers and less than 30% from imports, domestic fertilizer manufacturers will likely play a leading role in adjusting overall market prices.

By imposing a 5% VAT rate on fertilizers, the production costs of domestically manufactured fertilizers will decrease, which will in turn facilitate price reductions. Moreover, this change can urge importers to lower their prices in an attempt to compete with the market, which will benefit farmers significantly.

At the seminar titled "VAT for Fertilizers: Promoting Sustainable Agricultural Development," held on November 17, 2024, National Assembly delegate Trinh Xuan An, a permanent member of the National Assembly's Defense and Security Committee, also affirmed that the government’s proposal to apply a 5% VAT rate to fertilizers is scientifically well founded.

"I believe there is no basis to claim that a 5% VAT rate will increase fertilizer prices. Discussions on the effects of a 5% VAT should be objective and scientific. We should avoid conservative perspectives or emotionally charged language such as 'applying a 5% VAT will increase fertilizer prices and harm farmers.' We must make our decisions based on specific scientific calculations, not subjective or emotional reasoning," National Assembly Delegate Trinh Xuan An stated.

National Assembly Delegate Trinh Xuan An sharing insights at the seminar on November 17.

National Assembly Delegate Trinh Xuan An also argued that this issue extends beyond a technical tax policy. Accordingly, he noted that stakeholders must make their decisions based on a broad and comprehensive perspective as an alternative to subjective will. Notably, the Standing Committee of the National Assembly has maintained this viewpoint throughout the discussions and consultations on the draft Tax Law.

“I believe that the media must guide public opinion on this issue to avoid negatively impacting farmers, businesses, or the national economy,” National Assembly Delegate An emphasized.

Expert calculations on the impact of a 5% VAT rate on fertilizers

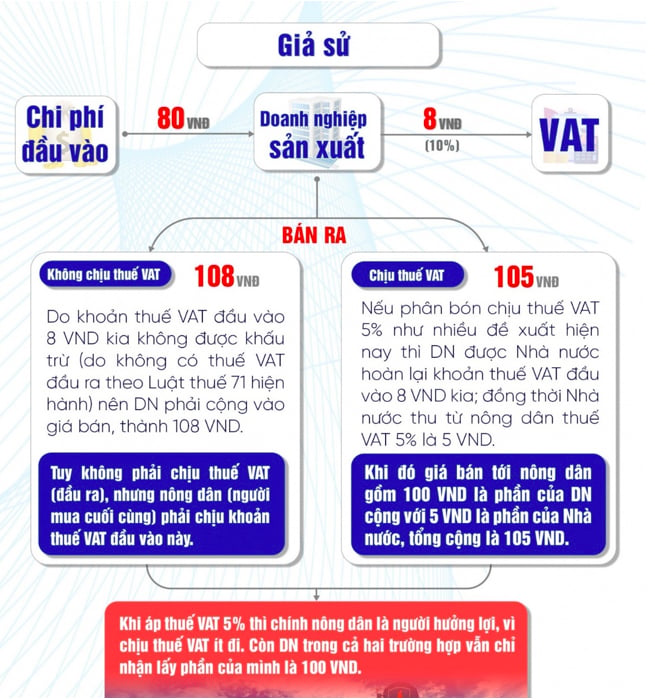

During the seminar "VAT for Fertilizers: Promoting Sustainable Agricultural Development," Nguyen Van Duoc, permanent member of the Vietnam Tax Consulting Association, provided detailed analyses of the effects of a 5% VAT rate on fertilizer prices. Using a hypothetical example, he compared the pricing of fertilizers by domestic producers and importers. If the pre-VAT product price is 100 VND, with input costs at 80 VND and a target profit of 20 VND, the outcomes will differ significantly depending on VAT deductibility.

If domestic producers cannot deduct input VAT, they will incur an additional 8 VND in non-deductible VAT costs. Subsequently, this change will increase production costs, reduce profits, and force fertilizer producers to raise selling prices to 108 VND in order to maintain their profit margins. Consequently, farmers will face higher costs.

For domestic producers to sustain production at 108 VND, imported fertilizers, which do not face similar VAT constraints, can still be sold at 100 VND. However, if importers adjust their prices to match market rates, they may also raise prices to 108 VND. This adjustment would indirectly force farmers to bear the additional tax burden for imported fertilizers due to the tax policy.

Moreover, the tax policy gives importers a competitive advantage by enabling lower prices independent of domestic VAT restrictions. This creates an uneven playing field, potentially affecting domestic production. Over time, monopolies will emerge as domestic producers face financial losses, reduced competitiveness, and even bankruptcy.

Tax expert Nguyen Van Duoc stressed the necessity of the 5% VAT rate for fertilizer to facilitate price reductions. This approach is compatible with the scientific principles, economic benefits, and balanced interests of all stakeholders.

Nguyen Van Duoc explained that exempting fertilizers from VAT can lead to several issues. Input VAT becomes a cost that reduces profit margins, forcing businesses to add these costs to the selling price. This indirectly imposes a tax burden on farmers, exacerbating their challenges with counterfeit fertilizers, high costs, and limited access to affordable products. It also results in tax revenue losses for the government.

In contrast, imported fertilizer businesses benefit from the current VAT exemption, as they are not subject to VAT at the import stage or on their final products. They also avoid the impact of VAT on their profits, which further consolidates their competitive edge over domestic producers.

The transition to a 5% VAT on fertilizers can enable significant price reductions.

Promoting sustainable agriculture

“I am deeply concerned that Vietnam’s fertilizer technology is failing to meet global standards. I hope the National Assembly will make the right decision regarding fertilizer VAT to improve fertilizer quality and enhance the value of Vietnamese agricultural products. Consequently, the agricultural sector can serve as the backbone of our economy,” Associate Professor Dr. Dinh Trong Thinh, an economic expert, stated at the seminar.

His comments highlighted the competitiveness challenges Vietnamese fertilizers face against foreign products. Various countries around the world are currently prioritizing agricultural production. For instance, import taxes on raw materials for fertilizer production in China have been reduced by 50% or even eliminated, whereas the country's VAT rate is maintained at a low level. Exports are fully supported with storage subsidies and complete domestic tax refunds, which allow Chinese fertilizer producers to profit significantly and dominate the competition in markets worldwide, including Vietnam.

Associate Professor Dr. Thinh emphasized the need for the amended Value-Added Tax Law to impose a 5% VAT rate for fertilizer. He argued that this policy shift will enable improvements in fertilizer productivity and quality, as well as investments in materials and equipment to meet the needs of farmers.

Translated by Nguyen Hai Long

(VAN) Vietnam's draft amendment to Decree No. 156 proposes a mechanism for medicinal herb farming under forest canopies, linking economic development to population retention and the sustainable protection and development of forests.

(VAN) In reality, many craft village models combined with tourism in Son La have proven effective, bringing significant economic benefits to rural communities.

(VAN) The international conference titled Carbon Market: International experiences and recommendations for Vietnam was successfully held recently in Ho Chi Minh City.

(VAN) According to the Project on rearranging provincial and communal administrative units, in 2025, the country will have 34 provinces/cities, 3,321 communes, wards, and special zones, and no district-level organization.

(VAN) The vice president of fertilizer with Stone X Group says the Trump administration’s tariffs are impacting fertilizer markets.

(VAN) Resolution 57 offers Vietnam a significant opportunity to narrow the global genetic technology disparity and convert its extensive genetic resources into commercial advantages.

(VAN) The Ministry of Agriculture and Environment will prioritize the implementation of five core and breakthrough solutions in science and technology, in addition to the seven groups of tasks identified in Decision No. 503.